Bitcoin ETF Investment Surges Past $5 Billion: Analyzing The Market Shift

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bitcoin ETF Investment Surges Past $5 Billion: Analyzing the Market Shift

The long-awaited arrival of Bitcoin exchange-traded funds (ETFs) in the US has ignited a firestorm of investment, with assets under management (AUM) recently surpassing the monumental $5 billion mark. This significant milestone signals a major shift in the perception and accessibility of Bitcoin, opening the door for a new wave of institutional and retail investors. But what's driving this surge, and what does it mean for the future of Bitcoin and the broader cryptocurrency market?

The Catalyst: Regulatory Approval and Increased Accessibility

The approval of the first Bitcoin ETFs by the Securities and Exchange Commission (SEC) marked a watershed moment. For years, institutional investors hesitated due to regulatory uncertainty and the perceived risks associated with direct Bitcoin ownership. ETFs, however, offer a familiar and regulated investment vehicle, mitigating these concerns. This newfound accessibility has been a key driver of the rapid growth in AUM. The ease of buying and selling Bitcoin through a brokerage account, rather than navigating the complexities of cryptocurrency exchanges, is particularly appealing to mainstream investors.

Who's Investing? A Diversified Landscape

The $5 billion figure isn't just driven by one type of investor. We're seeing a confluence of interest from various groups:

- Institutional Investors: Hedge funds, pension funds, and other large institutions are increasingly allocating a portion of their portfolios to Bitcoin ETFs, recognizing it as a potential diversification tool and a hedge against inflation.

- Retail Investors: The ease of access through traditional brokerage accounts has made Bitcoin ETFs attractive to everyday investors, who may have previously been intimidated by the technical aspects of direct cryptocurrency investment.

- High-Net-Worth Individuals (HNWIs): HNWIs are seeking alternative investment opportunities, and Bitcoin ETFs provide a regulated pathway to gain exposure to the cryptocurrency market.

Beyond the $5 Billion Milestone: What Lies Ahead?

The surpassing of $5 billion in AUM is a significant achievement, but it's likely just the beginning. Several factors suggest further growth:

- More ETF Approvals: The SEC's approval of the initial Bitcoin ETFs has paved the way for more applications. An increase in the number of available ETFs will likely lead to increased competition and potentially lower fees, further attracting investors.

- Continued Institutional Adoption: As more institutional investors gain comfort with Bitcoin ETFs, we can expect larger allocations in the future.

- Growing Retail Interest: Public awareness of Bitcoin and the ease of investing through ETFs will continue to draw retail investors into the market.

Potential Risks and Considerations:

While the outlook appears positive, investors should be aware of potential risks:

- Market Volatility: Bitcoin is known for its volatility, and ETF investments are subject to these price fluctuations.

- Regulatory Changes: Future regulatory changes could impact the Bitcoin ETF market.

- Security Risks: While ETFs offer a degree of security compared to directly holding Bitcoin, investors should still research the fund manager's security protocols.

Conclusion:

The surge in Bitcoin ETF investment past $5 billion signifies a monumental shift in the cryptocurrency landscape. Increased accessibility, regulatory clarity, and growing institutional adoption are key factors fueling this growth. While risks remain, the long-term potential for Bitcoin and its related ETFs appears significant, making it a compelling area for investors to watch closely. Further research and careful consideration of personal risk tolerance are crucial before making any investment decisions. Learn more about investing in Bitcoin ETFs by consulting with a qualified financial advisor.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bitcoin ETF Investment Surges Past $5 Billion: Analyzing The Market Shift. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

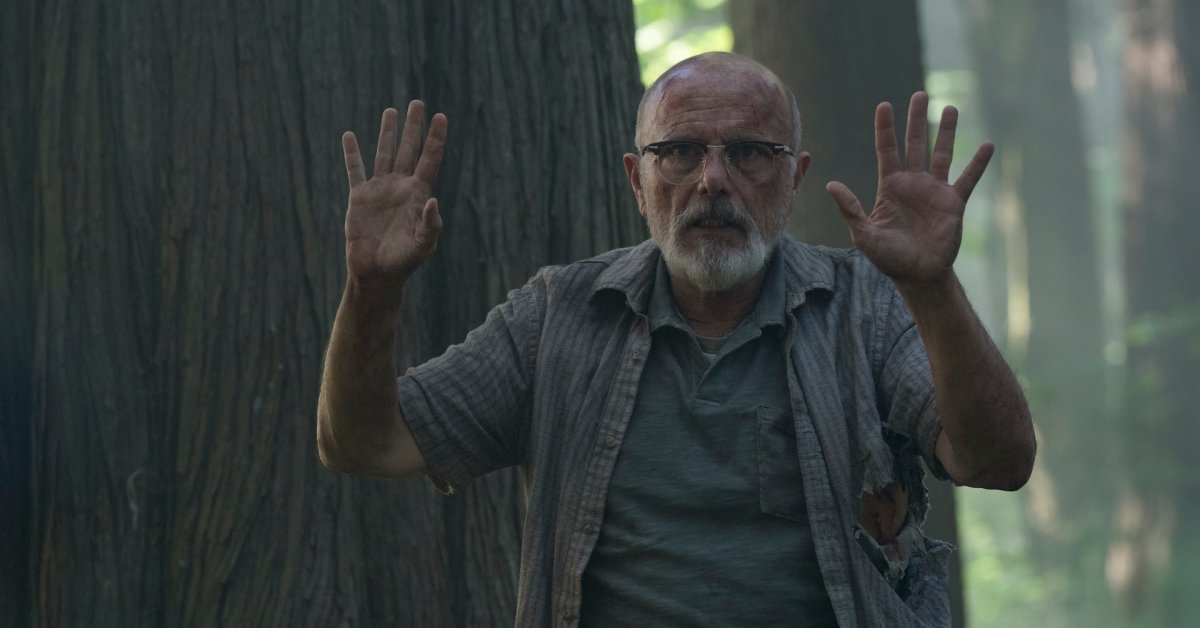

Joel And Ellies Evolving Dynamic A Comparison Of The Last Of Us Game And Season 2

May 20, 2025

Joel And Ellies Evolving Dynamic A Comparison Of The Last Of Us Game And Season 2

May 20, 2025 -

Five Continents Affected By Major Solar Storm Communications Breakdown

May 20, 2025

Five Continents Affected By Major Solar Storm Communications Breakdown

May 20, 2025 -

Geomagnetic Storm Impact Extensive Communications Failures Across Five Continents

May 20, 2025

Geomagnetic Storm Impact Extensive Communications Failures Across Five Continents

May 20, 2025 -

Big Twist Peaky Blinders Returns With A New Series Altering The Course

May 20, 2025

Big Twist Peaky Blinders Returns With A New Series Altering The Course

May 20, 2025 -

See Daniel Craig Cillian Murphy And Tom Hardy In This Powerful Ww 1 Drama

May 20, 2025

See Daniel Craig Cillian Murphy And Tom Hardy In This Powerful Ww 1 Drama

May 20, 2025