Asian Economic Data Releases: Monday, June 2nd, 2025 Overview

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Asian Economic Data Releases: Monday, June 2nd, 2025 – A Key Overview

Monday, June 2nd, 2025, promises a significant influx of Asian economic data, offering investors and analysts crucial insights into the region's economic health. This overview summarizes the key releases and their potential market impact. Understanding these figures is vital for navigating the complexities of the Asian market and making informed investment decisions.

Japan: Manufacturing PMI Takes Center Stage

Japan's Manufacturing Purchasing Managers' Index (PMI) for May 2025 will be a primary focus. This indicator provides a snapshot of the country's manufacturing sector's health, reflecting production levels, new orders, and employment trends. A strong PMI reading could boost the Japanese Yen and signal continued economic resilience. Conversely, a weaker-than-expected figure might trigger concerns about slowing growth and impact investor sentiment. Analysts will be closely scrutinizing this data for clues about future monetary policy decisions by the Bank of Japan. [Link to Bank of Japan website]

China: Inflation and Trade Data Under Scrutiny

China, the world's second-largest economy, will release its May 2025 inflation data (CPI and PPI) and trade figures. These figures are crucial for understanding the country's economic momentum and its impact on global supply chains. High inflation numbers could signal potential monetary tightening, while weak trade data might raise concerns about slowing global demand. The interplay between these indicators will be closely watched for signs of economic stability or potential challenges. [Link to National Bureau of Statistics of China]

South Korea: Export Numbers and Industrial Production

South Korea's May 2025 export figures and industrial production data will provide valuable insights into the performance of its export-oriented economy. Strong export numbers would reflect healthy global demand for Korean goods, boosting the South Korean Won. However, weaker-than-expected results could signal challenges in the global technology sector and potentially impact investor confidence. [Link to Statistics Korea]

India: Growth Indicators to Watch

While specific data releases for India on June 2nd, 2025, might vary, keep an eye out for any updates on key indicators such as industrial production, manufacturing PMI, or possibly early hints at upcoming GDP figures. India's economic performance continues to be a significant factor in the overall Asian economic narrative. [Link to Reserve Bank of India]

Market Impact and Investment Implications

The collective data release on June 2nd, 2025, will significantly influence market sentiment across Asia. Investors should carefully analyze the figures to assess their potential impact on various asset classes, including equities, currencies, and bonds. Unexpectedly strong or weak results could lead to significant market volatility.

Key Considerations for Investors:

- Currency fluctuations: Pay close attention to how the Yen, Yuan, and Won react to the released data.

- Investment strategy: Adjust your portfolio based on the overall economic picture painted by the data.

- Geopolitical factors: Remember that global events can significantly influence these economic indicators.

This overview provides a snapshot of the significant economic data releases anticipated on Monday, June 2nd, 2025. Remember to consult reputable financial news sources for the latest updates and analysis as the data becomes available. Stay informed, and make smart investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Asian Economic Data Releases: Monday, June 2nd, 2025 Overview. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

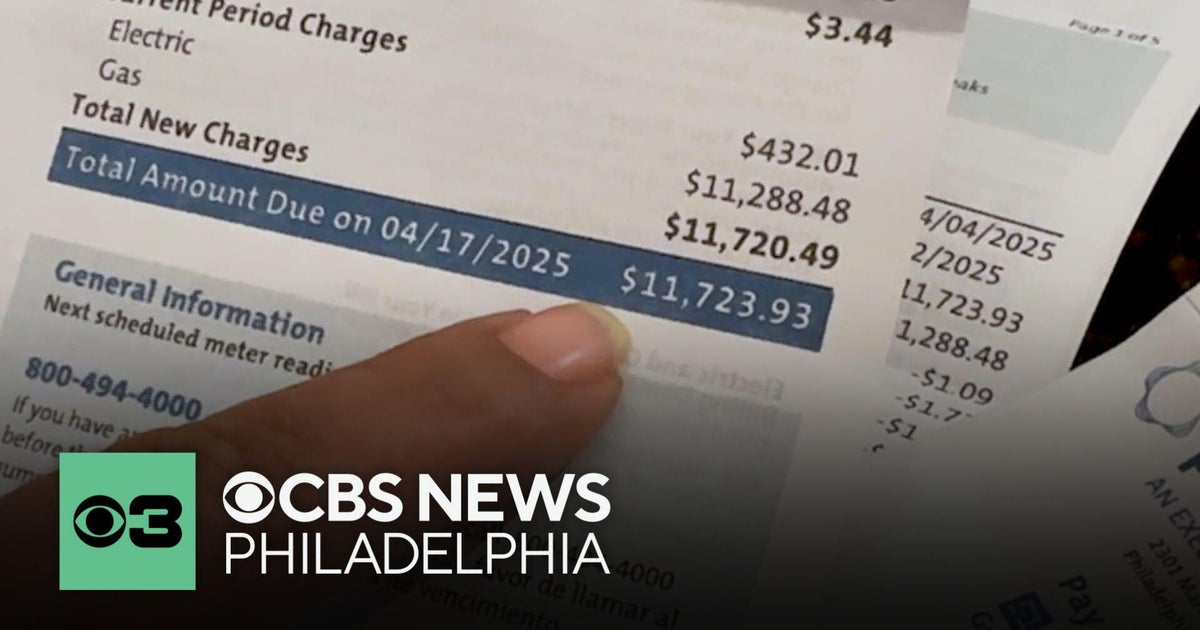

Pennsylvania Utility Customer Disputes Massive 12 000 Peco Energy Bill

Jun 03, 2025

Pennsylvania Utility Customer Disputes Massive 12 000 Peco Energy Bill

Jun 03, 2025 -

Al Rokers 20 Year Weight Loss Journey Maintaining A 100 Pound Success

Jun 03, 2025

Al Rokers 20 Year Weight Loss Journey Maintaining A 100 Pound Success

Jun 03, 2025 -

The Wire Star Shares Harrowing Tale Of Sons Tornado Survival In Henry County

Jun 03, 2025

The Wire Star Shares Harrowing Tale Of Sons Tornado Survival In Henry County

Jun 03, 2025 -

Update Sheinelle Jones And Family Following Husbands Death

Jun 03, 2025

Update Sheinelle Jones And Family Following Husbands Death

Jun 03, 2025 -

Dte Rate Increase Will Michigan Families Survive The Latest Price Hike

Jun 03, 2025

Dte Rate Increase Will Michigan Families Survive The Latest Price Hike

Jun 03, 2025