Australia Economic Update: RBA Maintains Interest Rates, Bullock Comments Live

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Australia Economic Update: RBA Holds Steady, Bullock's Live Comments Spark Debate

Australia's economic landscape remains a topic of intense scrutiny, and today's Reserve Bank of Australia (RBA) decision to maintain interest rates has sent ripples through the financial markets. Governor Philip Lowe's post-meeting press conference, featuring live commentary from economic expert Dr. [Insert Name of Economist/Analyst, e.g., Jane Bullock], has sparked considerable debate about the future direction of monetary policy.

The RBA's decision to hold the cash rate at [Insert Current Interest Rate]% was largely anticipated by economists, reflecting the ongoing complexities of the Australian economy. While inflation remains a concern, recent data suggests a potential slowdown, prompting a cautious approach from the central bank. This strategic pause allows the RBA to carefully assess the impact of previous rate hikes and the evolving economic environment.

Inflationary Pressures Persist, But Signs of Slowdown Emerge

The RBA's statement acknowledged the persistence of inflationary pressures, driven by factors including global supply chain disruptions and strong domestic demand. However, the bank also noted emerging signs of easing inflationary momentum, citing softening consumer spending in certain sectors and a moderation in wage growth.

- Key indicators: The RBA highlighted declining house prices in some major cities, a slight decrease in retail sales, and a levelling off in employment growth as potential indicators of a cooling economy.

- Global impacts: The ongoing global economic uncertainty, particularly in relation to [mention specific global economic event, e.g., the war in Ukraine or global recessionary fears], continues to influence the RBA's decision-making process.

Dr. [Bullock's Name]'s Live Commentary: A Cautious Optimism?

Dr. [Bullock's Name]'s live analysis following the RBA announcement provided valuable insight into the market's reaction and the potential implications for consumers and businesses. Her commentary focused on [mention key points of Bullock's analysis, e.g., the potential for future rate cuts, the impact on the housing market, the risks associated with sustained high inflation].

She highlighted the need for a balanced approach, emphasizing that while a pause in rate hikes is justified, further action may be necessary depending on the evolution of economic indicators. Her analysis also considered the potential impact on various sectors, including [mention specific sectors affected, e.g., housing, construction, and retail].

Dr. Bullock's key takeaways (as reported):

- [Summarize Bullock's main points concisely, using bullet points for readability]

- [Summarize another key point]

- [Summarize a final key point]

What This Means for Australian Consumers and Businesses

The RBA's decision and Dr. [Bullock's Name]'s insightful commentary have significant implications for Australian consumers and businesses. For homeowners with variable rate mortgages, the pause provides some relief, although the overall debt burden remains substantial. Businesses, however, will continue to navigate the challenges of a complex economic environment, balancing inflationary pressures with fluctuating demand.

The coming months will be crucial in determining the future direction of monetary policy. The RBA will closely monitor key economic indicators, including inflation, employment, and consumer spending, to inform its future decisions. Further analysis from experts like Dr. [Bullock's Name] will be essential in understanding the evolving economic landscape and its impact on Australians.

Learn More: For further insights into the Australian economy, visit the Reserve Bank of Australia website: [Insert RBA Website Link]. Stay informed on the latest economic news by following reputable financial news sources.

Call to Action (Subtle): Keep checking back for updates and further analysis as the economic situation unfolds.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Australia Economic Update: RBA Maintains Interest Rates, Bullock Comments Live. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Space X Starlink Mission Update Live Coverage From Cape Canaveral

Jul 09, 2025

Space X Starlink Mission Update Live Coverage From Cape Canaveral

Jul 09, 2025 -

Space X Falcon 9 500th Orbital Mission Launch This Week

Jul 09, 2025

Space X Falcon 9 500th Orbital Mission Launch This Week

Jul 09, 2025 -

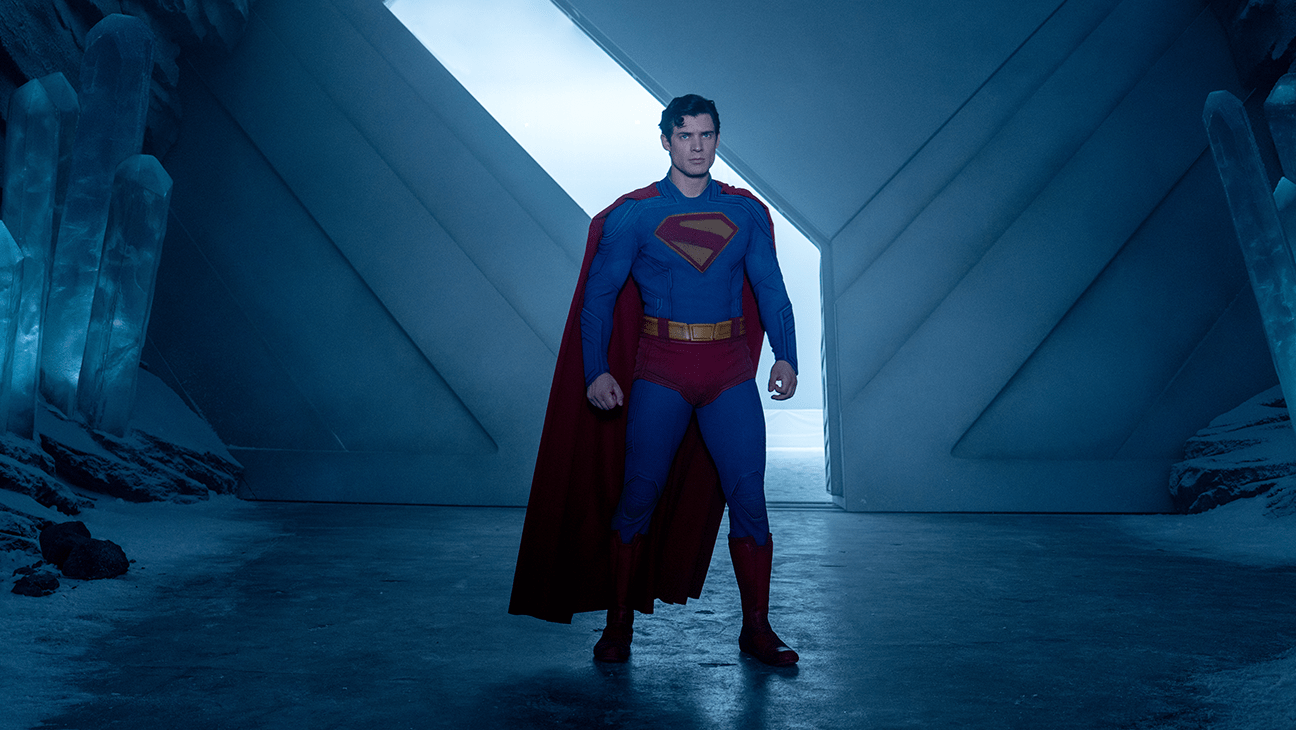

Early Reviews For Superman A Fresh Take On The Iconic Hero

Jul 09, 2025

Early Reviews For Superman A Fresh Take On The Iconic Hero

Jul 09, 2025 -

From Prostitution To Influencer Archita Phukans Harrowing Story

Jul 09, 2025

From Prostitution To Influencer Archita Phukans Harrowing Story

Jul 09, 2025 -

Rba Holds Cash Rate Governor Bullock Explains Timing Decision

Jul 09, 2025

Rba Holds Cash Rate Governor Bullock Explains Timing Decision

Jul 09, 2025

Latest Posts

-

Quentin Tarantinos Inglourious Basterds 2009 Cast Characters And Legacy

Jul 09, 2025

Quentin Tarantinos Inglourious Basterds 2009 Cast Characters And Legacy

Jul 09, 2025 -

R25 Lakh For Freedom Assamese Influencer Archita Phukans Struggle With Prostitution

Jul 09, 2025

R25 Lakh For Freedom Assamese Influencer Archita Phukans Struggle With Prostitution

Jul 09, 2025 -

Sarah Fergusons Refusal Of Kings Invitation A Royal Family Mystery

Jul 09, 2025

Sarah Fergusons Refusal Of Kings Invitation A Royal Family Mystery

Jul 09, 2025 -

Cape Canaveral Launch Follow Space Xs Falcon 9 Starlink Deployment Live

Jul 09, 2025

Cape Canaveral Launch Follow Space Xs Falcon 9 Starlink Deployment Live

Jul 09, 2025 -

Superman First Reactions Hail New Film As Thrilling Dcu Launch

Jul 09, 2025

Superman First Reactions Hail New Film As Thrilling Dcu Launch

Jul 09, 2025