Beyond Sirius XM: Discovering High-Growth Stocks For Wealth Building

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Beyond Sirius XM: Discovering High-Growth Stocks for Wealth Building

Sirius XM, while a solid performer, might not be the only key to unlocking significant wealth growth in the stock market. For savvy investors seeking substantial returns, diversifying beyond established names and exploring high-growth stocks is crucial. But identifying these potential winners requires careful research and a keen eye for emerging trends. This article will guide you through the process, highlighting key factors to consider and providing examples of sectors ripe for high-growth opportunities.

Why Look Beyond Established Names?

While established companies like Sirius XM offer stability and dividends, their growth potential is often capped. High-growth stocks, on the other hand, represent companies poised for explosive expansion, offering the potential for significantly higher returns – but also carrying greater risk. Diversification across both established and high-growth stocks is a cornerstone of a robust investment strategy. [Link to article on diversification strategies]

Identifying High-Growth Potential: Key Indicators

Several factors signal a company's high-growth potential. Analyzing these indicators is vital before investing:

- Strong Revenue Growth: Consistent and accelerating revenue growth is a primary indicator. Look for companies demonstrating year-over-year increases exceeding market averages.

- Innovative Products or Services: Companies offering disruptive technologies or innovative solutions in growing markets often experience rapid expansion. Think about the early investors in companies like Netflix or Amazon.

- Experienced Management Team: A strong leadership team with a proven track record is essential for navigating challenges and driving growth.

- Scalable Business Model: Companies with business models that can be easily scaled to meet increasing demand are better positioned for rapid growth.

- Positive Market Sentiment: Analyzing investor sentiment through news articles, analyst reports, and social media can provide valuable insights. [Link to reputable financial news source]

High-Growth Sectors to Watch:

Several sectors are currently showing significant growth potential:

- Renewable Energy: The global shift towards sustainable energy sources presents immense opportunities for companies involved in solar, wind, and other renewable technologies.

- Artificial Intelligence (AI): AI is rapidly transforming various industries, creating significant growth potential for companies developing and implementing AI solutions.

- Biotechnology and Pharmaceuticals: Advancements in biotechnology and pharmaceuticals offer exciting prospects, particularly in areas like gene therapy and personalized medicine.

- E-commerce and Fintech: The continued growth of e-commerce and the expansion of financial technology create opportunities for companies operating in these dynamic sectors.

Minimizing Risk in High-Growth Investing:

Investing in high-growth stocks inherently involves higher risk. To mitigate this:

- Diversify your portfolio: Don't put all your eggs in one basket. Spread your investments across multiple high-growth stocks and other asset classes.

- Conduct thorough research: Don't rely solely on hype. Analyze financial statements, understand the company's business model, and assess its competitive landscape.

- Invest for the long term: High-growth stocks can experience significant volatility. A long-term perspective is crucial to ride out short-term fluctuations.

- Consider professional advice: Consult with a financial advisor to develop a personalized investment strategy tailored to your risk tolerance and financial goals.

Conclusion:

While Sirius XM offers a stable investment, seeking higher returns requires exploring high-growth opportunities. By carefully analyzing key indicators and focusing on promising sectors, investors can identify companies with the potential for substantial wealth building. Remember to always conduct thorough research and diversify your portfolio to minimize risk. The path to financial success often lies beyond the well-trodden paths.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Beyond Sirius XM: Discovering High-Growth Stocks For Wealth Building. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Why Japanese Actors Are Rare In Kojima Productions Games A Technical Limitation

Jul 01, 2025

Why Japanese Actors Are Rare In Kojima Productions Games A Technical Limitation

Jul 01, 2025 -

Understanding The Impact Of Elon Musks Dogecoin Sale On Taxpayer Dividends

Jul 01, 2025

Understanding The Impact Of Elon Musks Dogecoin Sale On Taxpayer Dividends

Jul 01, 2025 -

Death Stranding 2 On The Beach Launch Interview Highlights And Future Implications

Jul 01, 2025

Death Stranding 2 On The Beach Launch Interview Highlights And Future Implications

Jul 01, 2025 -

Warren Buffetts Hidden Gem A Budget Friendly Stock With Big Potential

Jul 01, 2025

Warren Buffetts Hidden Gem A Budget Friendly Stock With Big Potential

Jul 01, 2025 -

Tpc Deere Run 2025 Expert Golf Predictions Avoiding The Obvious Favorites

Jul 01, 2025

Tpc Deere Run 2025 Expert Golf Predictions Avoiding The Obvious Favorites

Jul 01, 2025

Latest Posts

-

Illinois Womens Golf Celebrates Five Wgca All American Scholars

Jul 01, 2025

Illinois Womens Golf Celebrates Five Wgca All American Scholars

Jul 01, 2025 -

Topuria Vs Makhachev Cormiers Bold Prediction Shakes Up The Ufc Lightweight Division

Jul 01, 2025

Topuria Vs Makhachev Cormiers Bold Prediction Shakes Up The Ufc Lightweight Division

Jul 01, 2025 -

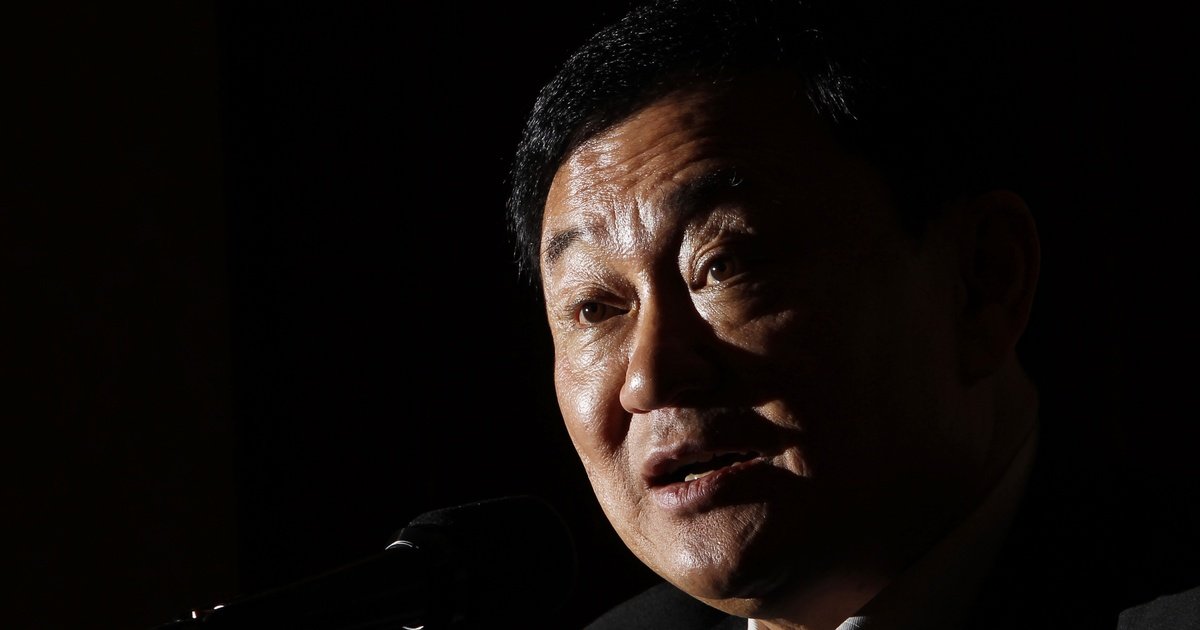

Understanding The Demise Of Thailands Powerful Shinawatra Family

Jul 01, 2025

Understanding The Demise Of Thailands Powerful Shinawatra Family

Jul 01, 2025 -

Ilia Topuria Rising Star Or Makhachevs Next Victim Cormier Offers Insight

Jul 01, 2025

Ilia Topuria Rising Star Or Makhachevs Next Victim Cormier Offers Insight

Jul 01, 2025 -

Jamal Roberts American Idol Winner Refuses Key To City Amidst Controversy

Jul 01, 2025

Jamal Roberts American Idol Winner Refuses Key To City Amidst Controversy

Jul 01, 2025