Bitcoin ETF Investments Exceed $5 Billion: A Market Analysis

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bitcoin ETF Investments Exceed $5 Billion: A Market Analysis

The crypto market is buzzing! Bitcoin exchange-traded funds (ETFs) have officially surpassed a staggering $5 billion in investment, marking a monumental milestone for the digital asset and signifying a significant shift in mainstream adoption. This surge underscores growing institutional confidence and retail investor interest in Bitcoin, despite the ongoing market volatility. But what does this mean for the future of Bitcoin and the broader crypto landscape? Let's delve into a comprehensive market analysis.

The $5 Billion Milestone: A Game Changer?

The recent influx of investment into Bitcoin ETFs represents a powerful endorsement of Bitcoin's potential as a viable asset class. This isn't just about speculative trading; it suggests a growing recognition of Bitcoin's role as a potential hedge against inflation and a store of value, attracting investors seeking diversification beyond traditional markets. This milestone follows the SEC's approval of the first Bitcoin futures ETF in 2021, paving the way for a more accessible and regulated entry point for institutional investors.

Factors Driving the Investment Boom:

Several factors have contributed to this impressive surge in Bitcoin ETF investments:

- Increased Regulatory Clarity: While the SEC continues to scrutinize spot Bitcoin ETF applications, the approval of futures ETFs has significantly reduced regulatory uncertainty, encouraging greater institutional participation. The ongoing debate surrounding spot ETFs is itself generating considerable market attention and anticipation.

- Institutional Adoption: Large financial institutions are increasingly incorporating Bitcoin into their portfolios, viewing it as a potential long-term investment opportunity. This institutional interest lends significant credibility and stability to the market.

- Inflationary Pressures: Global inflationary pressures have pushed investors to seek alternative assets that might offer protection against eroding purchasing power. Bitcoin, with its limited supply, is often seen as a potential hedge against inflation.

- Technological Advancements: Developments within the Bitcoin ecosystem, such as the Lightning Network improving transaction speeds and reducing fees, continue to enhance its usability and appeal.

- Retail Investor Enthusiasm: Despite market fluctuations, retail investors remain enthusiastic about Bitcoin, driven by its decentralized nature and potential for high returns.

Potential Challenges and Risks:

Despite the positive momentum, challenges and risks remain:

- Regulatory Uncertainty: The ongoing debate surrounding spot Bitcoin ETFs remains a significant factor. Uncertainty about future regulatory decisions could impact investor confidence.

- Market Volatility: Bitcoin is known for its price volatility, and this inherent risk is not to be underestimated. Investors need to be prepared for potential price swings.

- Security Concerns: Security breaches and hacks remain a concern within the cryptocurrency space, although Bitcoin's underlying technology is generally considered secure.

Looking Ahead: The Future of Bitcoin ETFs

The surpassing of the $5 billion mark is a significant milestone, but it's just the beginning. The future trajectory of Bitcoin ETF investments will depend on various factors, including regulatory developments, market sentiment, and technological innovation. The anticipation surrounding spot Bitcoin ETF approvals will undoubtedly continue to fuel investor interest.

Conclusion:

The $5 billion milestone in Bitcoin ETF investments signifies a crucial turning point for Bitcoin's mainstream adoption. While challenges and risks persist, the growing institutional interest and increasing regulatory clarity paint a promising picture for the future of Bitcoin and the broader crypto landscape. The journey is far from over, and investors should carefully consider the risks before investing in any cryptocurrency.

Further Reading:

- [Link to a reputable article on Bitcoin regulation]

- [Link to a reputable article on Bitcoin's price volatility]

- [Link to a reputable article on the Lightning Network]

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Investing in cryptocurrencies involves significant risk, and you could lose some or all of your investment. Always conduct thorough research and consider seeking professional financial advice before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bitcoin ETF Investments Exceed $5 Billion: A Market Analysis. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Midwest And Southern Us Battered By Deadly Tornado Outbreak

May 21, 2025

Midwest And Southern Us Battered By Deadly Tornado Outbreak

May 21, 2025 -

Peaky Blinders Creator Reveals New Series Details And A Game Changing Twist

May 21, 2025

Peaky Blinders Creator Reveals New Series Details And A Game Changing Twist

May 21, 2025 -

League Of Legends 2025 Hall Of Famer Revealed Price Concerns For New Skin

May 21, 2025

League Of Legends 2025 Hall Of Famer Revealed Price Concerns For New Skin

May 21, 2025 -

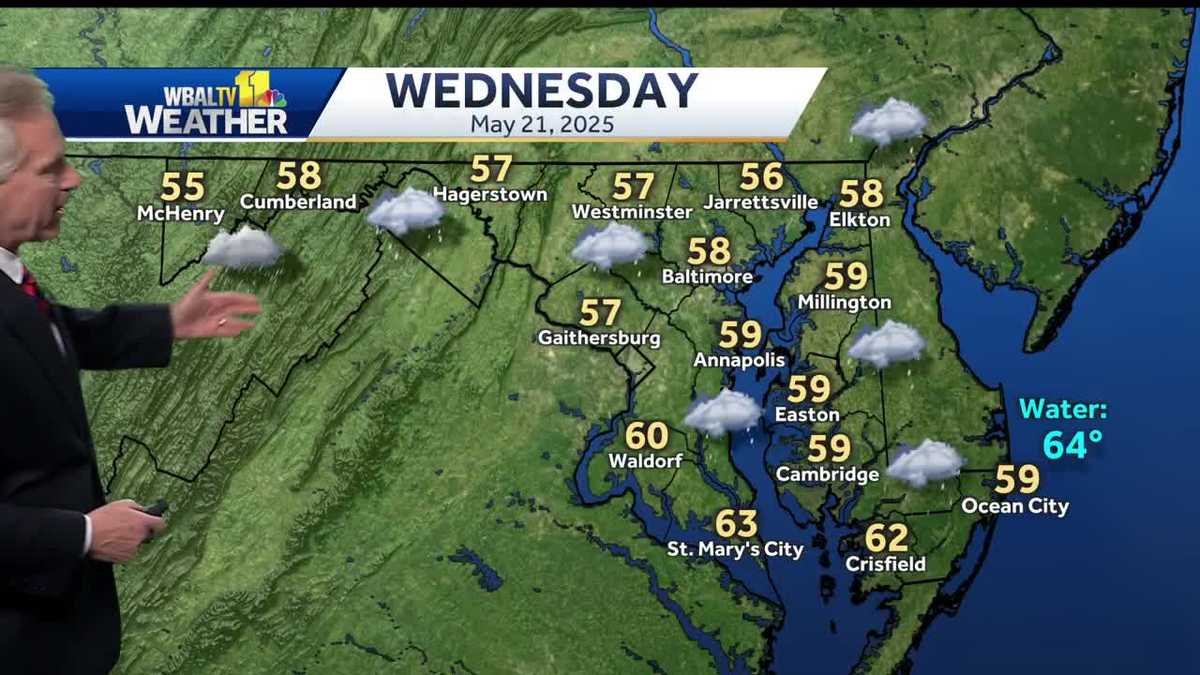

Chilly Rain To Blanket The Region Throughout Wednesday

May 21, 2025

Chilly Rain To Blanket The Region Throughout Wednesday

May 21, 2025 -

Nature Conservation Drives Corporate Value For 160 Japanese Companies Across 13 Sectors

May 21, 2025

Nature Conservation Drives Corporate Value For 160 Japanese Companies Across 13 Sectors

May 21, 2025