Asian Markets Monday, June 2, 2025: Economic Data & Events To Watch

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Asian Markets Monday, June 2nd, 2025: Economic Data & Events to Watch

A busy start to the week awaits Asian markets, with a confluence of key economic data releases and significant events poised to impact trading activity. From China's manufacturing PMI to India's inflation figures, investors will be closely scrutinizing several indicators to gauge the region's economic health and future trajectory. This comprehensive overview highlights the key data points and events to watch on Monday, June 2nd, 2025, providing insights for informed investment decisions.

China: Manufacturing PMI Takes Center Stage

China's manufacturing Purchasing Managers' Index (PMI) for May 2025 will be a major focus. This widely followed indicator provides a snapshot of the health of the country's manufacturing sector, a crucial driver of global economic growth. A strong PMI reading could boost investor sentiment, while a weaker-than-expected result might trigger concerns about slowing economic momentum. Analysts will be particularly interested in examining sub-indices related to production, new orders, and employment to gain a more nuanced understanding of the sector's performance. [Link to credible source providing historical PMI data]

India: Inflation Concerns Remain Paramount

India's inflation figures for May 2025 are also expected to generate significant market interest. Persistent inflationary pressures remain a key challenge for the Indian economy, impacting consumer spending and overall economic growth. The Reserve Bank of India's (RBI) monetary policy decisions are heavily influenced by inflation data, so any unexpected deviations from forecasts could trigger volatility in the Indian Rupee and equity markets. [Link to RBI website or reputable financial news source covering Indian inflation]

Japan: BoJ Meeting Aftermath and Yen Volatility

Following the recent Bank of Japan (BoJ) meeting, the market will be closely observing the Yen's reaction to any further policy shifts or announcements. The BoJ's monetary policy stance continues to be a significant factor influencing the Yen's exchange rate against major currencies like the US dollar. Any unexpected changes in the BoJ's yield curve control policy could lead to significant volatility in the Japanese markets. [Link to credible source providing analysis on BoJ policy]

Other Key Events and Data Releases:

- South Korea: Export data for May 2025 will offer insights into the health of South Korea's export-oriented economy. [Link to source for South Korean export data]

- Southeast Asia: Keep an eye out for any significant political developments or policy announcements from major economies in the region, such as Indonesia, Singapore, and Thailand. These events can significantly impact regional market sentiment.

- Global Market Sentiment: The overall global market sentiment, influenced by factors such as US interest rate expectations and geopolitical events, will also play a role in shaping Asian market performance.

Navigating the Market Volatility:

Monday, June 2nd, 2025, promises to be a dynamic day for Asian markets. Investors should carefully consider the interplay of these various economic indicators and events before making any investment decisions. Diversification and a well-defined risk management strategy are crucial in navigating the potential market volatility.

Disclaimer: This article provides general information and should not be construed as financial advice. Consult with a qualified financial advisor before making any investment decisions. The information presented here is based on publicly available data and expert analysis at the time of writing and is subject to change.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Asian Markets Monday, June 2, 2025: Economic Data & Events To Watch. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

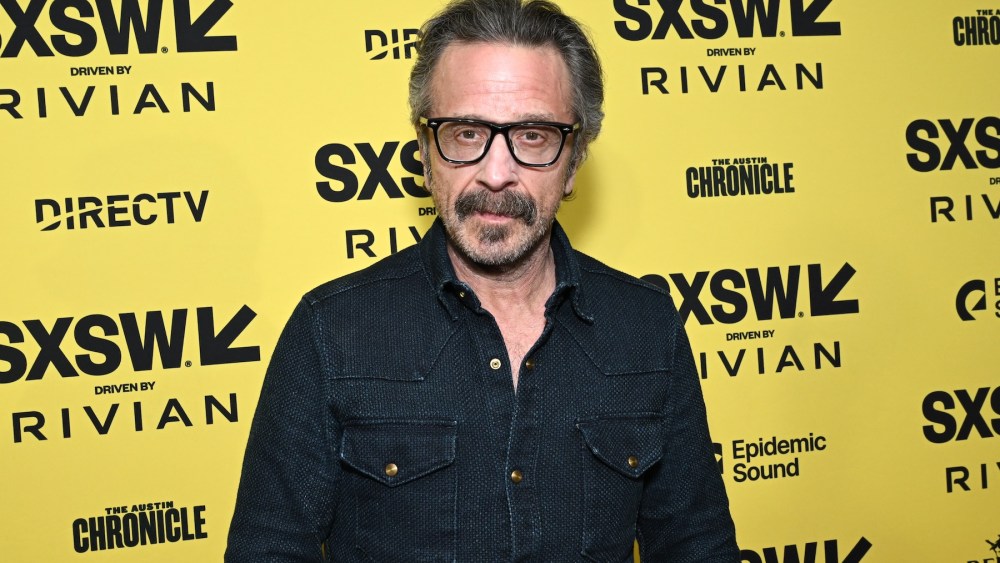

Marc Marons Wtf Podcast A Legacy Concludes After 16 Years

Jun 02, 2025

Marc Marons Wtf Podcast A Legacy Concludes After 16 Years

Jun 02, 2025 -

Jp Morgan Chase Ceo Identifies Trump Administrations Key Focus Area

Jun 02, 2025

Jp Morgan Chase Ceo Identifies Trump Administrations Key Focus Area

Jun 02, 2025 -

Global Instability Jamie Dimon Highlights Trumps Main Priority

Jun 02, 2025

Global Instability Jamie Dimon Highlights Trumps Main Priority

Jun 02, 2025 -

Harvard Faces Backlash Trumps Antisemitism Fight Potentially Impacts Israeli Jewish Scholars

Jun 02, 2025

Harvard Faces Backlash Trumps Antisemitism Fight Potentially Impacts Israeli Jewish Scholars

Jun 02, 2025 -

Tenis Roland Garros Zaciety Pojedynek Swiatek Rybakina Relacja Na Zywo

Jun 02, 2025

Tenis Roland Garros Zaciety Pojedynek Swiatek Rybakina Relacja Na Zywo

Jun 02, 2025