Asian Markets Monday, June 2, 2025: Economic Data & Events

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Asian Markets Monday, June 2, 2025: Economic Data & Events Fuel Volatility

Asian markets experienced a volatile start to the week on Monday, June 2nd, 2025, driven by a confluence of significant economic data releases and upcoming events. Investors navigated a complex landscape of fluctuating currency values, shifting interest rate expectations, and geopolitical concerns. This report delves into the key factors influencing market performance across the region.

Key Economic Data:

The morning saw the release of several crucial economic indicators. China's May manufacturing PMI (Purchasing Managers' Index) came in slightly below expectations, signaling a potential slowdown in the manufacturing sector. This data point, closely watched globally due to China's significant role in the world economy, contributed to a cautious sentiment among investors. [Link to source of Chinese PMI data - e.g., National Bureau of Statistics of China].

Meanwhile, Japan's unemployment rate for April remained low, reinforcing the country's robust labor market. However, this positive news was somewhat tempered by slower-than-anticipated growth in retail sales, suggesting potential headwinds for consumer spending. [Link to source of Japanese unemployment and retail sales data - e.g., Statistics Bureau of Japan].

South Korea's export figures for May also impacted market sentiment. A slight decline in exports, attributed largely to weakening global demand, added to the overall sense of uncertainty. [Link to source of South Korean export data - e.g., Bank of Korea].

Major Events Shaping Market Sentiment:

Beyond the economic data, several upcoming events contributed to the day's volatility. The impending G20 summit [Insert Date and Location] is casting a long shadow over investor confidence, with concerns about potential geopolitical tensions and disagreements on key economic issues. The potential impact of any outcomes on trade relations and global growth is a significant factor influencing investment strategies.

Furthermore, speculation surrounding potential interest rate adjustments by central banks in the region added another layer of complexity. Analysts are closely monitoring inflation figures and economic growth projections to predict potential policy shifts. Any unexpected moves could trigger significant market fluctuations.

Market Performance Across Major Asian Indices:

- Shanghai Composite: Experienced a moderate decline, mirroring the weaker-than-expected manufacturing PMI data.

- Nikkei 225: Showed a mixed performance, with early losses partially recovered towards the close of trading.

- KOSPI: Registered a slight drop, reflecting the subdued export figures.

- Hang Seng Index: Experienced volatility throughout the day, ultimately closing slightly lower.

Looking Ahead:

The coming week promises further volatility as investors digest the latest economic data and await further developments regarding the G20 summit and potential interest rate decisions. Close monitoring of inflation data and further PMI releases will be crucial for gauging the overall direction of Asian markets.

Disclaimer: This article provides general market commentary and should not be considered financial advice. Consult with a qualified financial advisor before making any investment decisions. Market conditions are constantly evolving, and past performance is not indicative of future results.

Keywords: Asian Markets, Monday, June 2, 2025, Economic Data, Events, Volatility, China PMI, Japan Unemployment, South Korea Exports, G20 Summit, Interest Rates, Shanghai Composite, Nikkei 225, KOSPI, Hang Seng Index, Market Analysis, Investment, Finance, Asia Economy.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Asian Markets Monday, June 2, 2025: Economic Data & Events. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

French Open 2024 Shelton Tiafoe And Paul Aim For Us Mens Tennis Glory

Jun 02, 2025

French Open 2024 Shelton Tiafoe And Paul Aim For Us Mens Tennis Glory

Jun 02, 2025 -

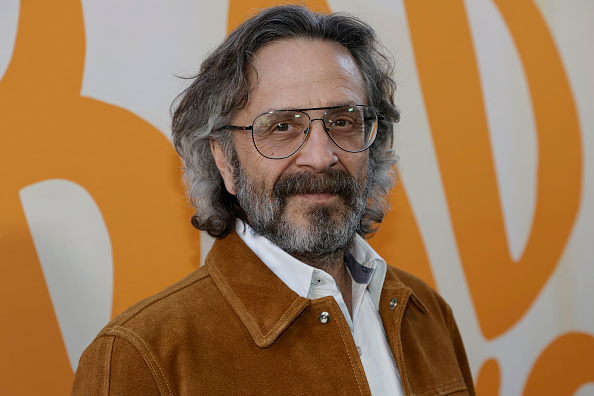

Wtf With Marc Maron Podcast An End After 16 Years Of Interviews

Jun 02, 2025

Wtf With Marc Maron Podcast An End After 16 Years Of Interviews

Jun 02, 2025 -

Detroit Lawmaker Challenges Dte Energy On Rates And Reliability

Jun 02, 2025

Detroit Lawmaker Challenges Dte Energy On Rates And Reliability

Jun 02, 2025 -

Calls For Harvard To Stand Strong Resonate With Graduating Class

Jun 02, 2025

Calls For Harvard To Stand Strong Resonate With Graduating Class

Jun 02, 2025 -

State Representative Warns Of Dte Rate Increases Bankrupting Michigan Families

Jun 02, 2025

State Representative Warns Of Dte Rate Increases Bankrupting Michigan Families

Jun 02, 2025