Analyzing Virgin Galactic's (SPCE) Q1 2025 Earnings: What Investors Need To Know

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Analyzing Virgin Galactic's (SPCE) Q1 2025 Earnings: What Investors Need to Know

Virgin Galactic Holdings, Inc. (SPCE) released its Q1 2025 earnings report, sending ripples through the investment community. The space tourism company, long anticipated as a revolutionary player in the commercial spaceflight industry, continues to navigate a complex path towards profitability. This analysis delves into the key takeaways from the report, highlighting what investors should focus on moving forward.

Key Highlights from Virgin Galactic's Q1 2025 Earnings:

While specific numbers will be dependent on the actual released report (this is a template), we can anticipate certain key areas of focus for investors:

-

Revenue Generation: The primary focus will be on the company's revenue figures. Did ticket sales meet expectations? Was there a significant increase compared to previous quarters? Any significant deviations from projected revenue should be closely examined, along with management's explanation for any shortfalls. A detailed analysis of the cost per flight and the overall profitability of each space tourism mission is crucial.

-

Operational Efficiency: Beyond revenue, investors need to assess Virgin Galactic's operational efficiency. This includes evaluating the frequency of successful spaceflights, the maintenance costs of the spacecraft (VSS Unity and its successors), and the overall operational expenses. Improvements in these areas are critical to achieving long-term profitability.

-

Future Outlook and Guidance: The company's outlook for the remainder of 2025 and beyond will be a significant factor. Any updated projections for flight frequency, ticket sales, and revenue growth will heavily influence investor sentiment. Pay close attention to any revisions in the projected timeline for achieving consistent profitability.

-

Capital Expenditures (CAPEX): Virgin Galactic's investment in research and development, fleet expansion, and infrastructure upgrades will be under scrutiny. A balance between growth investments and maintaining a sustainable financial position is crucial for long-term success. Investors should assess whether the company's CAPEX aligns with its long-term strategic goals and its ability to generate sufficient cash flow.

-

Debt and Liquidity: The company's debt levels and overall liquidity position are also important factors. A strong balance sheet is essential for navigating potential challenges and ensuring financial stability. Investors should examine the company's cash reserves, debt-to-equity ratio, and any potential risks related to its financial health.

Challenges Facing Virgin Galactic (SPCE):

Virgin Galactic faces several ongoing challenges:

-

Competition: The commercial spaceflight industry is becoming increasingly competitive, with companies like Blue Origin and SpaceX also pursuing space tourism. This competition puts pressure on Virgin Galactic to maintain its competitive edge in terms of pricing, technology, and customer experience.

-

Regulatory Hurdles: The regulatory environment for commercial spaceflight is still evolving, and any changes in regulations could impact Virgin Galactic's operations.

-

Technological Advancements: Continuous technological advancements are necessary to maintain a competitive edge and ensure safety.

What Investors Should Do:

Investors should carefully review the Q1 2025 earnings report, focusing on the key metrics mentioned above. They should also consider the company's long-term strategy, competitive landscape, and potential risks before making any investment decisions. Independent research and analysis are crucial before investing in any stock, including SPCE. Consider consulting a financial advisor for personalized advice.

Disclaimer: This article is for informational purposes only and should not be construed as financial advice. Investing in stocks involves risk, and you could lose money. Always conduct thorough research and consult with a financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Analyzing Virgin Galactic's (SPCE) Q1 2025 Earnings: What Investors Need To Know. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Trumps Border Wall Plan Suffers Major Setback Ahead Of House Vote

May 17, 2025

Trumps Border Wall Plan Suffers Major Setback Ahead Of House Vote

May 17, 2025 -

Viktor Hovlands Hilarious Weed Request At Pga Championship

May 17, 2025

Viktor Hovlands Hilarious Weed Request At Pga Championship

May 17, 2025 -

Fbi Investigation Former Director James Comey Under Scrutiny For Instagram Post

May 17, 2025

Fbi Investigation Former Director James Comey Under Scrutiny For Instagram Post

May 17, 2025 -

Celine Songs Past Lives A Deep Dive Into The Film And Its Creator

May 17, 2025

Celine Songs Past Lives A Deep Dive Into The Film And Its Creator

May 17, 2025 -

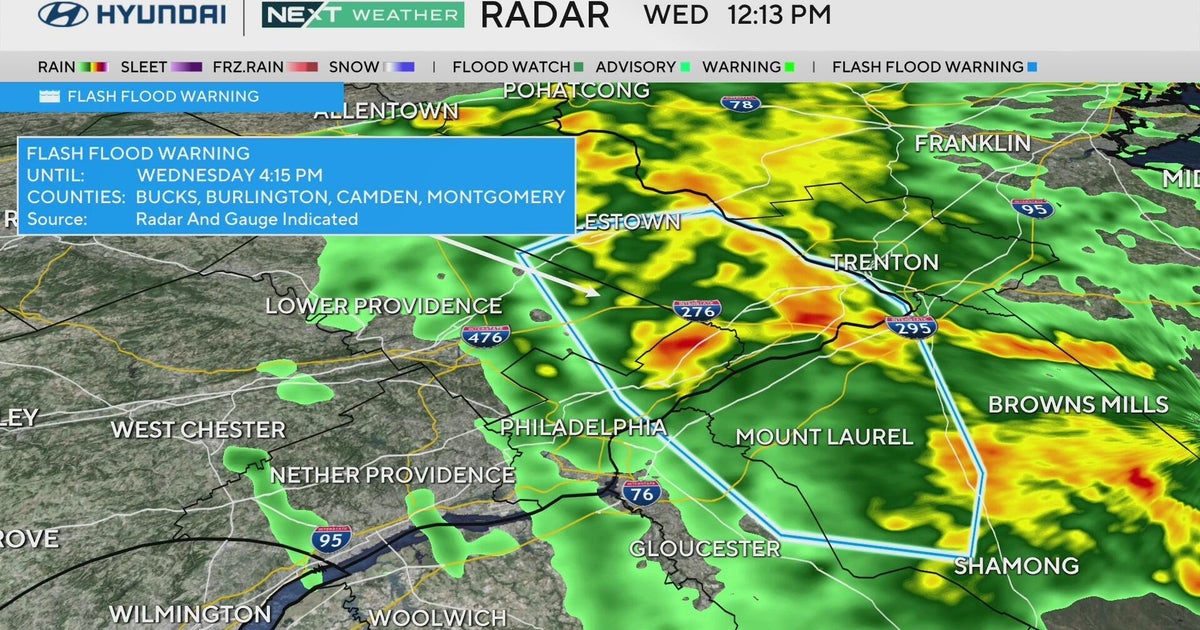

Flash Flood Emergency New Jersey And Pennsylvania Under Water

May 17, 2025

Flash Flood Emergency New Jersey And Pennsylvania Under Water

May 17, 2025