Billions Flood Into Bitcoin ETFs: A Bold Investment Strategy Pays Off

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Billions Flood into Bitcoin ETFs: A Bold Investment Strategy Pays Off

The cryptocurrency market is buzzing. Billions of dollars are pouring into Bitcoin exchange-traded funds (ETFs), marking a significant shift in institutional and individual investor sentiment. This surge represents a powerful endorsement of Bitcoin as a viable asset class and a bold investment strategy paying off handsomely for early adopters. But what's driving this influx, and what does it mean for the future of Bitcoin and the broader crypto market?

The ETF Boom: A Game Changer for Bitcoin Investment

The recent approval of Bitcoin ETFs in major markets, most notably the United States, has opened the floodgates. Previously, accessing Bitcoin directly involved navigating the complexities of cryptocurrency exchanges, a process many institutional investors found daunting and risky. ETFs offer a streamlined, regulated pathway for investment, making Bitcoin accessible to a much wider range of investors, including pension funds, hedge funds, and everyday retail investors. This increased accessibility is a crucial factor in the billions flowing into these funds.

Why the Sudden Surge in Investment?

Several key factors contribute to this significant investment surge:

- Regulatory Clarity: The approval of Bitcoin ETFs signals a growing acceptance of cryptocurrencies by regulatory bodies. This regulatory clarity reduces uncertainty and encourages institutional investment.

- Institutional Adoption: Large financial institutions are increasingly recognizing Bitcoin's potential as a diversification tool and a hedge against inflation. Their participation lends credibility and stability to the market.

- Increased Demand: Retail investors, emboldened by institutional adoption and the ease of access through ETFs, are also pouring money into Bitcoin ETFs. This represents a significant expansion of the investor base.

- Bitcoin's Proven Track Record: Despite its volatility, Bitcoin has demonstrated remarkable resilience over the years, establishing itself as a prominent digital asset. This long-term performance is attracting investors seeking long-term growth potential.

Risks and Considerations:

While the current trend is undeniably bullish, it's crucial to acknowledge the inherent risks associated with Bitcoin investment:

- Volatility: Bitcoin's price remains notoriously volatile, subject to significant fluctuations. Investors should be prepared for potential losses.

- Market Regulation: The regulatory landscape for cryptocurrencies is still evolving and remains uncertain in many jurisdictions. Changes in regulations can impact Bitcoin's price and accessibility.

- Security Concerns: Security breaches and hacks remain a concern within the cryptocurrency space. Investors should carefully choose reputable and secure ETF providers.

The Future of Bitcoin ETFs:

The influx of billions into Bitcoin ETFs suggests a promising future for this investment vehicle. As regulatory clarity improves and institutional adoption continues, we can expect to see even greater growth in the Bitcoin ETF market. This could lead to increased price stability and broader mainstream adoption of Bitcoin as a legitimate asset class. However, investors should always conduct thorough research and understand the risks before investing in any cryptocurrency-related product.

Call to Action:

While we don't offer financial advice, staying informed about market trends and regulatory changes is crucial for any investor considering Bitcoin ETFs. Further research into reputable financial news sources and consultation with a qualified financial advisor are recommended before making any investment decisions. Understanding the risks and rewards is paramount to responsible investing in this exciting but volatile market. Learn more about [link to reputable financial news source about Bitcoin ETFs].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Billions Flood Into Bitcoin ETFs: A Bold Investment Strategy Pays Off. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Assassins Creed Mirage Ubisoft Clarifies The Absence Of Animal Killing

May 21, 2025

Assassins Creed Mirage Ubisoft Clarifies The Absence Of Animal Killing

May 21, 2025 -

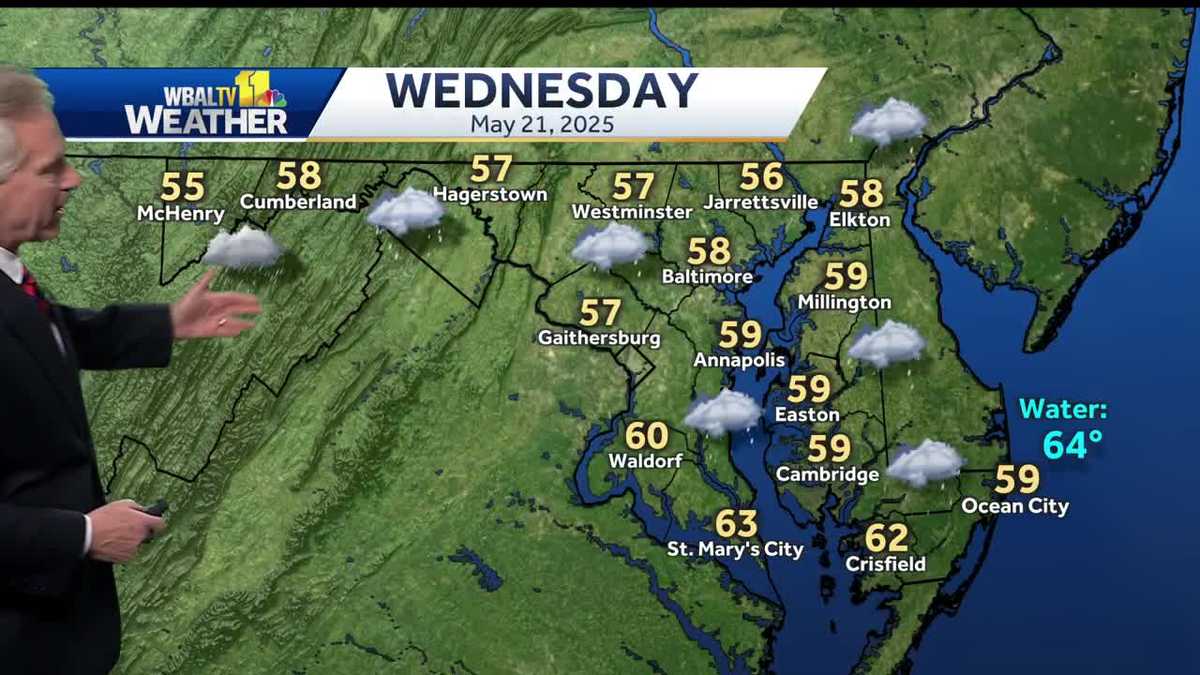

Wednesday Weather Expect Rain And Unseasonably Cool Temperatures

May 21, 2025

Wednesday Weather Expect Rain And Unseasonably Cool Temperatures

May 21, 2025 -

Assassins Creed Shadows Ubisoft Addresses Player Concerns About Animal Killing

May 21, 2025

Assassins Creed Shadows Ubisoft Addresses Player Concerns About Animal Killing

May 21, 2025 -

Two Boys Face Charges After Church Break In And Bathroom Defacement

May 21, 2025

Two Boys Face Charges After Church Break In And Bathroom Defacement

May 21, 2025 -

Letitia James Trumps Legal Troubles Vs Dojs Real Estate Fraud Investigation

May 21, 2025

Letitia James Trumps Legal Troubles Vs Dojs Real Estate Fraud Investigation

May 21, 2025