Analyzing The NIO Stock Decline: A Pre-Earnings Perspective

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Analyzing the NIO Stock Decline: A Pre-Earnings Perspective

NIO, a prominent player in the burgeoning electric vehicle (EV) market, has recently experienced a notable stock decline. This downturn, occurring in the pre-earnings period, has sparked considerable investor concern and speculation. Understanding the contributing factors is crucial for investors navigating this volatile market. This analysis delves into the potential reasons behind NIO's stock dip and offers a perspective on what to expect leading up to and following the release of its upcoming earnings report.

H2: Factors Contributing to the NIO Stock Decline

Several interconnected factors likely contribute to the current bearish sentiment surrounding NIO stock. These include:

-

Increased Competition: The EV market is rapidly expanding, with established automakers and new entrants vying for market share. Competition from Tesla, BYD, and other Chinese EV manufacturers is intensifying, putting pressure on NIO's sales and profitability. This heightened competitive landscape is a significant headwind for NIO's growth trajectory.

-

Macroeconomic Headwinds: Global economic uncertainty, rising interest rates, and inflation are impacting investor sentiment across various sectors, including the technology and automotive industries. NIO, being a growth stock, is particularly susceptible to these broader macroeconomic challenges.

-

Supply Chain Disruptions: The lingering effects of the global chip shortage and other supply chain bottlenecks continue to pose challenges for EV manufacturers, including NIO. Production delays and increased costs can negatively impact financial performance and investor confidence.

-

Investor Sentiment & Market Volatility: Overall market volatility and shifting investor sentiment towards growth stocks can significantly influence NIO's stock price. Negative news cycles, even if unrelated to NIO's specific performance, can contribute to selling pressure.

-

Upcoming Earnings Report: The anticipation surrounding NIO's upcoming earnings report is likely contributing to the current price fluctuation. Investors are closely scrutinizing NIO's performance metrics to gauge its future prospects. Any deviation from expectations could lead to significant price movements.

H2: Analyzing NIO's Strengths and Weaknesses

Despite the recent decline, NIO possesses several key strengths:

-

Innovative Technology: NIO is known for its technological advancements in battery technology, autonomous driving capabilities, and overall vehicle design. These innovations are crucial for attracting customers in a highly competitive market.

-

Brand Recognition: NIO has cultivated a strong brand identity, particularly in the Chinese market. This brand recognition is a significant asset, helping to drive sales and customer loyalty.

-

Expanding Infrastructure: NIO's investment in its battery swap network is a key differentiator, addressing range anxiety and enhancing the overall user experience. This strategic infrastructure development is a long-term competitive advantage.

However, NIO also faces weaknesses:

-

Profitability Concerns: NIO is yet to achieve consistent profitability, a major concern for many investors. The company's operating expenses and reliance on subsidies can impact its financial health.

-

Dependence on the Chinese Market: While NIO is expanding internationally, its significant dependence on the Chinese market exposes it to risks associated with the Chinese economy and government policies.

H2: A Pre-Earnings Perspective and What to Expect

The upcoming earnings report will be critical in determining the future trajectory of NIO's stock price. Investors should closely monitor:

-

Delivery Numbers: The number of vehicles delivered will be a key indicator of NIO's sales performance and market share.

-

Revenue Growth: Sustained revenue growth is crucial to demonstrate the company's ability to scale its operations and compete effectively.

-

Profitability Metrics: Investors will be looking for improvements in profitability metrics, including gross margins and operating income.

-

Guidance: Management's guidance for the upcoming quarters will offer insights into NIO's future expectations and growth plans.

H2: Conclusion

The recent decline in NIO's stock price reflects a complex interplay of macroeconomic factors, competitive pressures, and investor sentiment. While challenges exist, NIO's innovative technology and strategic infrastructure development position it for long-term growth. The upcoming earnings report will provide crucial insights into NIO's progress and will likely play a significant role in shaping investor sentiment and stock price movements. Investors should carefully analyze the earnings report and consider their own risk tolerance before making investment decisions. Remember to consult with a financial advisor before making any investment choices.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Analyzing The NIO Stock Decline: A Pre-Earnings Perspective. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Three Wicket Win For England Joe Roots 166 Leads To Victory Against West Indies

Jun 03, 2025

Three Wicket Win For England Joe Roots 166 Leads To Victory Against West Indies

Jun 03, 2025 -

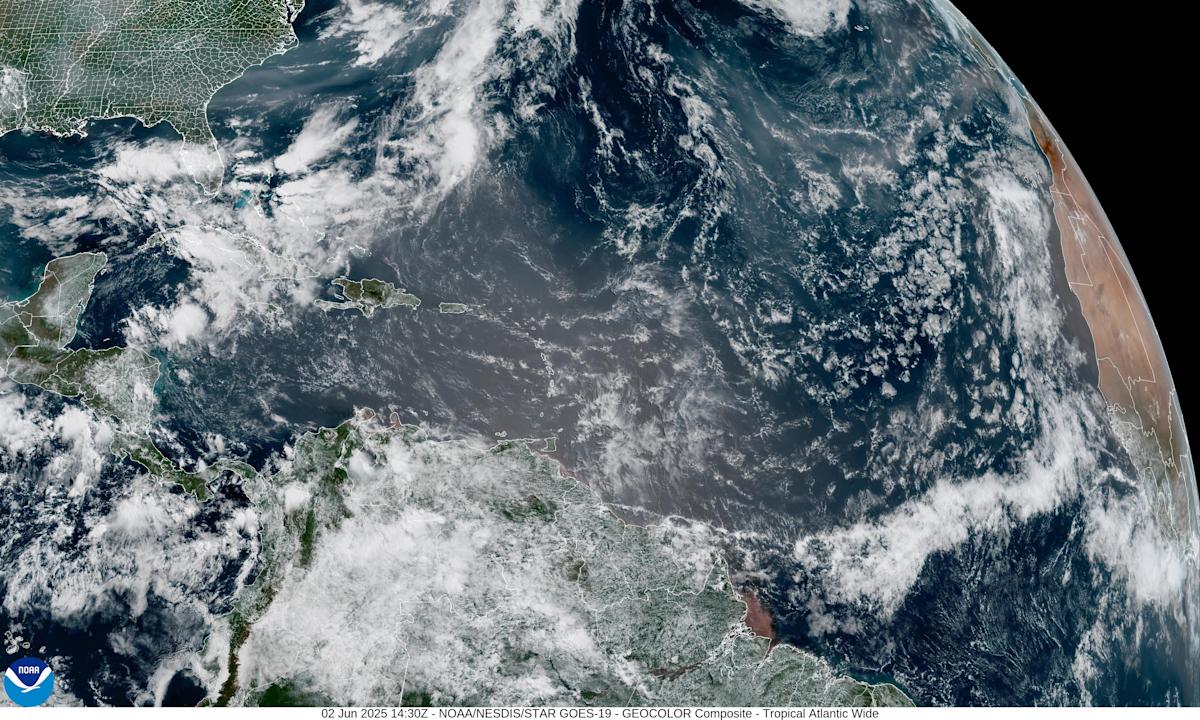

Air Quality Alert Saharan Dust And Wildfire Smoke Impacting Florida

Jun 03, 2025

Air Quality Alert Saharan Dust And Wildfire Smoke Impacting Florida

Jun 03, 2025 -

3 02 Surge For Hims And Hers Hims Shares May 30th Update

Jun 03, 2025

3 02 Surge For Hims And Hers Hims Shares May 30th Update

Jun 03, 2025 -

Global Tectonic Shifts Jamie Dimons Top Priority For Trump Administration

Jun 03, 2025

Global Tectonic Shifts Jamie Dimons Top Priority For Trump Administration

Jun 03, 2025 -

Top Asian Economic Events Monday June 2nd 2025 Calendar

Jun 03, 2025

Top Asian Economic Events Monday June 2nd 2025 Calendar

Jun 03, 2025