Bitcoin ETF Investments Exceed $5 Billion: A Deep Dive Into The Trend

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bitcoin ETF Investments Exceed $5 Billion: A Deep Dive into the Trend

The cryptocurrency market is buzzing! Bitcoin exchange-traded funds (ETFs) have just surpassed a monumental milestone: over $5 billion in invested assets. This surge signifies a major shift in investor sentiment and opens up exciting possibilities for the future of Bitcoin and the broader digital asset landscape. But what's driving this incredible growth, and what does it mean for you? Let's dive deep into the trend.

H2: The Meteoric Rise of Bitcoin ETFs

The recent surge in Bitcoin ETF investments represents a significant leap forward for the cryptocurrency industry's mainstream adoption. For years, accessing Bitcoin directly involved navigating complex exchanges and understanding the intricacies of digital wallets. ETFs, however, offer a familiar and regulated pathway for investors, providing exposure to Bitcoin's price movements through traditional brokerage accounts. This accessibility is a crucial factor in the dramatic increase we're witnessing.

H3: Key Factors Fueling the Growth

Several factors contribute to this explosive growth in Bitcoin ETF investments:

- Increased Regulatory Clarity: The gradual shift towards clearer regulatory frameworks in major markets like the US has instilled greater confidence among institutional and retail investors. The approval of the first Bitcoin futures ETF paved the way for the current wave of investment. (Learn more about the evolving regulatory landscape ).

- Institutional Adoption: Large financial institutions are increasingly allocating a portion of their portfolios to digital assets, viewing Bitcoin as a potential hedge against inflation and a diversification tool. This institutional interest fuels demand and pushes prices upward.

- Growing Retail Investor Interest: Retail investors are also embracing Bitcoin ETFs, drawn by the relative ease of access and the opportunity to participate in the cryptocurrency market without the complexities of direct ownership.

- Market Volatility & Safe Haven Potential: Despite its volatility, Bitcoin has shown resilience during periods of economic uncertainty, leading some investors to see it as a potential safe-haven asset.

H2: What Does This Mean for the Future?

The surpassing of the $5 billion mark signifies a significant turning point. It strengthens the narrative of Bitcoin's legitimacy and accelerates its integration into the mainstream financial system. We can expect:

- Increased Liquidity: Higher investment volumes lead to improved liquidity in the Bitcoin market, making it easier for investors to buy and sell their holdings.

- Further Price Appreciation: Continued strong inflows into Bitcoin ETFs could drive further price appreciation, though market volatility should always be considered.

- More ETF Offerings: The success of existing Bitcoin ETFs is likely to incentivize the launch of more innovative products, such as ETFs tracking other cryptocurrencies or offering leveraged exposure.

H2: Potential Risks and Considerations

While the outlook is positive, it's crucial to acknowledge the inherent risks associated with Bitcoin and ETF investments:

- Volatility: Bitcoin's price is notoriously volatile, and investors should be prepared for significant price swings.

- Regulatory Uncertainty: The regulatory landscape for cryptocurrencies is still evolving, and changes could impact the performance of Bitcoin ETFs.

- Security Risks: While ETFs themselves are generally secure, underlying security vulnerabilities in the cryptocurrency ecosystem remain a concern.

H2: Conclusion: A New Era for Bitcoin Investment?

The $5 billion milestone represents a monumental achievement for Bitcoin ETFs and the broader crypto market. It signals a growing acceptance of Bitcoin as a legitimate asset class and highlights the increasing accessibility of cryptocurrency investments for a wider range of investors. However, potential risks should be carefully considered before making any investment decisions. Conduct thorough research and seek professional financial advice if needed. The future of Bitcoin ETFs looks bright, but navigating this evolving landscape requires caution and informed decision-making. Stay tuned for further updates as this exciting trend continues to unfold.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bitcoin ETF Investments Exceed $5 Billion: A Deep Dive Into The Trend. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Ubisoft Milans Hiring Spree Hints At A New Rayman Title

May 21, 2025

Ubisoft Milans Hiring Spree Hints At A New Rayman Title

May 21, 2025 -

What A Gleason Score Of 9 Indicates Bidens Diagnosis Explained

May 21, 2025

What A Gleason Score Of 9 Indicates Bidens Diagnosis Explained

May 21, 2025 -

Esports Star Uzi Gifted Electric G Wagon By Mercedes Benz

May 21, 2025

Esports Star Uzi Gifted Electric G Wagon By Mercedes Benz

May 21, 2025 -

Official New Peaky Blinders Series Announced Featuring Significant Changes

May 21, 2025

Official New Peaky Blinders Series Announced Featuring Significant Changes

May 21, 2025 -

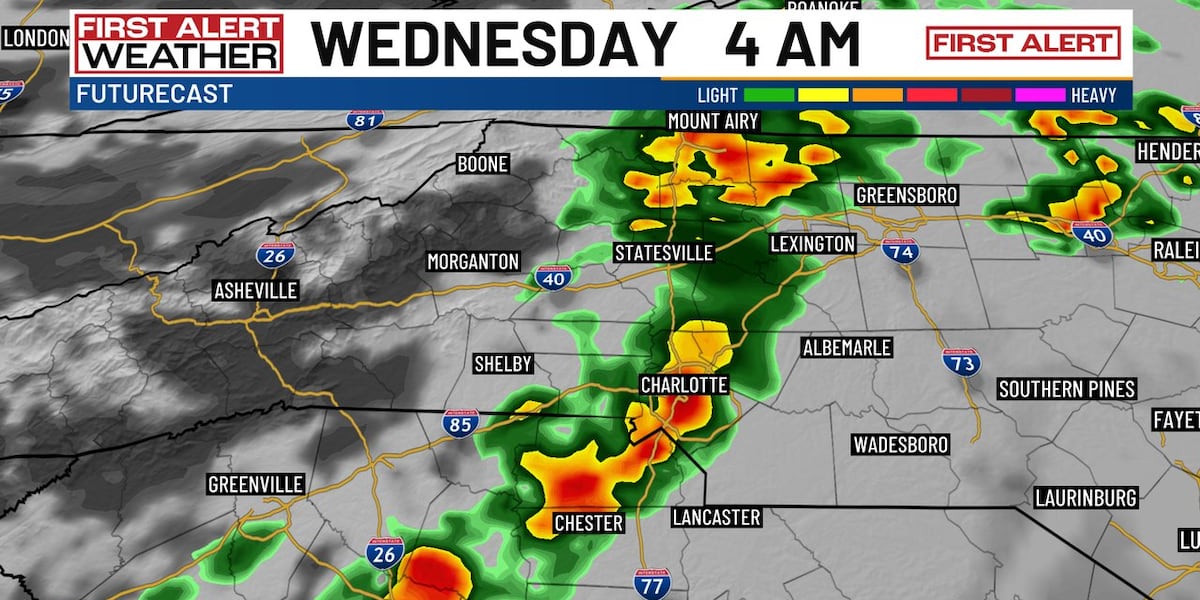

Charlotte Faces Overnight Storm Threat Cooler Temperatures Expected

May 21, 2025

Charlotte Faces Overnight Storm Threat Cooler Temperatures Expected

May 21, 2025