Analyzing Virgin Galactic's (SPCE) Q1 2025 Earnings: A Deep Dive Into Performance

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Analyzing Virgin Galactic's (SPCE) Q1 2025 Earnings: A Deep Dive into Performance

Virgin Galactic Holdings Inc. (SPCE), the pioneering space tourism company, released its Q1 2025 earnings report, sending ripples through the investment community. This report offers a crucial glimpse into the company's progress towards commercial spaceflight viability and its overall financial health. While the results weren't universally lauded, a detailed analysis reveals both promising signs and areas requiring further attention. Let's delve into the key takeaways.

Revenue and Ticket Sales: A Mixed Bag

The headline figure – revenue – showed a modest increase compared to Q1 2024, fueled primarily by increased ticket sales. However, the growth rate fell short of some analysts' predictions. This discrepancy highlights the ongoing challenges of scaling operations and converting interest into actual spaceflights. The company attributed some of the shortfall to delays in completing necessary upgrades to its spacecraft, VSS Unity. Further analysis is needed to determine if this is a temporary setback or a more systemic issue impacting long-term revenue projections.

Operational Expenses: A Focus on Efficiency

One area where Virgin Galactic demonstrated improvement was in controlling operational expenses. While still substantial, the company showed a commitment to streamlining processes and improving efficiency. This is a critical factor for long-term profitability, especially considering the high capital expenditure involved in spaceflight operations. The cost per flight is a key metric investors are watching closely, and any significant reduction signals progress towards sustainable business model. Investors will be keen to see if this trend continues in subsequent quarters.

Looking Ahead: Commercial Flight Schedule and Technological Advancements

Virgin Galactic's Q1 2025 report highlighted an ambitious commercial flight schedule for the remainder of the year. Successful execution of this schedule will be vital in demonstrating the company's ability to deliver on its promises and solidify its position in the burgeoning space tourism market. Furthermore, the company continues to invest in technological advancements, aiming to improve the reliability and efficiency of its spacecraft. These upgrades are essential for ensuring the safety and comfort of passengers, and for reducing operational costs over the long term.

Key Challenges and Risks

Despite the positive aspects, several challenges remain. The competitive landscape is heating up, with other companies entering the space tourism arena. Virgin Galactic needs to differentiate itself through superior service, affordability, and a consistent flight schedule to maintain a competitive edge. Regulatory hurdles and potential safety concerns also present ongoing risks. The company’s commitment to safety and transparent communication regarding any challenges will be crucial for maintaining investor confidence.

Investor Sentiment and Future Outlook

The market reacted with a mixed response to the Q1 2025 earnings. While some investors were encouraged by the progress in operational efficiency, others remained cautious due to the slower-than-expected revenue growth. The long-term success of Virgin Galactic will hinge on its ability to consistently deliver on its promises, manage costs effectively, and navigate the evolving regulatory landscape. Further updates on technological advancements and the company's commercial flight schedule will be closely scrutinized by investors.

In conclusion, Virgin Galactic’s Q1 2025 earnings provide a complex picture. While progress in operational efficiency is encouraging, the company faces significant challenges in scaling operations and achieving sustainable profitability. The coming quarters will be crucial in determining whether Virgin Galactic can successfully navigate these hurdles and establish itself as a leading player in the commercial space tourism sector. Further updates and analysis will be necessary to gain a clearer understanding of the long-term implications of these results.

Keywords: Virgin Galactic, SPCE, Q1 2025 earnings, space tourism, commercial spaceflight, revenue, operational expenses, stock market, investment, financial analysis, space travel, VSS Unity.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Analyzing Virgin Galactic's (SPCE) Q1 2025 Earnings: A Deep Dive Into Performance. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Coco Gauff Achieves Career High Ranking Climbing Past Iga Swiatek

May 17, 2025

Coco Gauff Achieves Career High Ranking Climbing Past Iga Swiatek

May 17, 2025 -

Tottenham Hotspur At Aston Villa Premier League Match Preview And Betting Odds

May 17, 2025

Tottenham Hotspur At Aston Villa Premier League Match Preview And Betting Odds

May 17, 2025 -

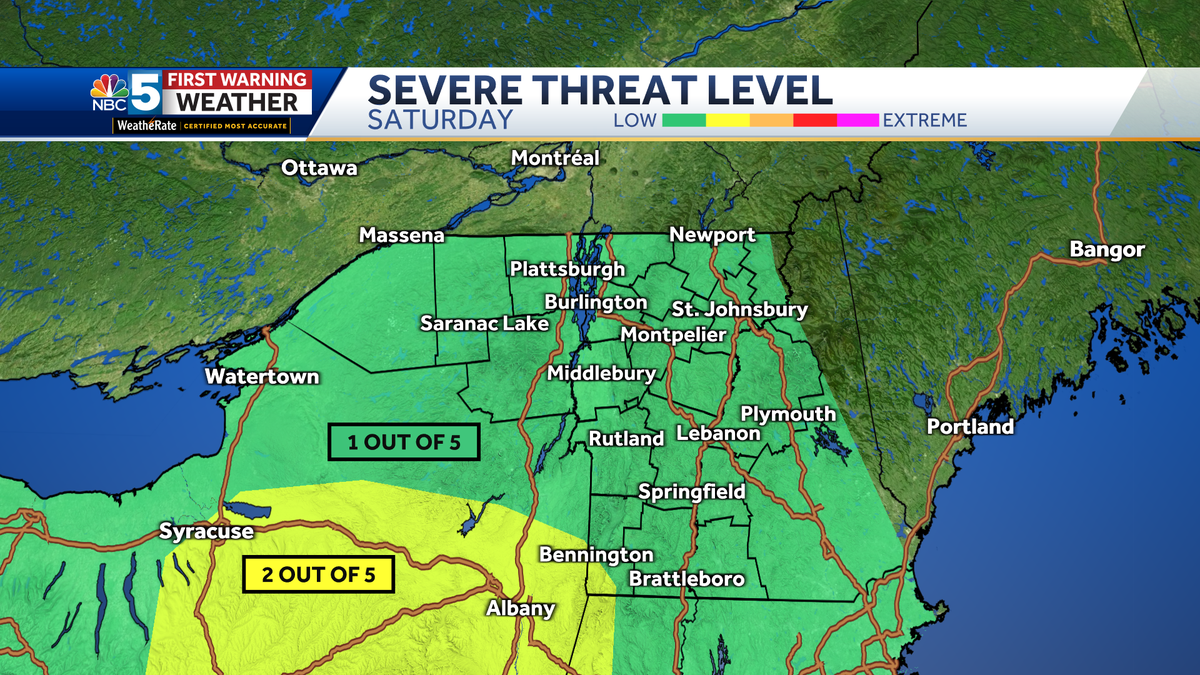

Pop Up Storms To Dump Rain On Parts Of New York And Vermont

May 17, 2025

Pop Up Storms To Dump Rain On Parts Of New York And Vermont

May 17, 2025 -

Breanna Stewarts Perspective Sue Birds Transition Beyond The Court

May 17, 2025

Breanna Stewarts Perspective Sue Birds Transition Beyond The Court

May 17, 2025 -

James Comey Investigation The Meaning And Implications Of The 86 47 Post

May 17, 2025

James Comey Investigation The Meaning And Implications Of The 86 47 Post

May 17, 2025