Are US Tariffs On China Working? JPMorgan CEO Jamie Dimon Says No

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Are US Tariffs on China Working? JPMorgan CEO Jamie Dimon Says No

JPMorgan Chase CEO Jamie Dimon's recent comments cast doubt on the effectiveness of US tariffs on Chinese goods, sparking a renewed debate on the economic impact of this long-standing trade policy. The ongoing trade war between the US and China has been a significant factor in global economic uncertainty, and Dimon's assessment adds fuel to the fire. His statement, delivered during a recent earnings call, suggests that the tariffs, implemented during the Trump administration, have not achieved their intended goals and may even be hurting the US economy.

This article delves into Dimon's claims, examines the arguments for and against the effectiveness of the tariffs, and explores the broader implications for businesses and consumers.

Dimon's Critique: More Harm Than Good?

Dimon, a prominent figure in the US financial landscape, argued that the tariffs have failed to significantly alter China's trade practices. He contends that they have instead increased costs for American businesses and consumers, contributing to inflation and hindering economic growth. His perspective aligns with many economists who argue that tariffs are a blunt instrument that disproportionately harms consumers and domestic industries reliant on imported goods from China.

"The tariffs haven't really worked the way people thought they would," Dimon reportedly stated. He emphasized the negative consequences for US businesses struggling with higher input costs, particularly in sectors heavily reliant on Chinese imports. This resonates with concerns about the impact on supply chains and the overall competitiveness of American businesses in the global market.

The Ongoing Debate: Arguments For and Against Tariffs

The effectiveness of US tariffs on China remains a hotly debated topic. Proponents argue that the tariffs have successfully pressured China to negotiate trade deals and address concerns regarding intellectual property theft and unfair trade practices. They point to certain concessions made by China as evidence of the tariffs' influence.

However, critics argue that the economic costs outweigh any potential benefits. They cite increased prices for consumers, reduced competitiveness for US businesses, and the negative impact on global trade as significant drawbacks. Furthermore, some economists argue that the tariffs have done little to address the underlying issues of trade imbalances and intellectual property theft. The complex interplay of global economics makes assessing the true impact a challenging task.

Beyond the Tariffs: A Broader Economic Picture

The debate surrounding US tariffs on China goes beyond the simple question of their effectiveness. It highlights larger issues:

- Global Supply Chain Resilience: The tariffs have exposed vulnerabilities in global supply chains, leading to a renewed focus on diversification and reshoring.

- Inflationary Pressures: Increased costs due to tariffs have contributed to inflation, impacting consumers and central bank monetary policy.

- Geopolitical Tensions: The trade war has exacerbated geopolitical tensions between the US and China, adding complexity to the already challenging international landscape.

Understanding these broader implications is crucial for navigating the evolving economic landscape.

What Does the Future Hold?

The long-term consequences of the US tariffs on China remain uncertain. While some argue for their continued use as a bargaining chip, others advocate for a more nuanced approach that focuses on addressing the root causes of trade imbalances through diplomatic means rather than punitive tariffs. The Biden administration has taken a somewhat less confrontational approach, but the underlying tensions persist. Dimon's comments underscore the need for a careful reevaluation of the current strategy and a renewed focus on fostering a more stable and cooperative global trading environment. Further analysis and long-term economic data will be needed to definitively assess the ultimate impact of these tariffs.

Learn More: For further insights into US-China trade relations, you can explore resources from the and the .

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Are US Tariffs On China Working? JPMorgan CEO Jamie Dimon Says No. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Mc Larens Piastri Secures Pole Beats Norris In Barcelona

Jun 02, 2025

Mc Larens Piastri Secures Pole Beats Norris In Barcelona

Jun 02, 2025 -

Miley And Billy Cyrus A Closer Look At Their Evolving Relationship

Jun 02, 2025

Miley And Billy Cyrus A Closer Look At Their Evolving Relationship

Jun 02, 2025 -

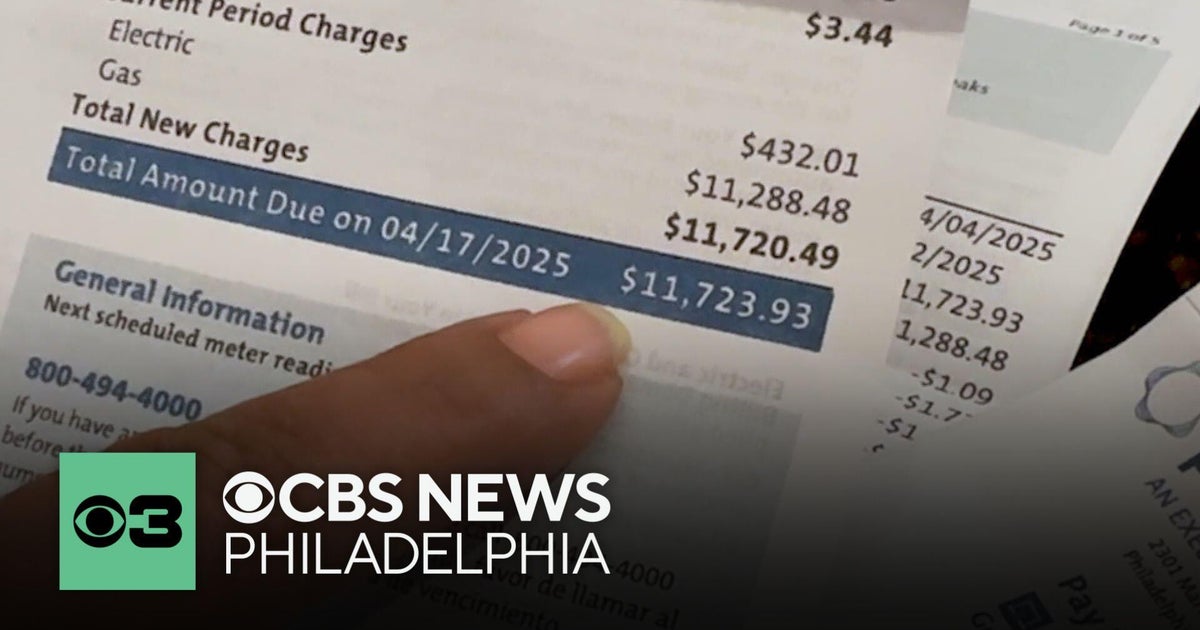

Months Of Missing Bills Lead To 12 000 Peco Surprise For Customer

Jun 02, 2025

Months Of Missing Bills Lead To 12 000 Peco Surprise For Customer

Jun 02, 2025 -

Actress Sydney Sweeney Releases Soap Made From Her Bathwater

Jun 02, 2025

Actress Sydney Sweeney Releases Soap Made From Her Bathwater

Jun 02, 2025 -

Police Apprehend North Texas Murder Suspect Following Extensive Manhunt

Jun 02, 2025

Police Apprehend North Texas Murder Suspect Following Extensive Manhunt

Jun 02, 2025