Analyzing The Criticism: The GOP's Difficult Defense Of Trump's "Big, Beautiful Bill"

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Analyzing the Criticism: The GOP's Difficult Defense of Trump's "Big, Beautiful Bill"

The Republican Party is facing an uphill battle defending the legacy of Donald Trump's economic policies, particularly what he dubbed his "big, beautiful bill"—referencing the Tax Cuts and Jobs Act of 2017. While initially lauded by Republicans as a job creator and economic stimulus, mounting criticism and underwhelming results are forcing the GOP to adopt a complex, and often contradictory, defense strategy.

The Act, which significantly lowered corporate and individual income tax rates, has become a focal point of the ongoing political debate. Proponents point to initial economic growth following its passage as evidence of its success. However, critics argue that the benefits primarily accrued to the wealthy, exacerbating income inequality and contributing to the national debt. This disparity lies at the heart of the GOP's defensive struggles.

<h3>The Core Arguments for and Against the Tax Cuts</h3>

The Republican defense rests on several pillars: job creation, economic growth, and increased investment. They cite data showing increased business investment and GDP growth in the immediate aftermath of the tax cuts. However, these claims are increasingly challenged.

-

The Job Creation Argument: While some job growth occurred post-2017, economists point to various factors influencing employment trends, making it difficult to isolate the tax cuts' specific impact. Furthermore, critics argue that the job gains were not proportionally distributed across income levels.

-

Economic Growth Claims: While GDP growth was initially higher, it's crucial to examine the sustainability of this growth. Critics contend that the growth was unsustainable, fueled by temporary boosts rather than long-term structural changes. The impact of the subsequent COVID-19 pandemic further complicates any definitive assessment.

-

Increased Investment Narrative: While businesses did increase investment in some sectors, the overall impact on long-term productivity and innovation remains debatable. Critics argue that much of this investment was used for stock buybacks and executive compensation, rather than generating substantial new jobs or technological advancements.

<h3>The GOP's Shifting Defense Strategy</h3>

Faced with mounting evidence contradicting their initial claims, the GOP has adopted a multi-pronged, and somewhat inconsistent, defense. Some Republicans now downplay the tax cuts' overall impact, arguing that other factors played a larger role in economic trends. Others attempt to shift the blame to external factors, such as the pandemic or global economic conditions. This inconsistent messaging has weakened their overall position.

<h3>The Long-Term Implications and the Path Forward</h3>

The debate surrounding the Tax Cuts and Jobs Act of 2017 underscores the complex relationship between tax policy and economic outcomes. The long-term effects are still unfolding, and future economic analyses will likely offer more clarity. For the Republican Party, effectively addressing the criticism requires a more nuanced approach, acknowledging both the successes and shortcomings of the legislation, rather than resorting to defensive rhetoric. The upcoming elections will likely further test the GOP's ability to articulate a compelling defense of Trump's economic legacy.

Further Reading: For a more in-depth analysis, explore reports from the Congressional Budget Office and the Tax Policy Center. These independent organizations provide valuable data and analysis on the impact of the Tax Cuts and Jobs Act.

Disclaimer: This article presents different perspectives on a complex issue. The information provided is for informational purposes only and does not constitute financial or political advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Analyzing The Criticism: The GOP's Difficult Defense Of Trump's "Big, Beautiful Bill". We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

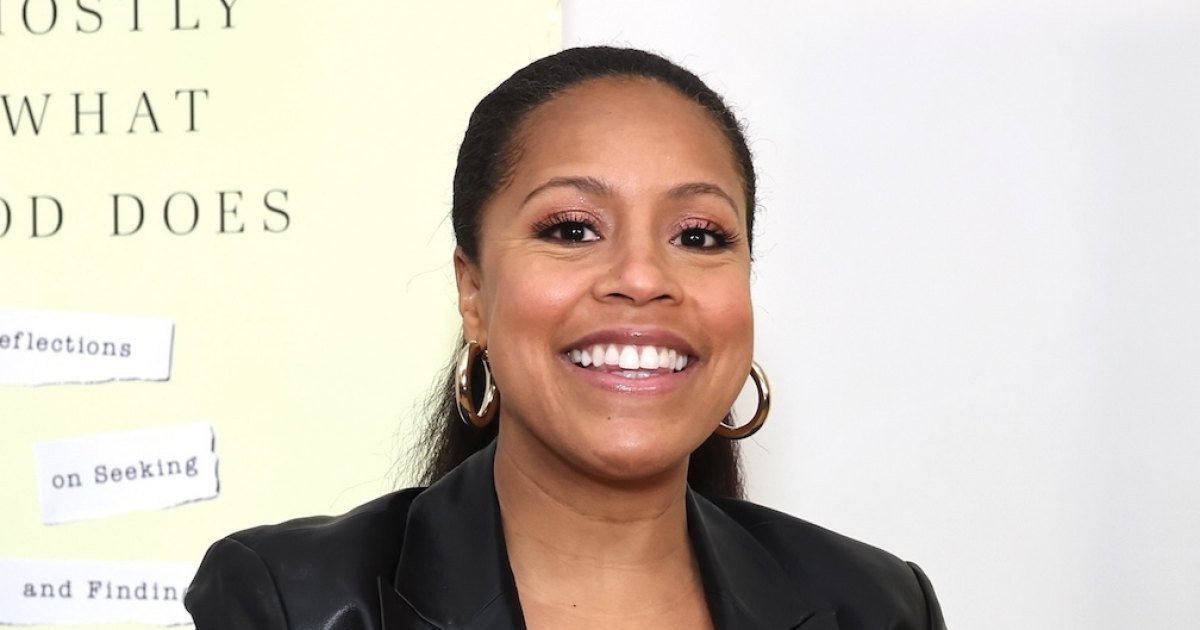

Sheinelle Jones Finds Strength In Family After Husbands Loss Source

Jun 04, 2025

Sheinelle Jones Finds Strength In Family After Husbands Loss Source

Jun 04, 2025 -

Fried Chicken Chain Acquired Private Equity Firm Closes 1 Billion Deal

Jun 04, 2025

Fried Chicken Chain Acquired Private Equity Firm Closes 1 Billion Deal

Jun 04, 2025 -

37 000 Private Sector Jobs Added In May Lowest Increase In More Than Two Years

Jun 04, 2025

37 000 Private Sector Jobs Added In May Lowest Increase In More Than Two Years

Jun 04, 2025 -

Accusations Of Racism Lu Pone Under Fire From Hundreds Of Broadway Colleagues

Jun 04, 2025

Accusations Of Racism Lu Pone Under Fire From Hundreds Of Broadway Colleagues

Jun 04, 2025 -

Lucy Guo How She Became The Worlds Youngest Self Made Billionaire

Jun 04, 2025

Lucy Guo How She Became The Worlds Youngest Self Made Billionaire

Jun 04, 2025