Australia's RBA Governor Bullock: Interest Rate Pause A Matter Of Timing

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Australia's RBA Governor Bullock: Interest Rate Pause, a Matter of Timing, Not a Sign of Victory

Australia is holding its breath. The Reserve Bank of Australia (RBA) Governor, Philip Lowe, recently hinted at a potential pause in the aggressive interest rate hiking cycle that has characterized the country's economic landscape for the past year. But don't mistake this pause for a victory over inflation; it's a strategic recalibration, a matter of timing, according to Lowe and subsequent expert analysis.

This strategic pause, while not yet confirmed, has sent shockwaves through the Australian financial markets and sparked intense debate among economists. The RBA's decision will significantly impact mortgage holders, businesses, and the overall economic trajectory of the nation.

Understanding the Current Economic Climate

Australia, like much of the world, is grappling with stubbornly high inflation. While recent data suggests a slight easing, the RBA remains cautious, citing lingering inflationary pressures and the need for sustained vigilance. The current cash rate sits at [insert current cash rate], a substantial increase from the historically low rates seen pre-pandemic. This aggressive tightening policy aimed to curb inflation by cooling down the overheated economy.

The core issue, as highlighted by Governor Lowe in recent statements, isn't simply the level of inflation, but also its persistence. Underlying inflationary pressures, driven by factors such as strong wage growth and supply chain disruptions, need careful monitoring. A premature declaration of victory could risk reigniting inflationary flames.

The Pause: A Strategic Maneuver, Not a Celebration

The potential interest rate pause is not an indication that the RBA believes the battle against inflation is won. Instead, it signifies a shift in tactical approach. The RBA is likely taking this opportunity to assess the full impact of previous rate hikes on the economy. This includes carefully analyzing:

- Lag effects of interest rate increases: The full impact of interest rate changes often takes several months to fully manifest in the economy. A pause allows the RBA to observe these lagged effects before making further decisions.

- Impact on consumer spending: Rising interest rates directly affect consumer borrowing costs, impacting spending patterns and overall economic activity. The RBA needs to gauge the extent of this impact.

- Housing market conditions: The Australian housing market has shown signs of cooling, but a further interest rate hike could trigger a more significant downturn. The RBA needs to balance inflation control with maintaining housing market stability.

What Lies Ahead for Australian Borrowers?

For Australian homeowners and borrowers, the potential pause provides a temporary reprieve from further interest rate increases. However, it's crucial to remember that this doesn't signal a return to lower rates anytime soon. The RBA's commitment to returning inflation to its target band of 2-3% remains steadfast. A prolonged period of higher interest rates is still highly likely.

Potential Scenarios:

- Continued Pause: The RBA may opt for a period of observation, maintaining the current cash rate for several months.

- Further Gradual Increases: Depending on upcoming economic data, the RBA might opt for further, smaller rate increases.

- Rate Cuts: While unlikely in the near term, a significant downturn in the economy could lead to interest rate cuts in the future.

This evolving situation requires homeowners and businesses to actively manage their finances and plan for various economic scenarios. Seeking professional financial advice is highly recommended.

Conclusion: Vigilance Remains Key

The potential interest rate pause in Australia is a strategic move, not a sign of victory over inflation. The RBA's approach reflects a careful balancing act between controlling inflation and maintaining economic stability. The coming months will be crucial in determining the next steps and the long-term impact on the Australian economy. Stay informed and seek expert advice to navigate this dynamic period. Learn more about current economic indicators by visiting the [link to RBA website].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Australia's RBA Governor Bullock: Interest Rate Pause A Matter Of Timing. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

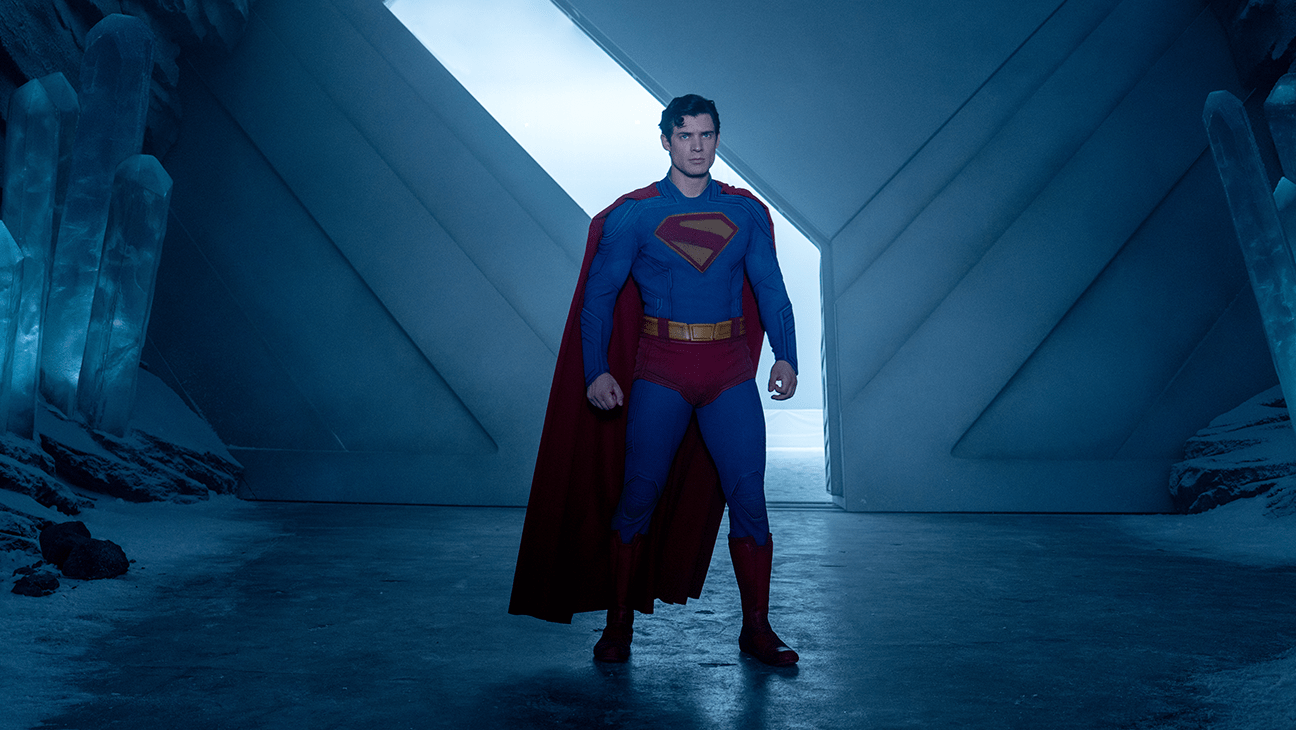

Superman First Reactions Promising Start For Dc Studios New Era

Jul 09, 2025

Superman First Reactions Promising Start For Dc Studios New Era

Jul 09, 2025 -

Neillsville Woman Sentenced For Tampering With Lottery Tickets

Jul 09, 2025

Neillsville Woman Sentenced For Tampering With Lottery Tickets

Jul 09, 2025 -

Bangladesh Vs Sri Lanka Toss Result And Sri Lankas Decision

Jul 09, 2025

Bangladesh Vs Sri Lanka Toss Result And Sri Lankas Decision

Jul 09, 2025 -

Revealed The Reason Behind Sarah Fergusons Refusal Of Kings Invitation

Jul 09, 2025

Revealed The Reason Behind Sarah Fergusons Refusal Of Kings Invitation

Jul 09, 2025 -

Neillsville Womans Sentence For Forging Lottery Tickets Announced

Jul 09, 2025

Neillsville Womans Sentence For Forging Lottery Tickets Announced

Jul 09, 2025

Latest Posts

-

End Of The Line Philadelphia Union Strike Resolved Live Updates

Jul 09, 2025

End Of The Line Philadelphia Union Strike Resolved Live Updates

Jul 09, 2025 -

Examining Us Complicity The Iran Israel Conflict And American Involvement

Jul 09, 2025

Examining Us Complicity The Iran Israel Conflict And American Involvement

Jul 09, 2025 -

Former Nhl Player Nick Tarnasky Caught In Heated Golf Course Altercation

Jul 09, 2025

Former Nhl Player Nick Tarnasky Caught In Heated Golf Course Altercation

Jul 09, 2025 -

Home Run Derby Yankees Rout Mariners Following Rain Delay

Jul 09, 2025

Home Run Derby Yankees Rout Mariners Following Rain Delay

Jul 09, 2025 -

Red Bull Announces Horners Exit Mekies Takes The Helm

Jul 09, 2025

Red Bull Announces Horners Exit Mekies Takes The Helm

Jul 09, 2025