Australia News: RBA Governor Bullock On Interest Rate Pause

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Australia News: RBA Governor Bullock on Interest Rate Pause – A Cautious Approach

Australia is holding its breath. The Reserve Bank of Australia (RBA) Governor, Philip Lowe, recently announced a pause in interest rate hikes, a decision that has sent ripples through the nation's financial markets and sparked widespread debate among economists and homeowners alike. This strategic move, however, is far from a sign of economic triumph; it's a cautious approach in the face of complex and evolving economic headwinds.

This article delves into the details of Governor Lowe's announcement, analyzing the reasoning behind the pause and exploring its potential implications for the Australian economy. We’ll also consider the ongoing debate surrounding inflation, employment, and the future trajectory of interest rates.

RBA's Rationale: A Balancing Act

The RBA's decision to pause interest rate increases reflects a careful balancing act. While inflation remains stubbornly above the target band of 2-3%, Governor Lowe highlighted several factors contributing to the pause:

-

Lagging Effects of Previous Hikes: The full impact of previous interest rate increases is yet to be felt across the Australian economy. The RBA acknowledges a time lag between policy changes and their effect on consumer spending and inflation. This "lag effect" is crucial in understanding the current pause.

-

Concerns about Household Spending: Rising interest rates have already significantly impacted household budgets, leading to reduced consumer spending. A further increase could potentially trigger a sharper economic slowdown, potentially leading to job losses.

-

Global Economic Uncertainty: The global economic outlook remains uncertain, with factors like the war in Ukraine and ongoing supply chain disruptions contributing to volatility. The RBA is clearly taking a wait-and-see approach, monitoring international developments before making further decisions.

What Does the Pause Mean for Australians?

The interest rate pause provides some temporary relief for homeowners burdened by rising mortgage repayments. However, it's crucial to remember that this is not a permanent reprieve. The RBA has explicitly stated that the pause is not indicative of an end to tightening monetary policy. This means that further rate hikes remain a possibility depending on future economic data.

Inflation: The Key Determinant

Inflation remains the central issue influencing the RBA's decisions. While recent data showed a slight easing in inflation, it’s still significantly above the target range. The RBA will be closely monitoring inflation figures in the coming months, with particular attention paid to:

- Wage Growth: Strong wage growth can fuel inflationary pressures. The RBA will be assessing the impact of current economic conditions on wage negotiations.

- Consumer Price Index (CPI): The CPI provides a key indicator of the overall price level in the economy. Continued high CPI figures would likely prompt the RBA to resume interest rate hikes.

Looking Ahead: What to Expect

The RBA's decision to pause represents a strategic recalibration, not a victory. The future path of interest rates will hinge on the interplay of various economic factors. Australians should brace themselves for continued volatility and expect further announcements from the RBA in the coming months. Staying informed about economic news and consulting with financial advisors is vital for navigating this period of uncertainty.

Further Reading:

- – Official source for RBA statements and publications.

- – For in-depth analysis and commentary.

Call to Action: Stay informed about the evolving economic situation in Australia. Regularly consult reliable news sources and financial experts to make informed decisions about your personal finances.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Australia News: RBA Governor Bullock On Interest Rate Pause. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Revealed The Reason Behind Sarah Fergusons Refusal Of The Kings Invitation

Jul 09, 2025

Revealed The Reason Behind Sarah Fergusons Refusal Of The Kings Invitation

Jul 09, 2025 -

Inglourious Basterds A Deeper Dive Into Tarantinos War Epic

Jul 09, 2025

Inglourious Basterds A Deeper Dive Into Tarantinos War Epic

Jul 09, 2025 -

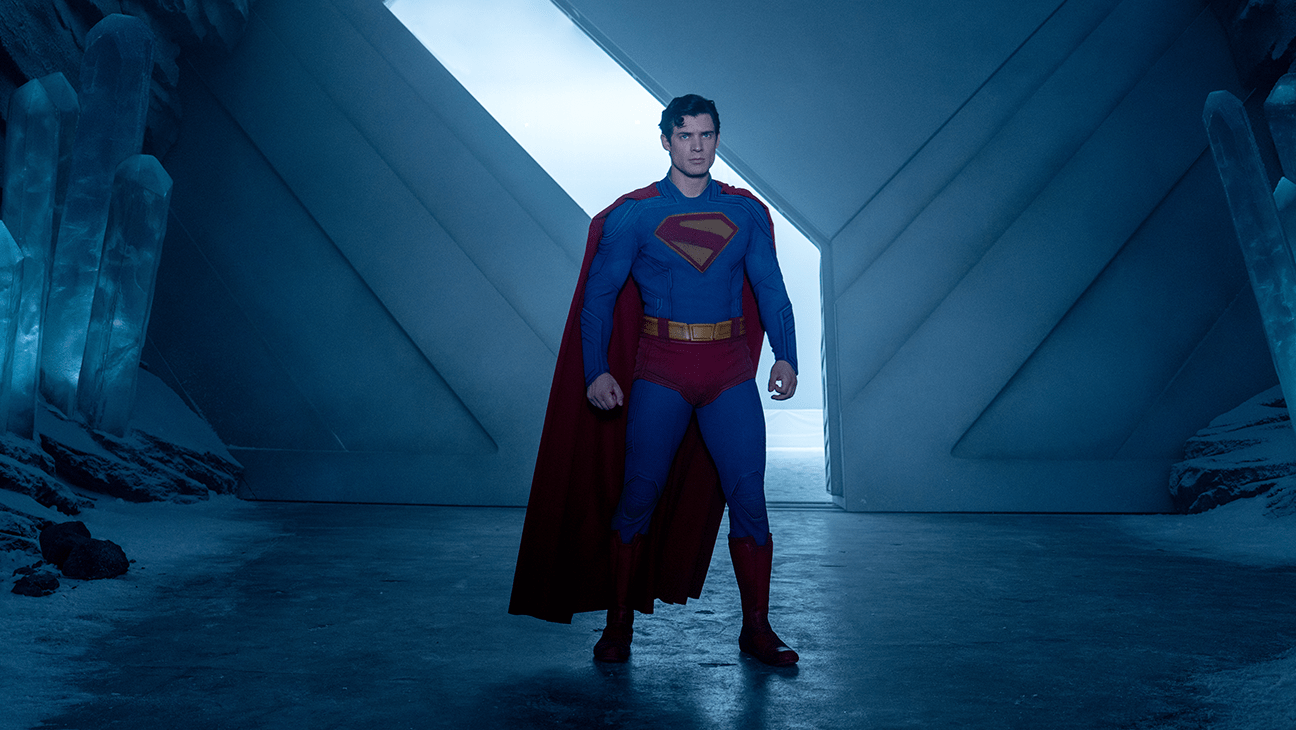

Critics React Is The New Superman Film A Success For Dc Studios

Jul 09, 2025

Critics React Is The New Superman Film A Success For Dc Studios

Jul 09, 2025 -

The Legacy Of Inglourious Basterds Impact And Cultural Influence

Jul 09, 2025

The Legacy Of Inglourious Basterds Impact And Cultural Influence

Jul 09, 2025 -

Space X Falcon 9 Details On The Upcoming 500th Orbital Flight

Jul 09, 2025

Space X Falcon 9 Details On The Upcoming 500th Orbital Flight

Jul 09, 2025

Latest Posts

-

Quentin Tarantinos Inglourious Basterds 2009 Cast Characters And Legacy

Jul 09, 2025

Quentin Tarantinos Inglourious Basterds 2009 Cast Characters And Legacy

Jul 09, 2025 -

R25 Lakh For Freedom Assamese Influencer Archita Phukans Struggle With Prostitution

Jul 09, 2025

R25 Lakh For Freedom Assamese Influencer Archita Phukans Struggle With Prostitution

Jul 09, 2025 -

Sarah Fergusons Refusal Of Kings Invitation A Royal Family Mystery

Jul 09, 2025

Sarah Fergusons Refusal Of Kings Invitation A Royal Family Mystery

Jul 09, 2025 -

Cape Canaveral Launch Follow Space Xs Falcon 9 Starlink Deployment Live

Jul 09, 2025

Cape Canaveral Launch Follow Space Xs Falcon 9 Starlink Deployment Live

Jul 09, 2025 -

Superman First Reactions Hail New Film As Thrilling Dcu Launch

Jul 09, 2025

Superman First Reactions Hail New Film As Thrilling Dcu Launch

Jul 09, 2025