Beyond Sirius XM: High-Growth Stocks For Long-Term Investors

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Beyond Sirius XM: High-Growth Stocks for Long-Term Investors

Sirius XM, while a solid performer in its niche, might not offer the explosive growth potential some long-term investors crave. For those seeking substantial returns over the next decade and beyond, diversifying into other high-growth sectors is crucial. This article explores compelling alternatives to Sirius XM, focusing on companies poised for significant expansion in burgeoning markets.

Why Look Beyond Sirius XM?

While Sirius XM enjoys a relatively stable subscriber base and predictable revenue streams, its growth trajectory might be limited compared to sectors experiencing rapid technological advancements and expanding market demand. Long-term investors often benefit from exposure to companies in these high-growth areas. While Sirius XM provides a steady income stream, higher risk, higher reward options offer potentially greater returns.

High-Growth Sectors to Consider:

Several sectors present promising opportunities for long-term investors seeking significant returns. Let's delve into a few:

1. Renewable Energy: The global transition to sustainable energy sources is driving explosive growth in this sector. Companies involved in solar energy, wind power, and energy storage are experiencing substantial demand and are likely to continue this trend for years to come. Investing in companies like [insert example of a publicly traded renewable energy company and link to its financial information] can provide exposure to this booming market.

2. Artificial Intelligence (AI): AI is rapidly transforming various industries, from healthcare and finance to transportation and manufacturing. Investing in companies at the forefront of AI development and application can yield substantial returns. Consider researching companies specializing in AI-powered software, hardware, or data analytics. [Link to an article discussing the future of AI investing]

3. Biotechnology and Pharmaceuticals: The healthcare sector consistently offers opportunities for significant growth. Companies developing innovative therapies, treatments, and diagnostic tools are particularly attractive. This sector, however, requires more in-depth research due to the higher inherent risk involved in pharmaceutical development and approval processes. [Link to a reputable source on biotech investing]

4. Electric Vehicles (EVs) and related infrastructure: The burgeoning electric vehicle market is attracting substantial investment. This includes not only EV manufacturers themselves, but also companies producing batteries, charging infrastructure, and related technologies. This sector is expected to see continued explosive growth driven by government regulations and increasing consumer demand for sustainable transportation.

5. E-commerce and Digital Transformation: The continued shift towards online shopping and digital services presents significant opportunities for growth. Companies that facilitate e-commerce, provide digital infrastructure, or offer innovative digital solutions are likely to see sustained expansion.

Strategies for Long-Term Success:

Investing in high-growth stocks requires a long-term perspective. Don't expect overnight riches. Successful long-term investing involves:

- Thorough Due Diligence: Research individual companies thoroughly before investing. Understand their business model, financial performance, competitive landscape, and future growth prospects.

- Diversification: Don't put all your eggs in one basket. Diversify your portfolio across multiple sectors and companies to mitigate risk.

- Patience: High-growth stocks can experience periods of volatility. Stay invested for the long term and ride out short-term fluctuations.

- Regular Review: Monitor your portfolio regularly and adjust your investments as needed based on market conditions and company performance.

Conclusion:

While Sirius XM provides a degree of stability, long-term investors seeking significant growth should consider diversifying their portfolios into the high-growth sectors outlined above. Remember, investing involves risk, and thorough research and a long-term perspective are essential for success. Consult with a financial advisor before making any investment decisions.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investment decisions should be made based on your own research and risk tolerance.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Beyond Sirius XM: High-Growth Stocks For Long-Term Investors. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Hershey Biopic Finn Wittrock Cast As The Chocolate King

Jul 02, 2025

Hershey Biopic Finn Wittrock Cast As The Chocolate King

Jul 02, 2025 -

Imposibilidad De Inscripcion Tebas Explica La Situacion De Nico En El Barca

Jul 02, 2025

Imposibilidad De Inscripcion Tebas Explica La Situacion De Nico En El Barca

Jul 02, 2025 -

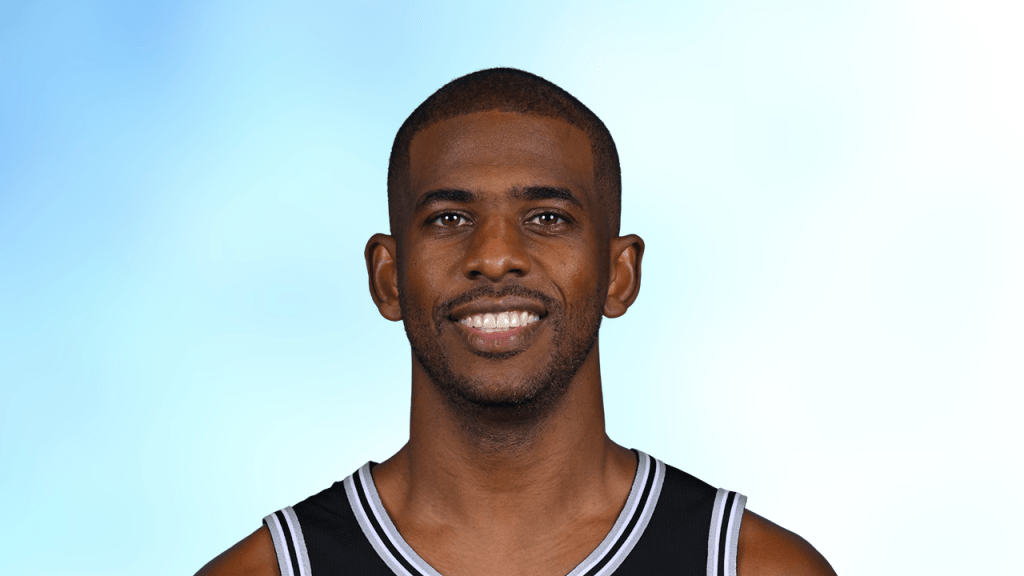

Where Will Chris Paul Go Examining The Suns And Clippers Chances

Jul 02, 2025

Where Will Chris Paul Go Examining The Suns And Clippers Chances

Jul 02, 2025 -

De Wines 67 Vetoes Reshape Ohios 60 Billion Budget A Detailed Analysis

Jul 02, 2025

De Wines 67 Vetoes Reshape Ohios 60 Billion Budget A Detailed Analysis

Jul 02, 2025 -

Chris Paul To The Bucks Examining The Trade Possibilities

Jul 02, 2025

Chris Paul To The Bucks Examining The Trade Possibilities

Jul 02, 2025