Analyzing Sunnova's Chapter 11 Filing: A Turning Point For Solar?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Analyzing Sunnova's Chapter 11 Filing: A Turning Point for the Solar Industry?

Sunnova Energy International Inc.'s recent Chapter 11 filing sent shockwaves through the residential solar industry. While the company insists this is a strategic restructuring, not a bankruptcy liquidation, the move raises critical questions about the future of the sector and the sustainability of current business models. Is this a mere hiccup, or a sign of deeper underlying issues within the booming renewable energy market?

Sunnova's Strategic Restructuring: What We Know

Sunnova, a leading provider of residential solar and energy storage solutions, announced its Chapter 11 filing on July 26, 2024, citing a need to restructure its debt. The company emphasized that it intends to continue operating normally throughout the process, fulfilling existing customer contracts and honoring warranties. The restructuring plan aims to reduce its debt burden, improve its financial flexibility, and ultimately strengthen its long-term position in the market. This involves negotiating with creditors to reduce debt obligations and potentially streamline its operations. Key aspects of the plan include:

- Debt Reduction: The primary goal is to significantly lower Sunnova's debt load, a common strategy in Chapter 11 proceedings.

- Operational Efficiency: Streamlining operations and potentially divesting non-core assets are likely to be part of the restructuring.

- Maintaining Customer Service: Sunnova has stressed its commitment to uninterrupted service for existing customers.

Is This a Sign of Trouble in the Solar Sector?

While Sunnova's filing is specific to its circumstances – factors such as high interest rates and aggressive expansion – it does raise broader concerns about the residential solar industry. Several factors contribute to this apprehension:

- High Debt Levels: Many solar companies, especially those experiencing rapid growth, have taken on significant debt to finance expansion. Rising interest rates have made this debt increasingly burdensome.

- Supply Chain Issues: The solar industry, like many others, has faced challenges with supply chain disruptions, impacting project timelines and profitability.

- Competition: The residential solar market is becoming increasingly competitive, putting pressure on pricing and profit margins.

The Broader Impact on the Renewable Energy Transition

Sunnova's situation highlights the complexities of scaling a rapidly growing industry. While the renewable energy transition is undeniably important, the path to widespread adoption isn't without its challenges. The financial health of key players like Sunnova directly impacts investor confidence and the overall pace of solar energy adoption. This filing could lead to:

- Increased Scrutiny of Solar Business Models: Investors and regulators will likely scrutinize the financial sustainability of solar companies more closely.

- Consolidation in the Industry: We might see increased mergers and acquisitions as weaker players struggle to compete.

- Slowdown in Growth: The short-term impact could be a temporary slowdown in the industry's growth rate.

Looking Ahead: What to Expect

The outcome of Sunnova's Chapter 11 process will significantly influence the future trajectory of the residential solar industry. The success of its restructuring plan will hinge on its ability to negotiate favorable terms with creditors and maintain customer confidence. While the filing represents a setback, it doesn't necessarily signal the demise of the sector. The long-term outlook for solar remains positive, driven by the urgent need for clean energy solutions and continued technological advancements. However, this event underscores the importance of sustainable business practices and responsible financial management within the industry. It will be crucial to observe how other companies adapt and navigate the evolving landscape of the residential solar market.

Further Reading:

This situation warrants careful monitoring. Stay tuned for further updates as the Sunnova restructuring process unfolds and its impact on the wider solar industry becomes clearer.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Analyzing Sunnova's Chapter 11 Filing: A Turning Point For Solar?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

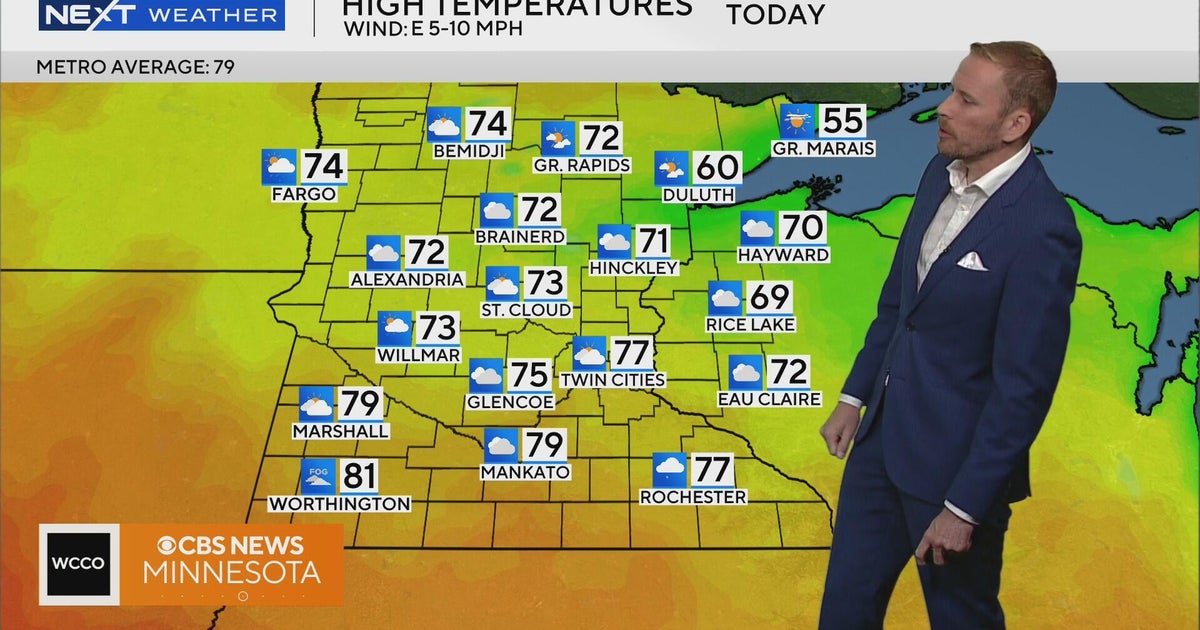

Next Weather Update Minnesota June 15th 2025 6 Am

Jun 16, 2025

Next Weather Update Minnesota June 15th 2025 6 Am

Jun 16, 2025 -

Katherine Legges Nascar Campaign Receives Boost From E L F

Jun 16, 2025

Katherine Legges Nascar Campaign Receives Boost From E L F

Jun 16, 2025 -

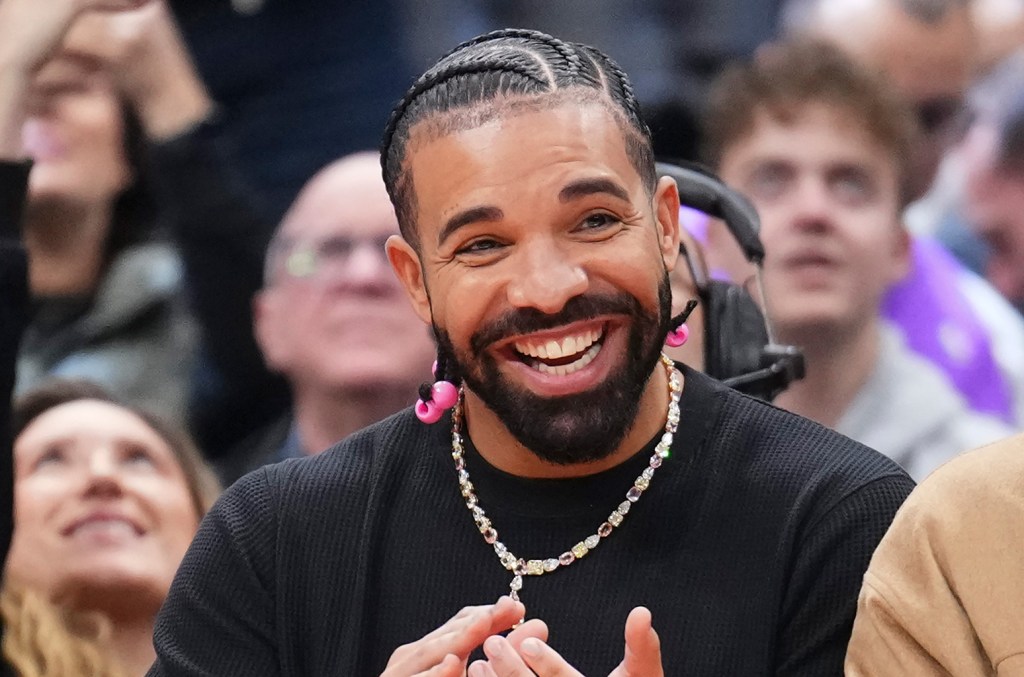

Live Stream Recap Drakes Cash Giveaway Featuring Kai Cenat At Kendrick Lamars Toronto Performance

Jun 16, 2025

Live Stream Recap Drakes Cash Giveaway Featuring Kai Cenat At Kendrick Lamars Toronto Performance

Jun 16, 2025 -

Chris Gotterup Ou Shoots 69 Secures Top 11 Spot Heading Into Us Open Final Round

Jun 16, 2025

Chris Gotterup Ou Shoots 69 Secures Top 11 Spot Heading Into Us Open Final Round

Jun 16, 2025 -

Knicks Coaching Search Updates On Interviews With Brown And Jenkins

Jun 16, 2025

Knicks Coaching Search Updates On Interviews With Brown And Jenkins

Jun 16, 2025