Bitcoin ETF Investments Exceed $5 Billion: What's Driving The Growth?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bitcoin ETF Investments Exceed $5 Billion: What's Driving the Growth?

The world of finance is buzzing. Bitcoin exchange-traded funds (ETFs) have just surpassed a staggering $5 billion in investments, marking a significant milestone for the cryptocurrency and a potential turning point for mainstream adoption. This surge raises the crucial question: what's fueling this incredible growth? Let's delve into the factors driving this unprecedented investment boom.

The Allure of Institutional Investment:

One of the primary drivers behind the burgeoning Bitcoin ETF market is the increasing interest from institutional investors. Previously hesitant due to regulatory uncertainty and Bitcoin's perceived volatility, large financial institutions are now embracing Bitcoin ETFs as a more regulated and accessible way to gain exposure to the cryptocurrency market. This shift represents a significant vote of confidence in Bitcoin's long-term potential. The availability of ETFs through established brokerage platforms lowers the barrier to entry for these major players, encouraging greater participation.

Regulatory Approvals Pave the Way:

The recent approval of several Bitcoin ETFs in key markets, notably the United States, has been instrumental in boosting investor confidence. The regulatory green light signals a degree of legitimacy and oversight that previously wasn't present, reassuring investors concerned about the risks associated with direct Bitcoin ownership. This regulatory clarity is a game-changer, attracting both institutional and retail investors.

Increased Accessibility and Diversification:

Bitcoin ETFs offer a level of accessibility previously unattainable for many investors. Unlike directly purchasing Bitcoin, which requires navigating cryptocurrency exchanges and understanding digital wallets, ETFs provide a familiar and straightforward investment vehicle through traditional brokerage accounts. This ease of access is a powerful driver of growth, particularly for those new to the cryptocurrency space. Furthermore, ETFs allow investors to diversify their portfolios with exposure to Bitcoin without needing to hold the asset directly, mitigating some of the inherent risks.

Hedge Against Inflation and Economic Uncertainty:

Many investors view Bitcoin as a potential hedge against inflation and economic uncertainty. Concerns about rising inflation and global economic instability have led some to seek alternative investment options, with Bitcoin seen by some as a store of value outside traditional financial systems. The appeal of Bitcoin as a "digital gold" has contributed significantly to the demand for Bitcoin ETFs.

The Future of Bitcoin ETFs:

The surpassing of the $5 billion mark is a significant achievement, but it's likely just the beginning. As regulatory clarity improves and more institutional investors enter the market, we can expect further growth in Bitcoin ETF investments. The future holds the potential for even greater integration of Bitcoin into the mainstream financial landscape, with Bitcoin ETFs playing a pivotal role.

What This Means for Investors:

This growth underscores the increasing mainstream acceptance of Bitcoin. While past performance is not indicative of future results, and investing in cryptocurrencies carries significant risk, the surge in Bitcoin ETF investments highlights the growing institutional interest and potential long-term prospects of this digital asset. It is crucial for investors to conduct thorough research and understand the associated risks before investing in any Bitcoin ETF. Consult with a qualified financial advisor to determine if Bitcoin ETFs align with your individual investment goals and risk tolerance.

Keywords: Bitcoin ETF, Bitcoin Exchange Traded Fund, Cryptocurrency Investment, Institutional Investment, Regulatory Approval, Bitcoin Price, Digital Gold, Inflation Hedge, Investment Strategy, Cryptocurrency ETF, Bitcoin Market.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bitcoin ETF Investments Exceed $5 Billion: What's Driving The Growth?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

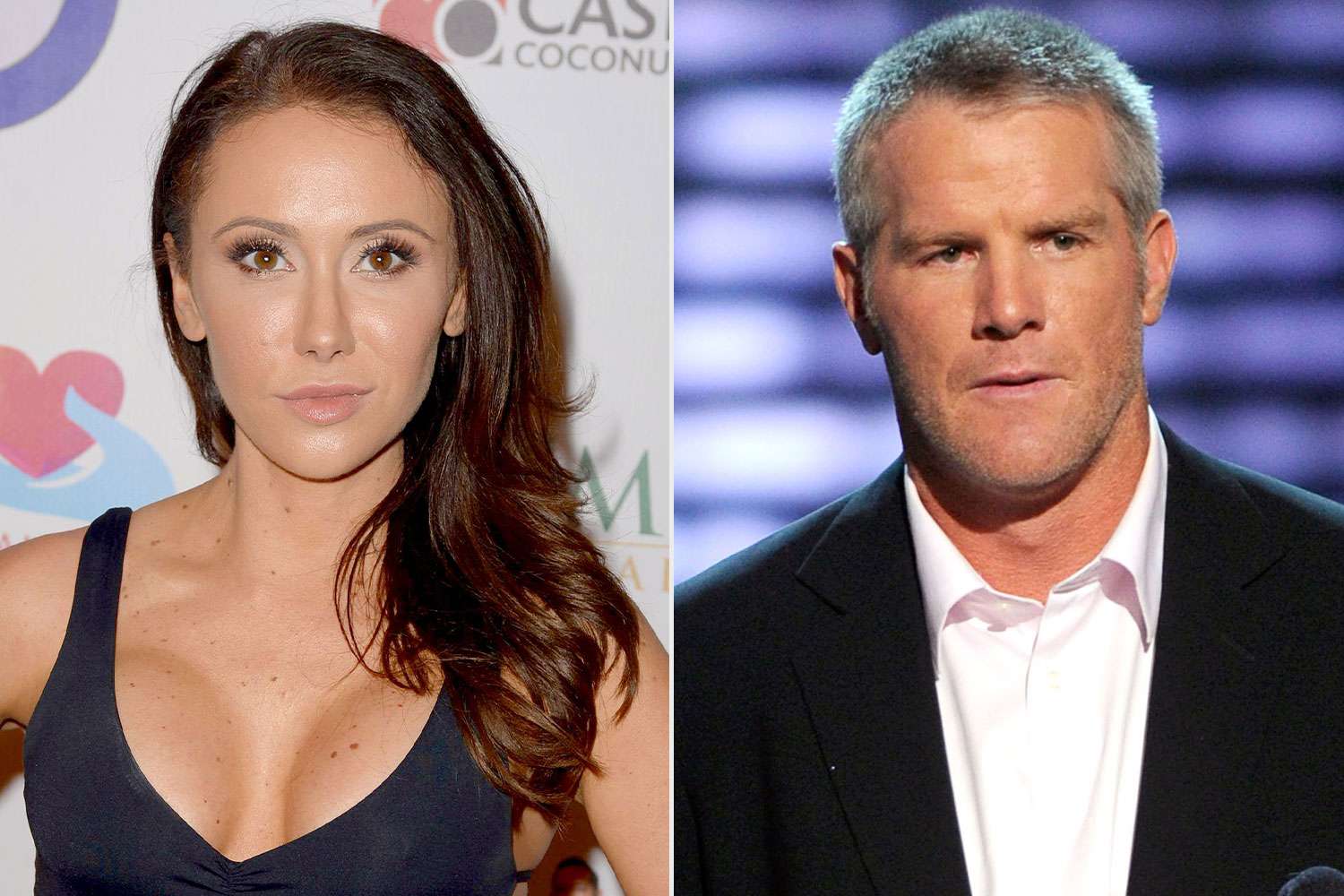

Dehumanized Jenn Sterger Recounts Her Experience In The Brett Favre Scandal

May 20, 2025

Dehumanized Jenn Sterger Recounts Her Experience In The Brett Favre Scandal

May 20, 2025 -

Jon Jones Retirement Rumors Intensify Aspinall Negotiations And The I M Done Message

May 20, 2025

Jon Jones Retirement Rumors Intensify Aspinall Negotiations And The I M Done Message

May 20, 2025 -

Lsg Needs A Win Srhs Marsh And Markram Set A 206 Run Target

May 20, 2025

Lsg Needs A Win Srhs Marsh And Markram Set A 206 Run Target

May 20, 2025 -

Major Setback For Holiday Rentals In Spain 65 000 Listings Removed

May 20, 2025

Major Setback For Holiday Rentals In Spain 65 000 Listings Removed

May 20, 2025 -

Watch Now Powerful Wwi Film With Daniel Craig Cillian Murphy And Tom Hardy

May 20, 2025

Watch Now Powerful Wwi Film With Daniel Craig Cillian Murphy And Tom Hardy

May 20, 2025