Analyzing The Clean Energy Tax Debate: Economic Winners And Losers

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Analyzing the Clean Energy Tax Debate: Economic Winners and Losers

The debate surrounding clean energy tax policies is heating up, sparking passionate discussions about economic impact. Are these policies a catalyst for growth and job creation, or a recipe for economic hardship for certain sectors? Let's delve into the complexities of this crucial issue, examining the potential winners and losers in this evolving energy landscape.

The Allure of Clean Energy Tax Incentives:

Governments worldwide are increasingly implementing tax incentives to accelerate the transition to clean energy. These incentives, which include tax credits, deductions, and exemptions, aim to make renewable energy sources like solar, wind, and geothermal more competitive with fossil fuels. The core argument is that these policies stimulate innovation, create jobs, and reduce harmful greenhouse gas emissions.

Who are the potential winners?

-

Renewable Energy Companies: Companies involved in manufacturing, installing, and maintaining renewable energy technologies stand to benefit significantly. Tax credits directly reduce their costs, making their products and services more affordable and boosting demand. This translates to increased profits and expansion opportunities. Think of companies specializing in solar panel production, wind turbine manufacturing, and geothermal energy development. These are likely to see substantial growth.

-

Green Technology Industries: The clean energy transition isn't solely about renewable energy generation. It encompasses the entire supply chain, from battery storage and smart grids to energy-efficient building materials. Companies innovating in these sectors will experience a surge in demand, fueled by government incentives and growing consumer awareness.

-

High-skilled Workers: The clean energy sector is a significant creator of high-skilled jobs. Engineers, technicians, scientists, and project managers are all in high demand. Tax incentives stimulate investment in research and development, further increasing the need for skilled professionals.

-

Consumers (Long-Term): While upfront costs might be higher, the long-term benefits for consumers can be substantial. Lower energy bills due to cheaper renewable energy sources and potential government rebates can lead to significant savings. Moreover, the positive externalities of reduced pollution contribute to better public health.

Who are the potential losers?

-

Fossil Fuel Industry: The transition to clean energy presents a significant challenge to the fossil fuel industry. Reduced demand for coal, oil, and natural gas can lead to job losses and decreased profitability in this traditional sector. While some fossil fuel companies are diversifying into renewable energy, many others face a difficult adaptation.

-

Workers in Traditional Energy Sectors: The decline in fossil fuel-based industries inevitably leads to job displacement for workers in mining, oil drilling, and coal power plants. Retraining and job creation initiatives are crucial to mitigate this negative impact.

-

Taxpayers (Short-Term): The cost of implementing clean energy tax incentives ultimately falls on taxpayers. While the long-term benefits are substantial, the immediate financial burden can be significant, prompting debates about the efficiency and equity of these policies.

Navigating the complexities:

The clean energy tax debate isn't simply a dichotomy of winners and losers. It's a complex interplay of economic, environmental, and social factors. Effective policy requires a nuanced approach that considers the needs of all stakeholders. This includes robust support for workers transitioning to new industries, targeted investments in communities affected by the decline of traditional energy sectors, and a focus on ensuring a just and equitable transition.

Looking Ahead: Further research and open dialogue are crucial to understanding the full economic consequences of clean energy tax policies. By carefully considering the potential winners and losers, policymakers can design policies that maximize the benefits while minimizing the negative impacts, paving the way for a sustainable and prosperous future. The future of energy is undoubtedly intertwined with the outcome of this ongoing debate. What are your thoughts on this complex issue? Share your opinions in the comments below.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Analyzing The Clean Energy Tax Debate: Economic Winners And Losers. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Climate Changes Effect On Pregnancy Heat Pollution And Pregnancy Complications

May 18, 2025

Climate Changes Effect On Pregnancy Heat Pollution And Pregnancy Complications

May 18, 2025 -

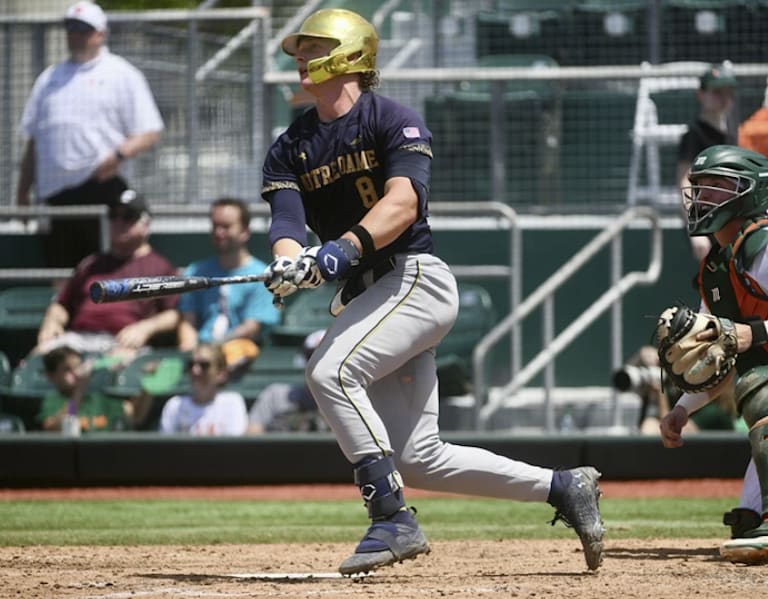

Notre Dame Baseballs Series Win Against Miami A Look At Tinneys Impact

May 18, 2025

Notre Dame Baseballs Series Win Against Miami A Look At Tinneys Impact

May 18, 2025 -

Lacrosse Tournament Bracket Ncaa Quarterfinal Games And Schedule Preview

May 18, 2025

Lacrosse Tournament Bracket Ncaa Quarterfinal Games And Schedule Preview

May 18, 2025 -

Hovland And De Chambeaus Day A 2 Under And An Even Par Round

May 18, 2025

Hovland And De Chambeaus Day A 2 Under And An Even Par Round

May 18, 2025 -

Fbi Investigation Deciphering The Mystery Behind James Comeys 86 47 Instagram

May 18, 2025

Fbi Investigation Deciphering The Mystery Behind James Comeys 86 47 Instagram

May 18, 2025