Bitcoin ETF Investments Exceed $5 Billion: Analyzing The Market Shift

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bitcoin ETF Investments Exceed $5 Billion: Analyzing the Market Shift

The cryptocurrency market is buzzing with excitement as Bitcoin exchange-traded fund (ETF) investments recently surpassed the monumental $5 billion mark. This significant milestone represents a powerful shift in the landscape, signaling growing institutional confidence and mainstream acceptance of Bitcoin as a viable asset class. But what does this surge in investment truly mean for the future of Bitcoin and the broader financial markets? Let's delve into the details and analyze this remarkable market shift.

The $5 Billion Milestone: A Game Changer?

The rapid growth of Bitcoin ETF investments reflects a confluence of factors. Increased regulatory clarity in certain jurisdictions, particularly the recent SEC approval of several Bitcoin futures ETFs, has played a crucial role. These approvals have opened the doors for a wider range of investors, including those traditionally hesitant to engage directly with the complexities of cryptocurrency exchanges. This accessibility is a key driver behind the surge in investment.

Institutional Investors Embrace Bitcoin:

The $5 billion figure isn't just about retail investors; it reflects a significant influx of capital from institutional players. Hedge funds, pension funds, and other large financial institutions are increasingly incorporating Bitcoin into their portfolios, recognizing its potential for diversification and long-term growth. This institutional adoption is a critical validation of Bitcoin's position as a legitimate asset, further bolstering its credibility.

Beyond the Hype: Understanding the Risks:

While the $5 billion milestone is undeniably impressive, it's crucial to acknowledge the inherent risks associated with Bitcoin investments. The cryptocurrency market remains volatile, subject to significant price swings driven by factors ranging from regulatory announcements to market sentiment. Investors should approach Bitcoin ETFs with a clear understanding of these risks and only allocate capital they can afford to lose. Diversification within a broader investment portfolio is also a crucial strategy to mitigate potential losses.

What the Future Holds:

The exceeding of the $5 billion mark in Bitcoin ETF investments marks a watershed moment. It indicates a maturing market with increased institutional participation and regulatory acceptance. However, the future trajectory remains uncertain. Further regulatory developments, technological advancements, and overall market sentiment will continue to shape the narrative.

Key Factors Shaping the Future of Bitcoin ETFs:

- Regulatory Landscape: Continued clarity and favorable regulatory decisions in major markets will be crucial for sustained growth.

- Technological Advancements: Innovations like the Lightning Network could enhance Bitcoin's scalability and efficiency, making it more attractive to a wider audience.

- Market Sentiment: Broader economic conditions and investor confidence will inevitably impact Bitcoin's price and overall market appeal.

- Competition: The emergence of new cryptocurrencies and alternative investment options will present ongoing challenges.

Conclusion: A Promising Outlook, But Proceed with Caution:

The surpassing of $5 billion in Bitcoin ETF investments signals a significant shift in the market. It underscores growing institutional acceptance and the increasing mainstream appeal of Bitcoin. However, investors should remain cautious and conduct thorough research before investing in any Bitcoin ETF. The volatile nature of the cryptocurrency market demands a well-informed and risk-tolerant approach. Staying updated on market trends and regulatory developments is key to navigating this dynamic landscape. This milestone is a significant step forward, but it's just one chapter in the ongoing Bitcoin story.

Learn More: For further insights into Bitcoin investing and ETF strategies, consider exploring resources like [link to a reputable financial news source]. Remember to consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bitcoin ETF Investments Exceed $5 Billion: Analyzing The Market Shift. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

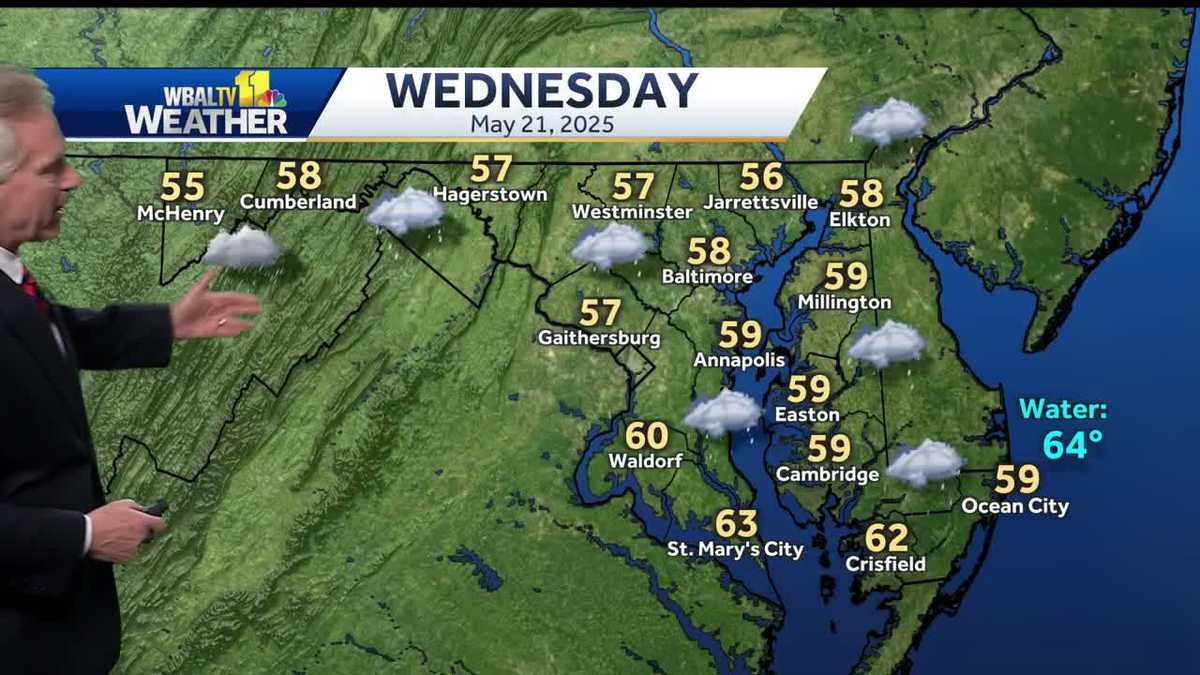

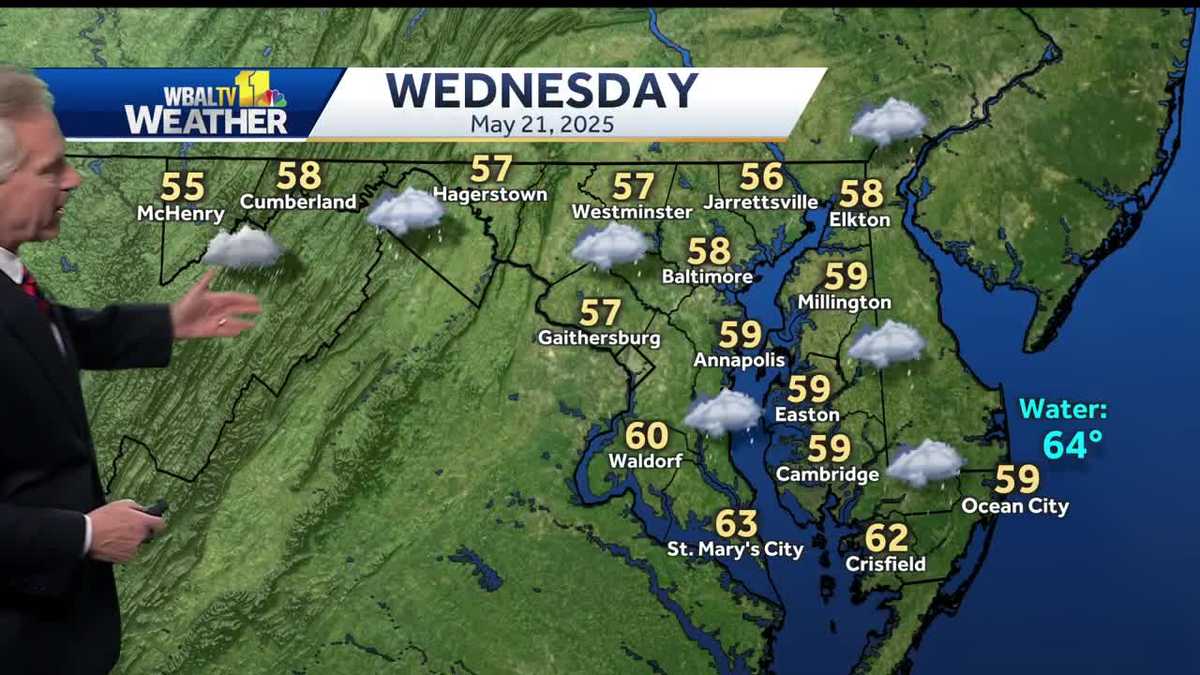

Weekly Forecast Continued Shower Risk And Temperature Drop

May 21, 2025

Weekly Forecast Continued Shower Risk And Temperature Drop

May 21, 2025 -

Regional Weather Alert Rain And Cold To Hit Wednesday

May 21, 2025

Regional Weather Alert Rain And Cold To Hit Wednesday

May 21, 2025 -

Wednesday Weather Alert Rain And Chilly Temperatures To Impact Region

May 21, 2025

Wednesday Weather Alert Rain And Chilly Temperatures To Impact Region

May 21, 2025 -

Cease Fire Push Trump In Talks With Putin And Zelensky As Russia Increases Ukraine Offensive

May 21, 2025

Cease Fire Push Trump In Talks With Putin And Zelensky As Russia Increases Ukraine Offensive

May 21, 2025 -

Ubisofts Reasoning Why Assassins Creed Valhalla Prevents Animal Killing

May 21, 2025

Ubisofts Reasoning Why Assassins Creed Valhalla Prevents Animal Killing

May 21, 2025