Bitcoin ETF Investment Soars Past $5 Billion: Analyzing The Market Shift

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bitcoin ETF Investment Soars Past $5 Billion: Analyzing the Market Shift

The long-awaited surge in Bitcoin ETF investment has finally arrived, surpassing a staggering $5 billion in assets under management (AUM). This monumental milestone marks a significant turning point for the cryptocurrency market, signaling a growing acceptance of Bitcoin among institutional investors and paving the way for broader mainstream adoption.

The recent approval of several Bitcoin exchange-traded funds (ETFs) by regulatory bodies like the Securities and Exchange Commission (SEC) in the United States has acted as a catalyst for this unprecedented influx of investment. This regulatory green light has legitimized Bitcoin in the eyes of many, encouraging larger financial institutions to participate in the market with less risk aversion. This move signifies a dramatic shift from the previously cautious approach towards cryptocurrencies.

What's Driving This Massive Investment?

Several factors contribute to this explosive growth in Bitcoin ETF investment:

-

Increased Regulatory Clarity: The SEC's approval of Bitcoin ETFs has significantly reduced regulatory uncertainty, making it easier for institutional investors to allocate funds to this asset class. This clarity is crucial for risk-averse investors who previously hesitated due to the lack of regulatory oversight.

-

Institutional Adoption: Major financial institutions, including BlackRock, Fidelity, and Invesco, have filed for their own Bitcoin ETFs, signaling a growing confidence in the long-term viability of Bitcoin. This institutional backing lends credibility to Bitcoin and encourages further investment.

-

Diversification Strategy: Many investors view Bitcoin as a hedge against inflation and a potential diversifier in their portfolios. The accessibility offered by ETFs makes it easier for investors to integrate Bitcoin into their existing investment strategies without the complexities of directly buying and holding Bitcoin.

-

Ease of Access: Bitcoin ETFs provide a user-friendly way for investors to gain exposure to Bitcoin without the technical challenges associated with using cryptocurrency exchanges. This ease of access opens the doors for a wider range of investors, including those unfamiliar with the intricacies of the cryptocurrency market.

Potential Implications of the $5 Billion Milestone

This surge in Bitcoin ETF investment is likely to have several significant implications:

-

Increased Price Volatility: While the influx of investment is positive, it could also lead to increased price volatility in the short term. The market may experience periods of both significant gains and losses as investor sentiment fluctuates.

-

Further Institutional Adoption: The success of existing Bitcoin ETFs is likely to encourage even more institutional investors to enter the market, further fueling growth and potentially driving up the price of Bitcoin.

-

Mainstream Adoption: As Bitcoin becomes more accessible through ETFs, it is likely to gain broader mainstream adoption, further solidifying its position as a legitimate asset class.

-

Competition in the ETF Market: The growing popularity of Bitcoin ETFs is likely to result in increased competition among providers, potentially leading to lower fees and more innovative products for investors.

Looking Ahead: What to Expect

The future of Bitcoin ETF investment remains bright, but investors should proceed with caution. While the $5 Billion milestone represents significant progress, the cryptocurrency market is still subject to considerable volatility. It's crucial to conduct thorough research and understand the risks involved before investing in any Bitcoin ETF. Staying informed about regulatory changes and market trends is also essential for making informed investment decisions.

Further Reading:

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in cryptocurrencies involves significant risk, and you could lose money.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bitcoin ETF Investment Soars Past $5 Billion: Analyzing The Market Shift. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Urgent Peace Push Trump Initiates Russia Ukraine Truce Negotiations

May 20, 2025

Urgent Peace Push Trump Initiates Russia Ukraine Truce Negotiations

May 20, 2025 -

Walmart Warns Of Price Increases After Trumps Tariff Comments

May 20, 2025

Walmart Warns Of Price Increases After Trumps Tariff Comments

May 20, 2025 -

Eagles Lock Up Head Coach Nick Sirianni With New Deal

May 20, 2025

Eagles Lock Up Head Coach Nick Sirianni With New Deal

May 20, 2025 -

The Putin Trump Dynamic A Power Shift In The Global Arena

May 20, 2025

The Putin Trump Dynamic A Power Shift In The Global Arena

May 20, 2025 -

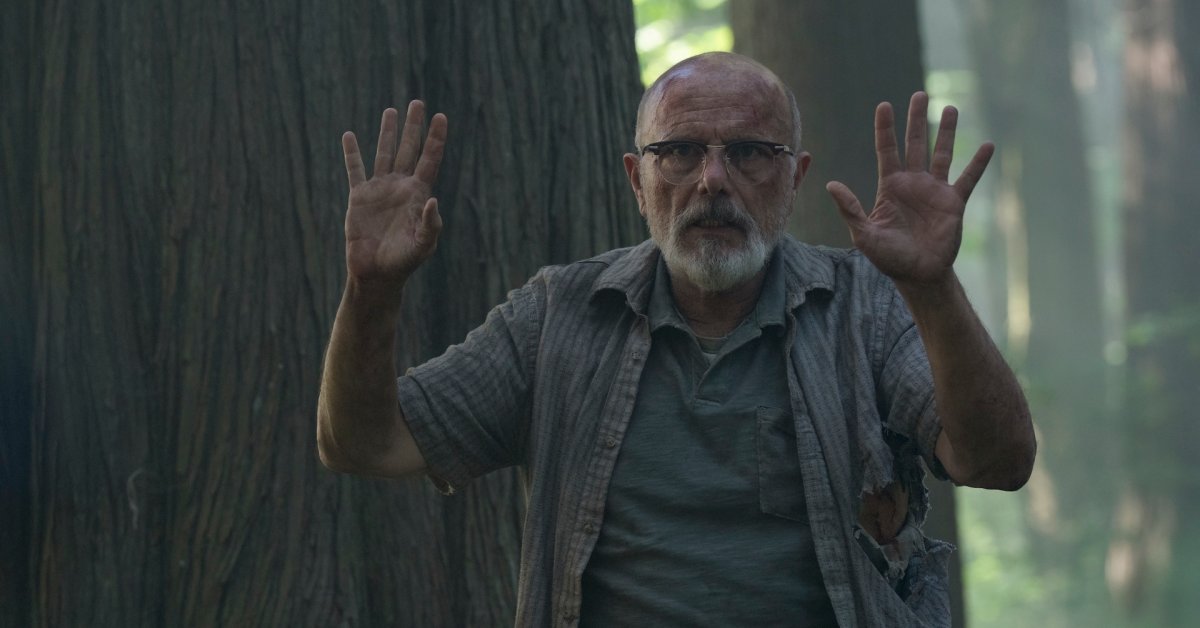

Reframing The Relationship How The Last Of Us Show Diverges From The Games Narrative Season 2

May 20, 2025

Reframing The Relationship How The Last Of Us Show Diverges From The Games Narrative Season 2

May 20, 2025