Analyzing The Crypto Crash: What's Behind Today's Price Drop?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Analyzing the Crypto Crash: What's Behind Today's Price Drop?

The cryptocurrency market experienced a significant downturn today, sending shockwaves through investors and sparking widespread speculation about the causes. Bitcoin, the leading cryptocurrency, plummeted [insert percentage] while other major coins like Ethereum and Solana also suffered substantial losses. This dramatic price drop begs the question: what triggered this sudden market crash? Let's delve into the potential factors contributing to today's volatility.

Regulatory Uncertainty Remains a Major Headwind:

One key factor consistently impacting crypto prices is regulatory uncertainty. Governments worldwide are still grappling with how to effectively regulate the decentralized nature of cryptocurrencies. Recent pronouncements from [mention specific regulatory bodies or governments and their actions], coupled with ongoing debates about taxation and consumer protection, contribute to a climate of uncertainty that can spook investors. This lack of clear regulatory frameworks creates instability and discourages large-scale institutional investment.

Macroeconomic Factors Exacerbate the Situation:

The current macroeconomic environment plays a significant role. High inflation rates, rising interest rates, and fears of a potential recession are driving investors towards safer assets. Cryptocurrencies, often considered a high-risk investment, are typically among the first to suffer during periods of economic instability. The recent [mention specific economic indicators, e.g., inflation reports, interest rate hikes] have likely contributed to the sell-off.

Specific Events Triggering the Sell-Off:

Beyond the broader economic picture, specific events can trigger immediate price drops. This might include:

- Negative news surrounding major players: Negative news concerning a prominent cryptocurrency exchange, a large-scale hack, or a significant regulatory action against a major player can create a domino effect, leading to a market-wide sell-off.

- Whale activity: Large cryptocurrency holders ("whales") can significantly impact market prices through their trading activities. A large sell-off by a whale can trigger a cascade effect, leading to further price declines.

- Technical glitches or vulnerabilities: Exploits or vulnerabilities in smart contracts or blockchain technology can lead to significant losses and erode investor confidence.

Analyzing the Long-Term Implications:

While today's drop is undeniably significant, it's crucial to consider the long-term implications. Cryptocurrency markets have historically been volatile, experiencing both dramatic rises and falls. Many analysts believe that this recent downturn is simply a correction within a larger trend. However, it is also important to acknowledge the potential for a prolonged bear market, especially given the current macroeconomic headwinds.

What to Watch For:

Investors should monitor several key indicators in the coming days and weeks:

- Regulatory developments: Any significant regulatory announcements or policy changes could significantly impact market sentiment.

- Macroeconomic data: Key economic indicators, such as inflation rates and interest rate decisions, will continue to influence investor behavior.

- Bitcoin price action: Bitcoin's price often acts as a bellwether for the broader crypto market. Its movement will be closely watched for clues about the market's future direction.

Conclusion:

The current crypto crash is a complex event resulting from a confluence of factors, from regulatory uncertainty and macroeconomic conditions to specific market events. While the short-term outlook remains uncertain, understanding these contributing factors is crucial for navigating the volatility and making informed investment decisions. Remember to always conduct thorough research and manage your risk effectively. Stay informed about the latest developments and consult with a financial advisor before making any investment decisions.

Disclaimer: This article provides general information and should not be considered financial advice. Investing in cryptocurrencies involves significant risk, and you could lose money.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Analyzing The Crypto Crash: What's Behind Today's Price Drop?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

6ix9ine On Trippie Redd Altercation A 2017 Flashback

Sep 23, 2025

6ix9ine On Trippie Redd Altercation A 2017 Flashback

Sep 23, 2025 -

Lincoln City Vs Chelsea Live Team News Prediction And Streaming Details

Sep 23, 2025

Lincoln City Vs Chelsea Live Team News Prediction And Streaming Details

Sep 23, 2025 -

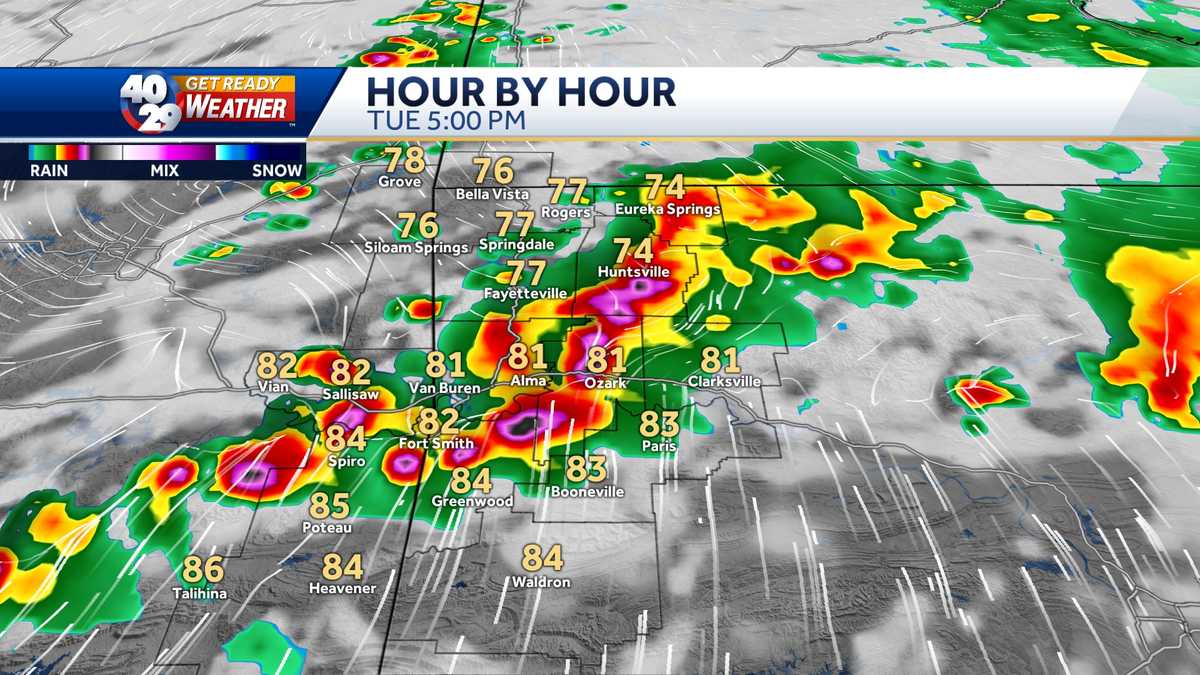

Tuesdays Forecast Arkansas Under Threat Of Heavy Rainfall And Severe Weather

Sep 23, 2025

Tuesdays Forecast Arkansas Under Threat Of Heavy Rainfall And Severe Weather

Sep 23, 2025 -

Three New Us Destinations Added To Air Canadas Flight Schedule

Sep 23, 2025

Three New Us Destinations Added To Air Canadas Flight Schedule

Sep 23, 2025 -

Secs Stance On Crypto Etfs Black Rocks Ethereum Proposal And Future Implications

Sep 23, 2025

Secs Stance On Crypto Etfs Black Rocks Ethereum Proposal And Future Implications

Sep 23, 2025