Beyond SiriusXM: Discovering Higher-Yielding Millionaire-Making Stocks

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Beyond SiriusXM: Discovering Higher-Yielding Millionaire-Making Stocks

Tired of the same old investment strategies? Ready to ditch the low-yield options and chase truly life-changing returns? Then you're in the right place. While SiriusXM (SIRI) might have offered some gains in the past, the pursuit of serious wealth requires a more diversified and potentially higher-yielding approach. This article explores strategies for finding millionaire-making stocks that go beyond the familiar names and offer the potential for substantial growth.

Why Look Beyond Established Names Like SiriusXM?

While established companies like SiriusXM offer a degree of stability, their growth potential is often limited. For those aiming for significant wealth generation, a more aggressive approach focusing on high-growth sectors and undervalued companies may be necessary. This doesn't mean ignoring established players entirely – diversification is key – but it does mean actively seeking out opportunities beyond the mainstream.

Identifying High-Yield, Millionaire-Making Stocks:

Discovering these hidden gems requires a multi-faceted approach. Here are some key strategies:

-

Focus on Emerging Industries: Industries like renewable energy, artificial intelligence, biotechnology, and cybersecurity are experiencing explosive growth. Investing in companies at the forefront of these innovations can yield significant returns. Research companies pioneering groundbreaking technologies within these sectors.

-

Fundamental Analysis: Don't just look at the stock price; delve into the company's financials. Examine revenue growth, profit margins, debt levels, and future projections. A strong balance sheet and a clear path to profitability are vital indicators of long-term success. Resources like [link to reputable financial news source] can assist in this process.

-

Dividend Aristocrats (with caution): While dividend-paying stocks offer a steady stream of income, focusing solely on high dividend yields can be risky. Ensure the company's dividend is sustainable and that its overall financial health supports continued payouts.

-

Growth Stock Potential: Look for companies with strong revenue growth and the potential to disrupt existing markets. These companies often experience significant price appreciation, potentially leading to millionaire-making returns. Consider carefully the risk involved, however; growth stocks can be volatile.

-

Value Investing: Identifying undervalued companies – those trading below their intrinsic value – can be a lucrative strategy. Thorough research and a long-term perspective are crucial for this approach.

Diversification: The Cornerstone of Success:

It's crucial to diversify your portfolio across different sectors and asset classes to mitigate risk. Don't put all your eggs in one basket, even if that basket seems exceptionally promising. Consult with a qualified financial advisor to create a personalized investment strategy that aligns with your risk tolerance and financial goals.

Beyond the Hype: Due Diligence is Paramount:

The stock market is full of hype and speculation. Don't fall prey to get-rich-quick schemes or invest based solely on tips or social media trends. Conduct thorough due diligence on any company before investing, and consider consulting with a financial professional.

Conclusion: Building Your Wealth Strategically

Building lasting wealth requires a proactive and informed approach. While SiriusXM and other established companies have their place, actively seeking out high-growth, higher-yielding stocks within emerging industries offers the potential for significantly greater returns. Remember, thorough research, diversification, and a long-term perspective are key to achieving your financial goals. Start your research today and begin building your path to financial freedom.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money. Consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Beyond SiriusXM: Discovering Higher-Yielding Millionaire-Making Stocks. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

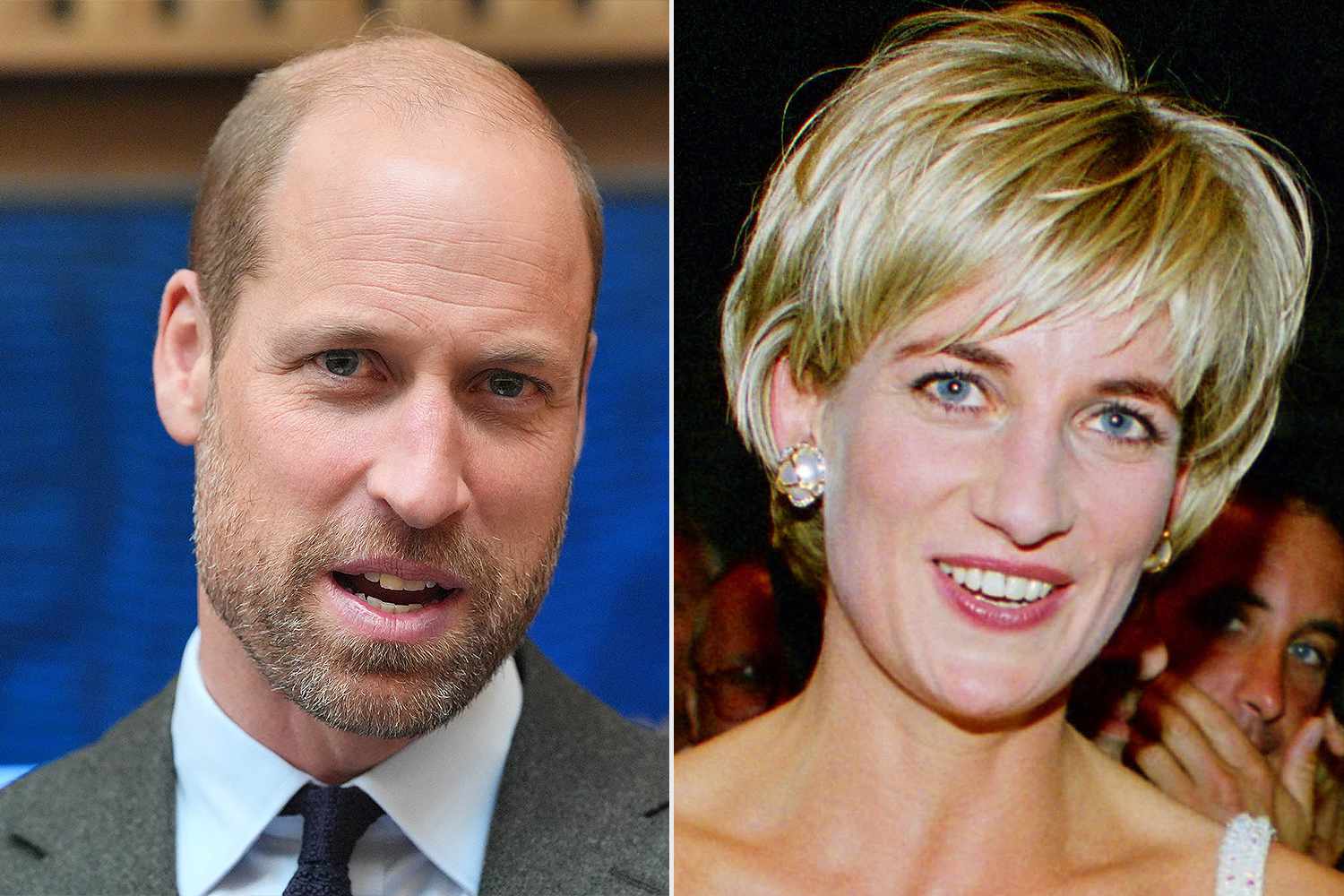

Prince William Honors Princess Dianas Legacy On Her Birthday

Jul 02, 2025

Prince William Honors Princess Dianas Legacy On Her Birthday

Jul 02, 2025 -

Athletic Analizando Las Alternativas A Nico Williams En La Banda Derecha

Jul 02, 2025

Athletic Analizando Las Alternativas A Nico Williams En La Banda Derecha

Jul 02, 2025 -

Hoax Call Sends Police And Swat To Upmc Park Arena

Jul 02, 2025

Hoax Call Sends Police And Swat To Upmc Park Arena

Jul 02, 2025 -

American Idol Winner Jamal Roberts Noir And Blanc Concert Coming To Laurel

Jul 02, 2025

American Idol Winner Jamal Roberts Noir And Blanc Concert Coming To Laurel

Jul 02, 2025 -

Controversy Erupts Mayor Bibb And The Browns Stadium Relocation

Jul 02, 2025

Controversy Erupts Mayor Bibb And The Browns Stadium Relocation

Jul 02, 2025