Billion-Dollar Retirement Scam: FBI Alert And Expert Analysis On AI's Role

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Billion-Dollar Retirement Scam: FBI Issues Urgent Alert as AI's Role Explodes

A massive retirement scam, estimated to have defrauded victims of over a billion dollars, has prompted an urgent alert from the FBI, highlighting the increasingly sophisticated role of artificial intelligence in perpetrating these crimes. The sheer scale of the operation, coupled with the innovative use of AI technology, underscores a growing threat to retirement savings and demands immediate attention from both individuals and regulatory bodies.

The FBI's alert, issued last week, details a complex scheme targeting retirees across the country. Victims are often contacted through seemingly legitimate channels, including personalized emails, phone calls, and even text messages meticulously crafted using AI-powered tools. These sophisticated communications leverage personal information obtained through data breaches or social engineering tactics, creating a sense of trust and urgency that preys on vulnerable individuals.

<h3>How AI Fuels the Retirement Scam</h3>

The perpetrators utilize AI in several key ways:

- Personalized Phishing: AI algorithms analyze vast amounts of data to personalize phishing attempts, making them far more convincing than generic scams. This includes tailoring the messaging to reflect the victim's age, location, and even their specific investment portfolio.

- Voice Cloning: Advanced AI can now convincingly clone a victim's voice or the voice of a trusted authority figure, making fraudulent phone calls incredibly difficult to detect.

- Automated Communication: AI powers automated systems that can send thousands of personalized messages simultaneously, significantly expanding the reach and efficiency of the scam.

- Deepfake Videos: While not yet widespread in this specific scam, the potential for AI-generated deepfake videos featuring trusted financial advisors urging immediate action is a significant and growing concern.

<h3>Expert Analysis: The Future of Financial Fraud</h3>

Dr. Anya Sharma, a cybersecurity expert at Stanford University, commented on the increasing sophistication of these scams: "The use of AI in financial fraud is rapidly evolving. We're no longer dealing with simple phishing emails; we're seeing highly personalized and targeted attacks that leverage the power of machine learning to bypass traditional security measures." Dr. Sharma emphasizes the need for improved cybersecurity education and the development of more robust AI-powered detection systems to combat these threats.

<h3>Protecting Yourself from Retirement Scams</h3>

The FBI's alert urges retirees to remain vigilant and take proactive steps to protect their savings. Here are some key preventative measures:

- Verify Information: Never provide personal or financial information over the phone or through unsolicited emails or text messages. Always verify the legitimacy of any request through official channels.

- Be Skeptical of Urgent Requests: Legitimate financial institutions rarely pressure individuals into making immediate investment decisions.

- Educate Yourself: Stay informed about common scams and the latest tactics used by fraudsters. Resources like the FTC website and the AARP's fraud prevention center offer valuable information.

- Use Strong Passwords and Multi-Factor Authentication: Protect your online accounts with strong, unique passwords and enable multi-factor authentication whenever possible.

<h3>The Urgent Need for Action</h3>

The billion-dollar retirement scam serves as a stark warning of the evolving landscape of financial crime. Governments, financial institutions, and technology companies must collaborate to develop more effective strategies for detecting and preventing AI-powered fraud. Increased public awareness and education are also crucial to protecting vulnerable populations from these increasingly sophisticated attacks. The future of secure retirement planning depends on it. Learn more about protecting your retirement savings by visiting the [link to a reputable financial security resource].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Billion-Dollar Retirement Scam: FBI Alert And Expert Analysis On AI's Role. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Streaming Charts Buzz Mel Gibsons 52 Rotten Tomatoes Film A Hit

Sep 01, 2025

Streaming Charts Buzz Mel Gibsons 52 Rotten Tomatoes Film A Hit

Sep 01, 2025 -

Labor Day 2024 Anti Trump Protests Set To Erupt Across America

Sep 01, 2025

Labor Day 2024 Anti Trump Protests Set To Erupt Across America

Sep 01, 2025 -

Reflecting On Katrina Improvements And Ongoing Challenges In Disaster Response

Sep 01, 2025

Reflecting On Katrina Improvements And Ongoing Challenges In Disaster Response

Sep 01, 2025 -

Lightfoots Direct Challenge Chicago Counters Trump Troop Deployment

Sep 01, 2025

Lightfoots Direct Challenge Chicago Counters Trump Troop Deployment

Sep 01, 2025 -

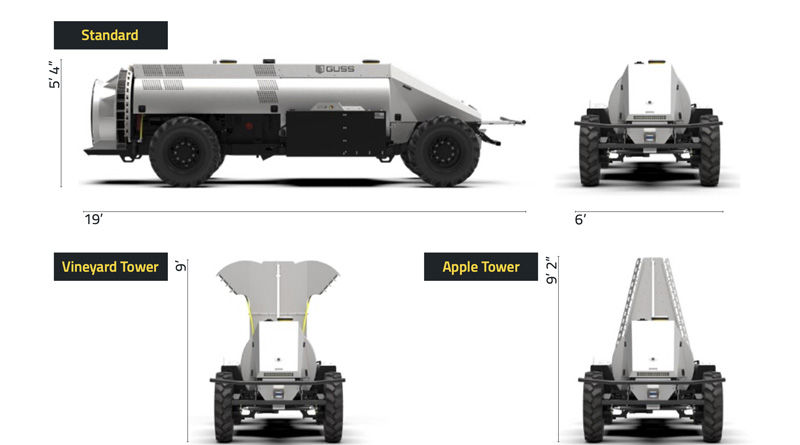

Optimizing Spray Application The Mini Guss Autonomous Sprayer Solution

Sep 01, 2025

Optimizing Spray Application The Mini Guss Autonomous Sprayer Solution

Sep 01, 2025

Latest Posts

-

Minneapolis Shooting Separating Fact From Fiction In The Ongoing Investigation

Sep 02, 2025

Minneapolis Shooting Separating Fact From Fiction In The Ongoing Investigation

Sep 02, 2025 -

What To Expect From Apples September Event 7 Potential Product Launches

Sep 02, 2025

What To Expect From Apples September Event 7 Potential Product Launches

Sep 02, 2025 -

Gta Vi Rockstars 300 Million Water Technology Revealed

Sep 02, 2025

Gta Vi Rockstars 300 Million Water Technology Revealed

Sep 02, 2025 -

Apples September Event Unveiling 7 Groundbreaking Devices

Sep 02, 2025

Apples September Event Unveiling 7 Groundbreaking Devices

Sep 02, 2025 -

Syko Stu Recovering After Raja Jackson Assault Released From Hospital

Sep 02, 2025

Syko Stu Recovering After Raja Jackson Assault Released From Hospital

Sep 02, 2025