Billionaire Buyout: Private Equity's $1 Billion Investment In Fried Chicken Giant

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Billionaire Buyout: Private Equity's $1 Billion Investment in Fried Chicken Giant Sparks Industry Debate

The fried chicken industry just saw a seismic shift. A major private equity firm has announced a staggering $1 billion investment in the seemingly unstoppable fried chicken giant, [Insert Fictional Fried Chicken Chain Name Here] (IFCC), sending shockwaves through the financial world and igniting a heated debate among industry analysts. This blockbuster deal marks one of the largest private equity investments in the fast-food sector this year, raising questions about the future of the fried chicken market and the growing power of private equity in shaping consumer landscapes.

Who's Behind the Buyout?

The acquisition is spearheaded by [Insert Fictional Private Equity Firm Name Here] (IPEF), a renowned private equity firm known for its aggressive investment strategies and significant portfolio of successful food and beverage companies. While the specifics of the deal remain undisclosed, sources suggest IPEF is betting big on IFCC's continued growth and market dominance. This massive investment underscores the confidence major players have in the enduring appeal of fried chicken, even in a fluctuating economy.

What Does This Mean for IFCC and Consumers?

This $1 billion injection of capital could translate to several significant changes for IFCC and its customers:

- Expansion and Innovation: Expect to see increased investment in new store openings, both domestically and internationally. We might also witness exciting menu innovations, leveraging IPEF's expertise in brand development and marketing. New technologies, such as improved delivery services and enhanced digital ordering systems, are also highly likely.

- Increased Competition: This substantial investment will undoubtedly intensify competition within the already fiercely competitive fried chicken market. Other major players will likely need to respond with their own strategies to maintain market share.

- Potential Price Changes: While not immediately guaranteed, increased operational efficiency through private equity investment could lead to lower prices for consumers. However, analysts also caution that this is not always the case, and some price adjustments might be expected due to increased operational costs and supply chain fluctuations.

The Private Equity Factor: A Double-Edged Sword?

Private equity investments in the food industry are increasingly common, raising concerns among some critics about prioritizing profit maximization over ethical considerations and employee welfare. While IPEF's involvement could lead to significant growth for IFCC, questions remain about the long-term impact on employment conditions and potential changes to IFCC’s commitment to sustainability and ethical sourcing. This deal highlights the ongoing discussion surrounding the role of private equity in shaping the future of our food systems. Further research into IPEF's past practices and their stated commitment to responsible investing will be crucial in assessing the broader societal implications of this buyout.

The Future of Fried Chicken

This billion-dollar buyout signifies more than just a financial transaction; it represents a pivotal moment in the evolution of the fried chicken industry. The next few years will be critical in observing how this investment shapes IFCC's trajectory and its impact on the broader fast-food landscape. Will this be a recipe for success, or a case study in the potential pitfalls of private equity involvement in the food sector? Only time will tell. Stay tuned for further updates as this story unfolds.

Keywords: Billionaire Buyout, Private Equity, Fried Chicken, Fast Food, Investment, [Insert Fictional Fried Chicken Chain Name Here], [Insert Fictional Private Equity Firm Name Here], Food Industry, Market Dominance, Expansion, Innovation, Competition, Economic Impact, Consumer Prices, Ethical Considerations, Sustainability.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Billionaire Buyout: Private Equity's $1 Billion Investment In Fried Chicken Giant. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

St Louis Launches Demolition Project For Tornado Hit Lra Properties

Jun 05, 2025

St Louis Launches Demolition Project For Tornado Hit Lra Properties

Jun 05, 2025 -

Political Fallout Analyzing The Gops Response To Trumps Latest Legislation

Jun 05, 2025

Political Fallout Analyzing The Gops Response To Trumps Latest Legislation

Jun 05, 2025 -

Private Equity Firm Snaps Up Popular Fried Chicken Chain In 1 B Deal

Jun 05, 2025

Private Equity Firm Snaps Up Popular Fried Chicken Chain In 1 B Deal

Jun 05, 2025 -

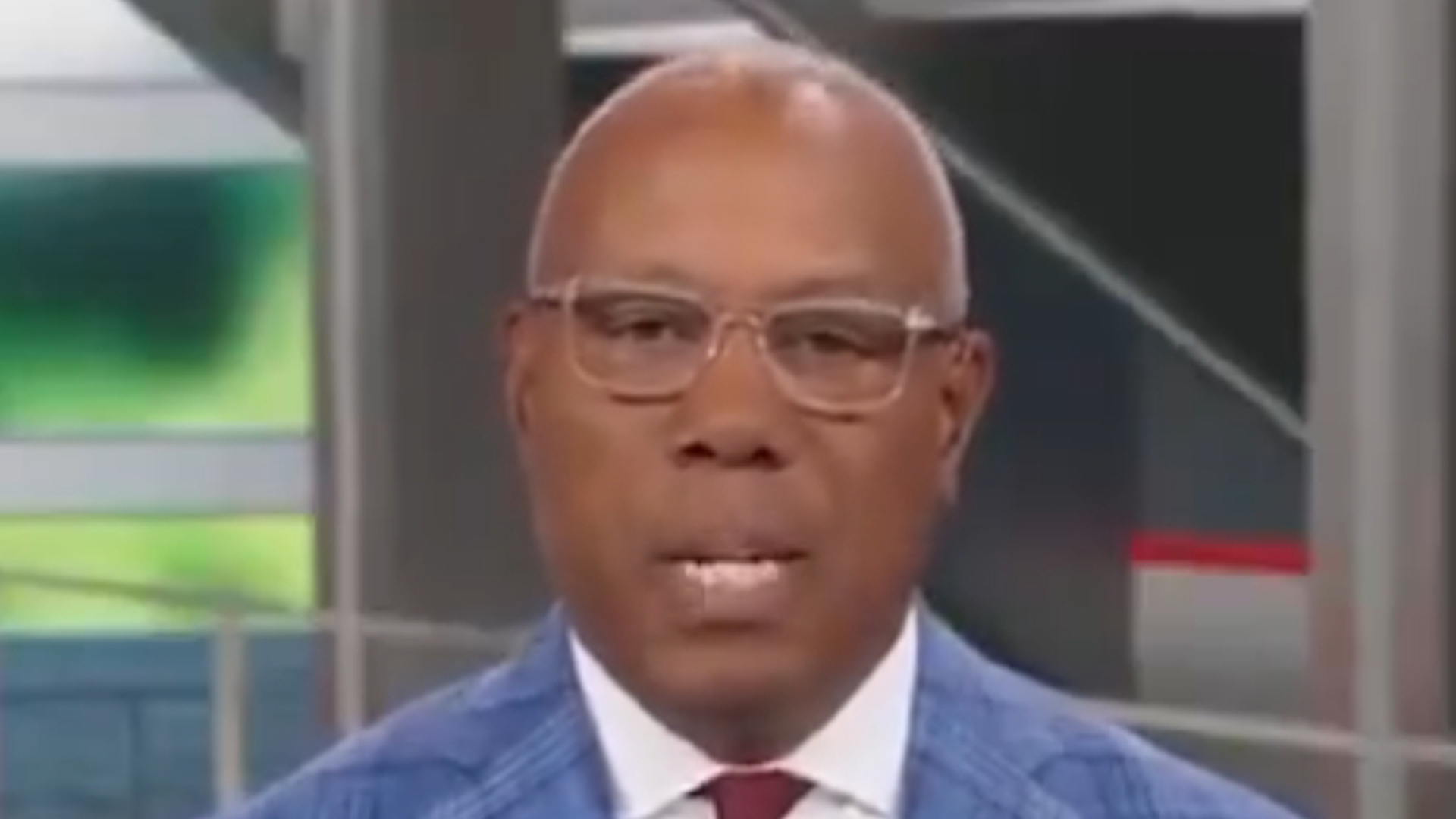

Prostate Cancer Diagnosis Espns Jay Harris To Undergo Surgery Takes Break From Tv

Jun 05, 2025

Prostate Cancer Diagnosis Espns Jay Harris To Undergo Surgery Takes Break From Tv

Jun 05, 2025 -

The Suhail Bhat Story A Ball Boys Triumph In Indian Football

Jun 05, 2025

The Suhail Bhat Story A Ball Boys Triumph In Indian Football

Jun 05, 2025