Bitcoin ETF Investments Exceed $5 Billion: Analyzing The Market Trend

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bitcoin ETF Investments Exceed $5 Billion: Analyzing the Market Trend

Bitcoin exchange-traded funds (ETFs) have officially crossed a monumental threshold, surpassing $5 billion in total investments. This landmark achievement signals a significant shift in the perception and adoption of Bitcoin as a mainstream asset class. This surge in investment reflects growing institutional interest and a broader acceptance of cryptocurrencies within traditional finance. But what does this mean for the future of Bitcoin and the broader cryptocurrency market? Let's delve deeper into the analysis.

The Rise of Bitcoin ETFs and Institutional Adoption:

The recent surge in Bitcoin ETF investments isn't a sudden phenomenon. It's the culmination of several factors contributing to increased institutional confidence. Historically, institutional investors hesitated due to regulatory uncertainty and the perceived volatility of cryptocurrencies. However, the maturation of the crypto market and the emergence of regulated products like ETFs have significantly eased these concerns.

-

Regulatory Clarity: While regulatory landscapes vary globally, the increasing clarity around Bitcoin and cryptocurrency regulation in key markets like the US has emboldened institutional players. The approval of the first Bitcoin futures ETF in the US paved the way for broader acceptance. [Link to relevant news article about ETF approvals]

-

Increased Institutional Demand: Major financial institutions are actively seeking exposure to the cryptocurrency market, viewing Bitcoin as a potential hedge against inflation and a diversification tool within their portfolios. This institutional influx has significantly impacted the price and volume of Bitcoin trading.

-

Ease of Access: Bitcoin ETFs provide a relatively straightforward and regulated way for institutional and retail investors to gain exposure to Bitcoin without directly dealing with the complexities of cryptocurrency exchanges. This ease of access has been a key driver of growth.

Analyzing the Market Trend: What Lies Ahead?

The $5 billion milestone is undoubtedly a significant achievement, but it's crucial to consider the broader implications and potential future trends.

Potential Challenges:

-

Regulatory Uncertainty: While regulatory clarity has improved, the regulatory landscape for cryptocurrencies remains dynamic and subject to change. Future regulatory hurdles could impact investment flows.

-

Market Volatility: Bitcoin's price remains volatile, influenced by various factors including macroeconomic conditions, technological developments, and market sentiment. This volatility is an inherent risk for ETF investors.

-

Competition: As the ETF market matures, we're likely to see increased competition among providers, potentially leading to price wars and a need for innovative product offerings.

Future Outlook:

Despite the challenges, the long-term outlook for Bitcoin ETFs appears positive. The continued institutional adoption, coupled with growing retail investor interest, is expected to drive further investment. The development of innovative products, such as actively managed Bitcoin ETFs or those tracking other cryptocurrencies, will likely contribute to market growth. Experts predict that the total investment in Bitcoin ETFs could reach significantly higher figures in the coming years. [Link to a reputable financial analyst prediction or report].

Conclusion:

The exceeding of $5 billion in Bitcoin ETF investments represents a major turning point for the cryptocurrency market. While challenges remain, the trend indicates a growing acceptance of Bitcoin as a legitimate asset class within the traditional finance world. This milestone suggests a promising future for Bitcoin ETFs and their potential to shape the trajectory of the cryptocurrency industry. However, investors should always conduct thorough research and understand the inherent risks associated with cryptocurrency investments before making any financial decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bitcoin ETF Investments Exceed $5 Billion: Analyzing The Market Trend. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

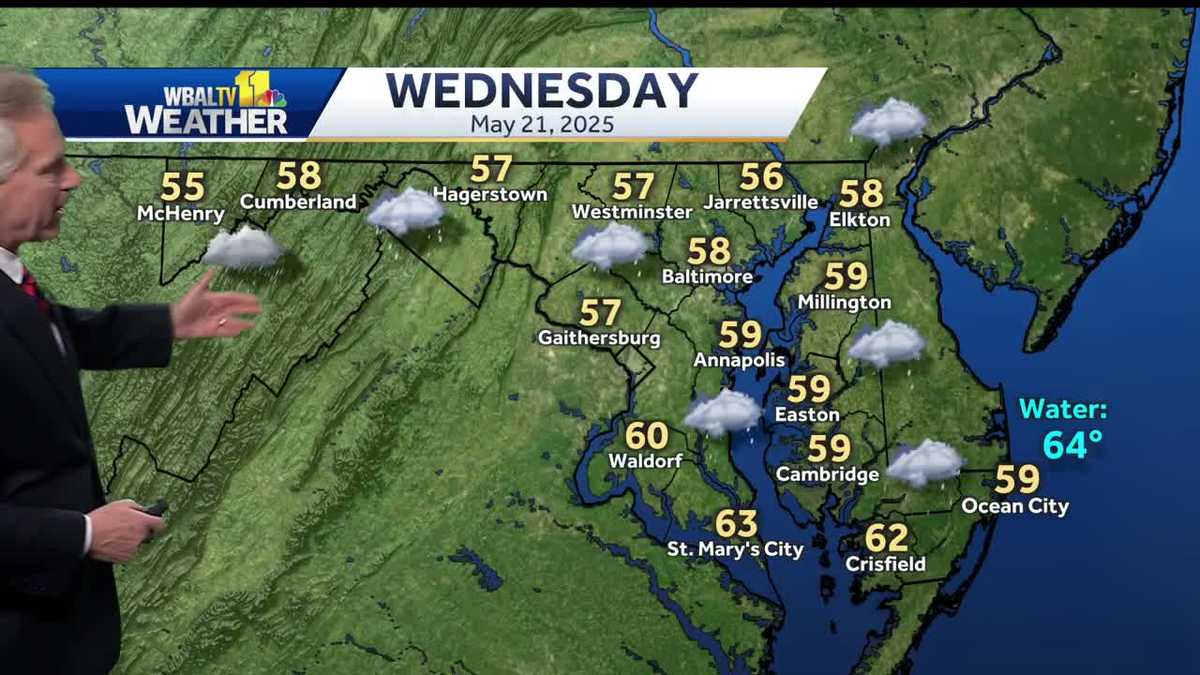

Wednesday Weather Alert Rain And Cold Temperatures Expected

May 21, 2025

Wednesday Weather Alert Rain And Cold Temperatures Expected

May 21, 2025 -

Ellen De Generes Re Emerges On Social Media Fans React

May 21, 2025

Ellen De Generes Re Emerges On Social Media Fans React

May 21, 2025 -

Emotional Return Ellen De Generes Re Emerges On Social Media

May 21, 2025

Emotional Return Ellen De Generes Re Emerges On Social Media

May 21, 2025 -

Jamie Lee Curtis Defends Lindsay Lohan Always Honest With Me

May 21, 2025

Jamie Lee Curtis Defends Lindsay Lohan Always Honest With Me

May 21, 2025 -

League Of Legends 2025 Hall Of Fame Member Revealed Will The Skin Break The Bank

May 21, 2025

League Of Legends 2025 Hall Of Fame Member Revealed Will The Skin Break The Bank

May 21, 2025