Apple Faces 25% Tariff: Analyzing The Impact On US Consumers And The Economy

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Apple Faces 25% Tariff: Analyzing the Impact on US Consumers and the Economy

Apple, the tech giant, is facing a potential 25% tariff on its products imported from China. This development has sent ripples through the tech industry and sparked concerns about its impact on US consumers and the broader economy. The implications are far-reaching and deserve careful analysis.

The Tariff's Origins and Potential Impact

The potential tariff increase is a complex issue rooted in ongoing trade tensions between the US and China. While the specifics can be intricate, the core consequence is simple: a significant price hike for Apple products sold in the US. This could affect everything from iPhones and iPads to MacBooks and Apple Watches.

A 25% increase represents a substantial jump in cost, potentially pushing many products beyond the reach of budget-conscious consumers. The impact would be particularly felt by lower-income households already struggling with inflation. This situation highlights the interconnectedness of global trade and its direct impact on everyday life.

Analyzing the Ripple Effect:

The consequences extend beyond just Apple's bottom line. The increased cost of Apple products could:

- Reduce consumer spending: Higher prices may lead consumers to postpone purchases or opt for cheaper alternatives, impacting overall consumer spending and economic growth.

- Affect Apple's profitability: Increased production costs could squeeze Apple's profit margins, potentially leading to job losses or reduced investment in research and development.

- Impact the US tech sector: The tariff could set a precedent, potentially influencing trade policies for other tech companies and leading to broader economic uncertainty within the sector.

- Increase inflation: The increased cost of Apple products could contribute to overall inflation, eroding purchasing power for all consumers.

Apple's Response and Mitigation Strategies

Apple has not yet officially commented on the specific impact of a 25% tariff. However, the company has a history of navigating global trade complexities. Possible mitigation strategies could include:

- Diversifying manufacturing: Shifting production to countries outside of China to avoid tariffs. This is a complex undertaking, requiring significant investment and time.

- Absorbing some of the cost: Apple could choose to absorb a portion of the increased cost to maintain competitiveness, impacting their profit margins.

- Raising prices: The most straightforward response would be to increase prices on its products to offset the tariff, directly impacting consumers.

Long-Term Implications and Economic Uncertainty:

The long-term implications of a 25% tariff on Apple products remain uncertain. The situation underscores the fragility of global supply chains and the risks associated with trade wars. Economic analysts are closely monitoring the situation, predicting potential impacts on everything from consumer confidence to overall GDP growth. The uncertainty itself contributes to economic instability.

What Consumers Can Expect:

Consumers should be prepared for potential price increases on Apple products if the tariffs are implemented. Shopping around for the best deals and considering alternative brands might become more important than ever. Staying informed about trade developments is crucial for making informed purchasing decisions.

Conclusion: Navigating the Uncertain Waters of Global Trade

The potential 25% tariff on Apple products serves as a stark reminder of the interconnectedness of the global economy. The impact will ripple through various sectors, affecting consumers, businesses, and the overall economic landscape. Further developments and governmental responses will be crucial in determining the ultimate consequences of this trade dispute. Staying informed and adaptable will be essential for navigating this period of economic uncertainty.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Apple Faces 25% Tariff: Analyzing The Impact On US Consumers And The Economy. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Nwjwan Tbryzy Grftar Dr Dywar Gzarsh Kaml Emlyat Amdad W Njat

May 27, 2025

Nwjwan Tbryzy Grftar Dr Dywar Gzarsh Kaml Emlyat Amdad W Njat

May 27, 2025 -

Citizens Jmp On Core Weave Crwv A Measured Approach To Investment

May 27, 2025

Citizens Jmp On Core Weave Crwv A Measured Approach To Investment

May 27, 2025 -

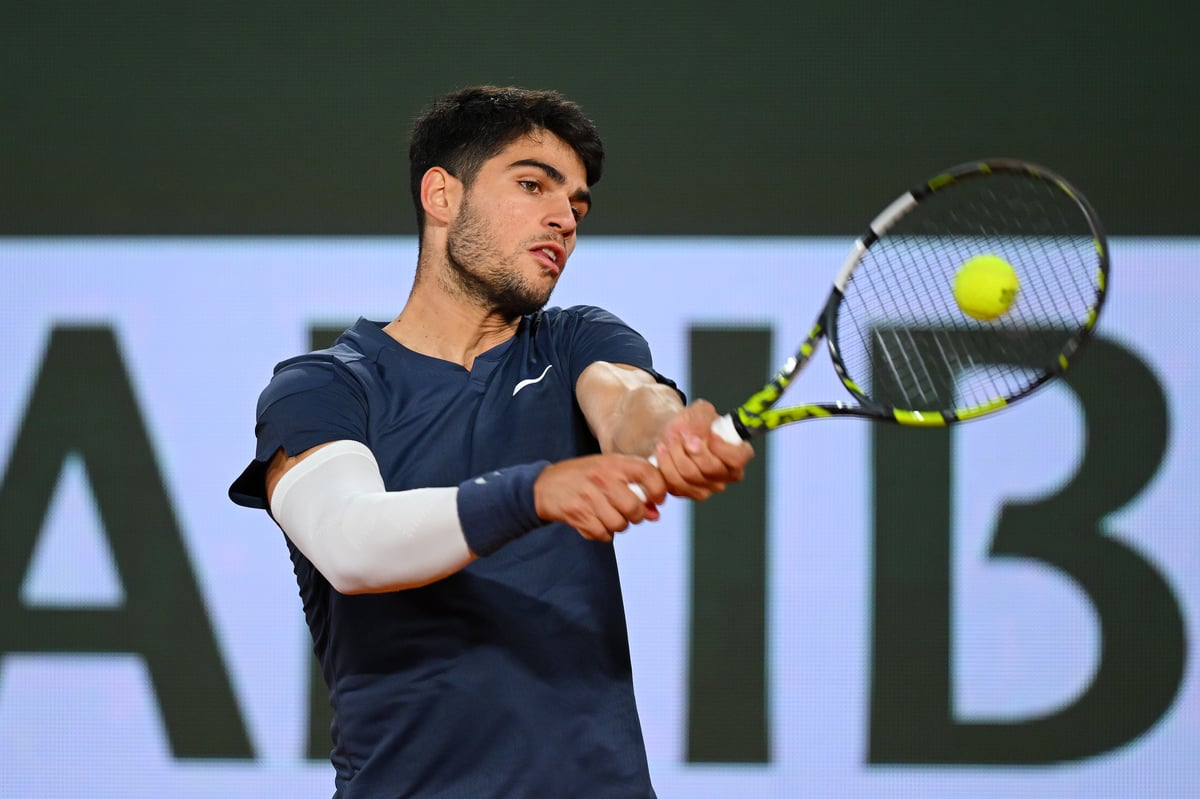

French Open 2025 Uk Where To Watch Roland Garros Online And On Tv

May 27, 2025

French Open 2025 Uk Where To Watch Roland Garros Online And On Tv

May 27, 2025 -

Investing In Ai 3 Undervalued Stocks With Palantir Like Potential

May 27, 2025

Investing In Ai 3 Undervalued Stocks With Palantir Like Potential

May 27, 2025 -

Less Stress More Romance Dating On A Three Day Weekend

May 27, 2025

Less Stress More Romance Dating On A Three Day Weekend

May 27, 2025