Billions Flow Into Bitcoin ETFs: A Look At The Recent Investment Surge

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Billions Flow into Bitcoin ETFs: A Look at the Recent Investment Surge

The world of finance is buzzing. Billions of dollars are pouring into Bitcoin exchange-traded funds (ETFs), marking a significant shift in institutional and retail investor sentiment towards the leading cryptocurrency. This unprecedented surge raises crucial questions: What's driving this investment boom? What does it mean for the future of Bitcoin and the broader crypto market? And are there risks involved? Let's delve into the details.

The Institutional Embrace of Bitcoin ETFs

The recent influx of capital into Bitcoin ETFs is largely attributed to the growing acceptance of Bitcoin as a legitimate asset class by institutional investors. Hedge funds, pension funds, and other large financial players are increasingly allocating a portion of their portfolios to Bitcoin, viewing it as a potential hedge against inflation and a diversification tool. The approval of several Bitcoin ETFs by regulatory bodies, particularly in the United States, has further fueled this trend. This regulatory clarity provides a level of comfort and legitimacy that was previously lacking, encouraging greater participation from risk-averse investors.

Retail Investors Jump Onboard

The ease of access provided by ETFs is also driving retail investor participation. Unlike directly purchasing Bitcoin, which requires navigating the complexities of cryptocurrency exchanges and wallets, ETFs offer a familiar and straightforward investment vehicle accessible through traditional brokerage accounts. This accessibility lowers the barrier to entry, enabling a broader range of individuals to participate in the Bitcoin market.

Factors Fueling the Bitcoin ETF Boom:

- Regulatory Approvals: The approval of several Bitcoin ETFs by key regulatory bodies has significantly boosted investor confidence.

- Inflationary Pressures: Bitcoin's perceived role as a hedge against inflation continues to be a major draw for investors seeking to protect their purchasing power.

- Increased Institutional Adoption: Major financial institutions are increasingly integrating Bitcoin into their investment strategies, signaling a growing acceptance of the asset class.

- Technological Advancements: The ongoing development and improvement of blockchain technology continues to enhance Bitcoin's appeal and long-term potential.

- Growing Market Maturity: The cryptocurrency market, once considered highly volatile and speculative, is showing signs of maturity, attracting more mainstream investors.

Potential Risks and Considerations:

While the surge in Bitcoin ETF investments is undeniably significant, it's crucial to acknowledge the inherent risks associated with cryptocurrencies. Bitcoin's price remains volatile, and investors should be prepared for potential price swings. Furthermore, regulatory landscapes can change rapidly, potentially impacting the performance of Bitcoin ETFs. Thorough due diligence and a clear understanding of risk tolerance are essential before investing.

Looking Ahead: The Future of Bitcoin ETFs

The recent surge in Bitcoin ETF investments suggests a broader trend towards the mainstream adoption of cryptocurrencies. As regulatory clarity improves and institutional acceptance grows, we can expect further growth in the Bitcoin ETF market. However, it's important to remember that the cryptocurrency market is still evolving, and investors should proceed with caution and conduct their own research before making any investment decisions. The future remains uncertain, but the current trend points towards a significant role for Bitcoin ETFs in the future of finance.

Call to Action: Stay informed about the latest developments in the cryptocurrency market by following reputable financial news sources and consulting with a qualified financial advisor before making any investment decisions. Understanding the risks and rewards associated with Bitcoin ETFs is crucial for responsible investment.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Billions Flow Into Bitcoin ETFs: A Look At The Recent Investment Surge. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

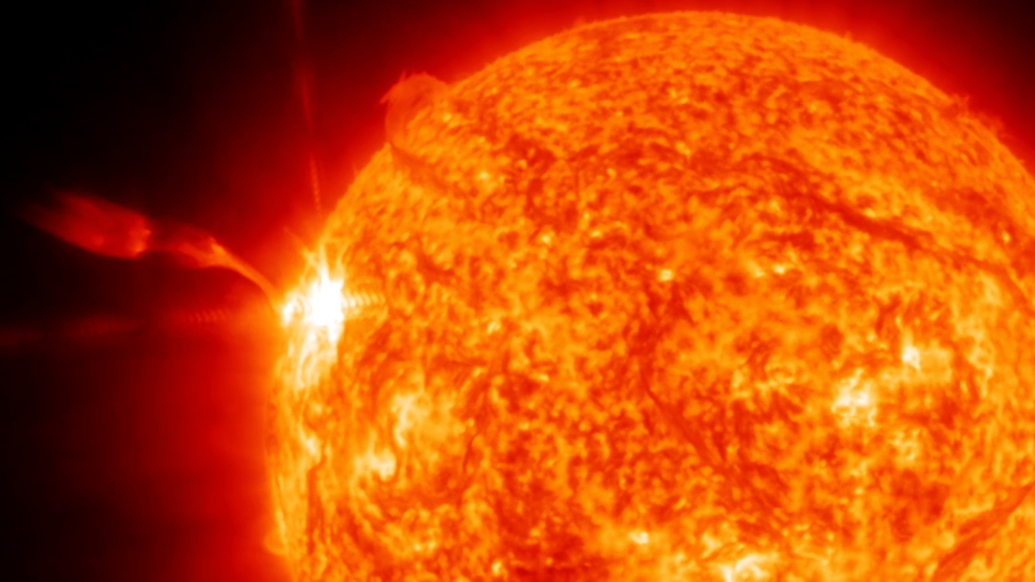

Intense Solar Flare Triggers Radio Outages Across Europe Asia And The Middle East Watch Video

May 20, 2025

Intense Solar Flare Triggers Radio Outages Across Europe Asia And The Middle East Watch Video

May 20, 2025 -

Mortgage Refinance Rate Trends May 19 2025 Data And Insights

May 20, 2025

Mortgage Refinance Rate Trends May 19 2025 Data And Insights

May 20, 2025 -

New Ruling In Spain Impacts 65 000 Tourist Rentals What You Need To Know

May 20, 2025

New Ruling In Spain Impacts 65 000 Tourist Rentals What You Need To Know

May 20, 2025 -

Pope Leo Calls For World Peace And Unity In Inauguration Address

May 20, 2025

Pope Leo Calls For World Peace And Unity In Inauguration Address

May 20, 2025 -

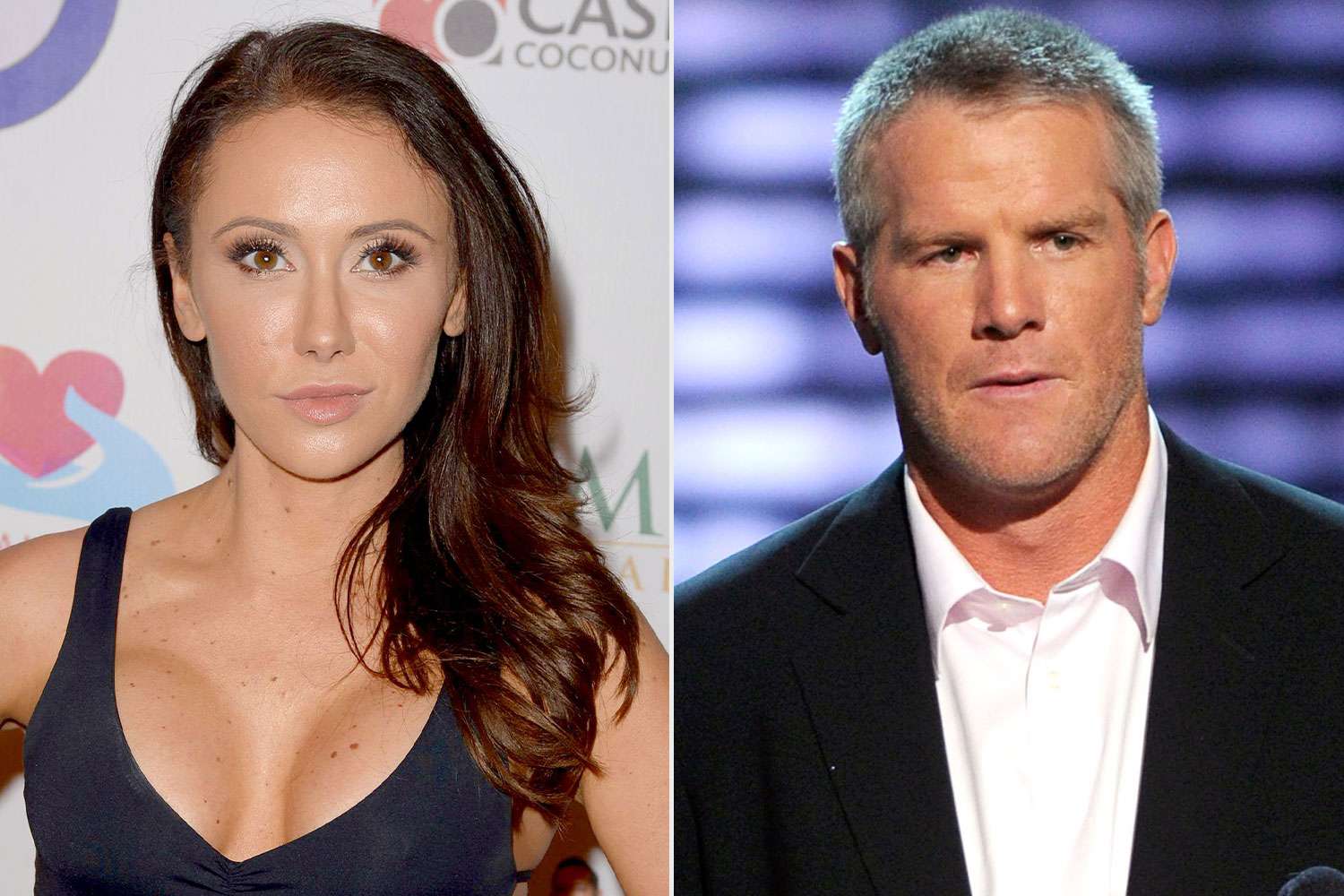

Jenn Sterger On Brett Favre Sext Scandal Fallout I Was Never Treated Like A Person

May 20, 2025

Jenn Sterger On Brett Favre Sext Scandal Fallout I Was Never Treated Like A Person

May 20, 2025