Billions Flow Into Bitcoin ETFs: A Look At The Market's Bold Directional Bets

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Billions Flow into Bitcoin ETFs: A Look at the Market's Bold Directional Bets

The cryptocurrency market is abuzz with excitement as billions of dollars pour into Bitcoin exchange-traded funds (ETFs). This surge signifies a major shift in investor sentiment, marking a bold directional bet on Bitcoin's future. But what's driving this influx of capital, and what does it mean for the future of Bitcoin and the broader crypto market? Let's delve into the details.

The ETF Gold Rush: A Paradigm Shift in Bitcoin Investment

The approval of the first Bitcoin futures ETF in the US in 2021 was a watershed moment. However, the recent surge in investment surpasses previous milestones. Billions are now flowing into both futures-based ETFs and, more significantly, spot Bitcoin ETFs where investors gain direct exposure to the price of Bitcoin itself. This signifies a growing institutional acceptance of Bitcoin as a legitimate asset class. Previously hesitant institutional investors, including pension funds and hedge funds, are now actively participating, driven by the perceived benefits of diversification and exposure to this potentially high-growth asset.

Why the Sudden Surge? Several Factors Converge

Several key factors contribute to this unprecedented inflow of capital into Bitcoin ETFs:

- Regulatory Clarity: Increased regulatory clarity in key markets like the US is fostering greater confidence among institutional investors. The SEC's approval of spot Bitcoin ETFs, after years of deliberation, has significantly reduced regulatory uncertainty. This clarity is a major catalyst for institutional investment.

- Inflation Hedge: With persistent inflationary pressures globally, many investors view Bitcoin as a potential hedge against inflation. Its decentralized nature and limited supply make it an attractive alternative to traditional assets.

- Technological Advancements: The ongoing development of the Bitcoin network, including the Lightning Network for faster and cheaper transactions, enhances its practicality and appeal. These advancements alleviate some of the previous concerns regarding scalability and usability.

- Increased Institutional Adoption: As mentioned earlier, the growing participation of institutional investors is a key driver. Their significant capital injections amplify the market's upward momentum.

Navigating the Risks: Understanding the Volatility

Despite the positive momentum, it's crucial to acknowledge the inherent risks associated with Bitcoin investment. Bitcoin's price remains notoriously volatile, and investors should be prepared for significant price swings. Before investing in Bitcoin ETFs, thorough due diligence and risk assessment are paramount. Consider consulting with a qualified financial advisor to determine if Bitcoin ETFs align with your risk tolerance and investment goals.

Looking Ahead: What the Future Holds

The massive inflow of capital into Bitcoin ETFs signals a significant shift in the market landscape. This trend is likely to continue, at least in the short to medium term, driven by the factors discussed above. However, the long-term outlook remains subject to various factors, including regulatory developments, macroeconomic conditions, and technological advancements.

What this means for you:

The significant investment in Bitcoin ETFs presents both opportunities and challenges. If you are considering investing, remember to conduct thorough research, understand the associated risks, and only invest what you can afford to lose. Staying informed about market trends and regulatory changes will be critical for navigating this dynamic space.

Keywords: Bitcoin ETF, Bitcoin Exchange Traded Fund, Cryptocurrency ETF, Bitcoin Investment, Institutional Investment, Bitcoin Price, Crypto Market, Regulatory Clarity, SEC, Inflation Hedge, Volatility, Bitcoin Futures ETF, Spot Bitcoin ETF

(Note: This article provides general information and does not constitute financial advice. Consult a financial professional before making any investment decisions.)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Billions Flow Into Bitcoin ETFs: A Look At The Market's Bold Directional Bets. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

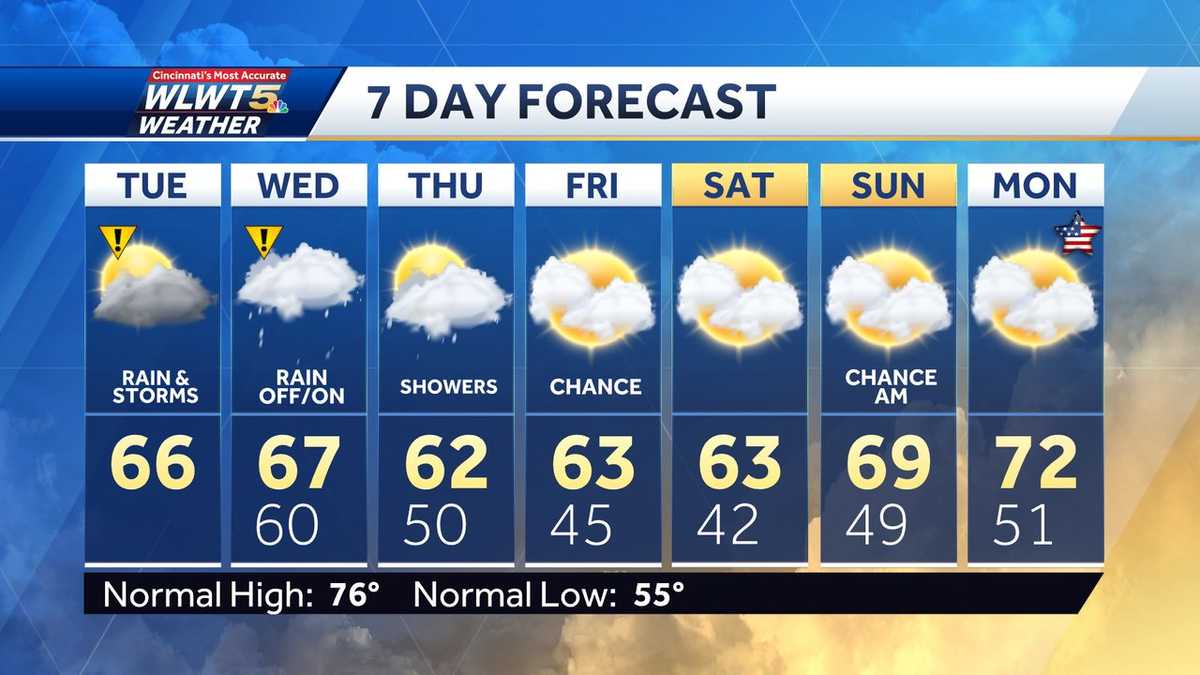

Weekly Weather Outlook Rain And Falling Temperatures

May 21, 2025

Weekly Weather Outlook Rain And Falling Temperatures

May 21, 2025 -

Nature Conservation Drives Corporate Value Growth For 160 Japanese Companies New Sector Specific Guidelines Unveiled

May 21, 2025

Nature Conservation Drives Corporate Value Growth For 160 Japanese Companies New Sector Specific Guidelines Unveiled

May 21, 2025 -

Cooler Temperatures And Rain To Continue Throughout The Week

May 21, 2025

Cooler Temperatures And Rain To Continue Throughout The Week

May 21, 2025 -

World War I Epic Featuring Daniel Craig Cillian Murphy And Tom Hardy Streaming Now

May 21, 2025

World War I Epic Featuring Daniel Craig Cillian Murphy And Tom Hardy Streaming Now

May 21, 2025 -

Recognition For Solo Leveling First Award And Future Prospects

May 21, 2025

Recognition For Solo Leveling First Award And Future Prospects

May 21, 2025