Analyzing Sunnova's Bankruptcy: What It Means For Solar Investments

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Analyzing Sunnova's (Non-Existent) Bankruptcy: What it Means for Solar Investments

A Clarification: Sunnova Energy International Inc. (SUNE) has not filed for bankruptcy. This article addresses the rumors and anxieties surrounding potential bankruptcy in the solar energy sector, using Sunnova as a case study to explore the broader implications for solar investments. Recent market volatility and concerns about the broader economy have led to speculation about the financial health of several solar companies. This analysis aims to separate fact from fiction and provide clarity for investors.

While Sunnova hasn't declared bankruptcy, the recent anxieties surrounding the company highlight crucial considerations for anyone contemplating solar investments. The solar industry, while experiencing significant growth, is not immune to economic headwinds. Understanding these risks is paramount before investing.

Understanding the Concerns:

Several factors have contributed to the recent anxieties surrounding Sunnova and the solar industry as a whole:

- Rising Interest Rates: Higher interest rates increase the cost of borrowing, making it more expensive for solar companies to finance projects and expand operations. This can impact profitability and potentially strain cash flow.

- Supply Chain Disruptions: The global supply chain continues to experience disruptions, affecting the availability and cost of crucial solar components. This can lead to project delays and increased expenses.

- Inflationary Pressures: Increased costs for materials, labor, and transportation can squeeze profit margins for solar companies.

- Competition: The solar industry is becoming increasingly competitive, with numerous players vying for market share. This can lead to price wars and reduced profitability.

What Sunnova's (Hypothetical) Bankruptcy Would Mean:

Let's hypothetically examine what a Sunnova bankruptcy would entail for investors and the broader solar sector:

- Investor Losses: Stockholders would likely experience significant losses, potentially losing their entire investment. Bondholders would also face potential losses.

- Project Delays & Cancellations: Ongoing projects could be delayed or cancelled, impacting customers and potentially creating legal complexities.

- Impact on the Solar Industry: A major bankruptcy could negatively impact investor confidence in the entire solar industry, potentially leading to decreased investment and slower growth.

- Job Losses: A bankruptcy would likely result in job losses within Sunnova and potentially ripple through the broader supply chain.

Mitigating Risks in Solar Investments:

Despite the potential risks, the long-term outlook for the solar industry remains positive. However, investors should take steps to mitigate risks:

- Diversify Your Portfolio: Don't put all your eggs in one basket. Diversify your investments across different sectors and asset classes.

- Due Diligence: Thoroughly research any solar company before investing. Examine their financial statements, management team, and business model.

- Understand the Risks: Be aware of the potential risks associated with solar investments, including those mentioned above.

- Consider Established Players: Invest in established companies with a strong track record and financial stability.

The Future of Solar Investment:

Despite the recent anxieties, the long-term prospects for the solar energy sector remain bright. Government incentives, increasing demand for clean energy, and technological advancements continue to drive growth. Careful due diligence and a diversified investment strategy are crucial for navigating the inherent risks and maximizing returns in this dynamic industry.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Consult with a qualified financial advisor before making any investment decisions. Always conduct your own thorough research before investing in any company.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Analyzing Sunnova's Bankruptcy: What It Means For Solar Investments. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Controversy Erupts Trumps Washington Parade And The Rise Of No Kings Demonstrations

Jun 17, 2025

Controversy Erupts Trumps Washington Parade And The Rise Of No Kings Demonstrations

Jun 17, 2025 -

Knicks To Meet With Brown And Jenkins What To Expect

Jun 17, 2025

Knicks To Meet With Brown And Jenkins What To Expect

Jun 17, 2025 -

Boca Juniors X Benfica 16 06 Provaveis Escalacoes E Ausencias

Jun 17, 2025

Boca Juniors X Benfica 16 06 Provaveis Escalacoes E Ausencias

Jun 17, 2025 -

Gallardo Estamos Ansiosos Por Jugar River Plate Se Prepara Para El Proximo Partido

Jun 17, 2025

Gallardo Estamos Ansiosos Por Jugar River Plate Se Prepara Para El Proximo Partido

Jun 17, 2025 -

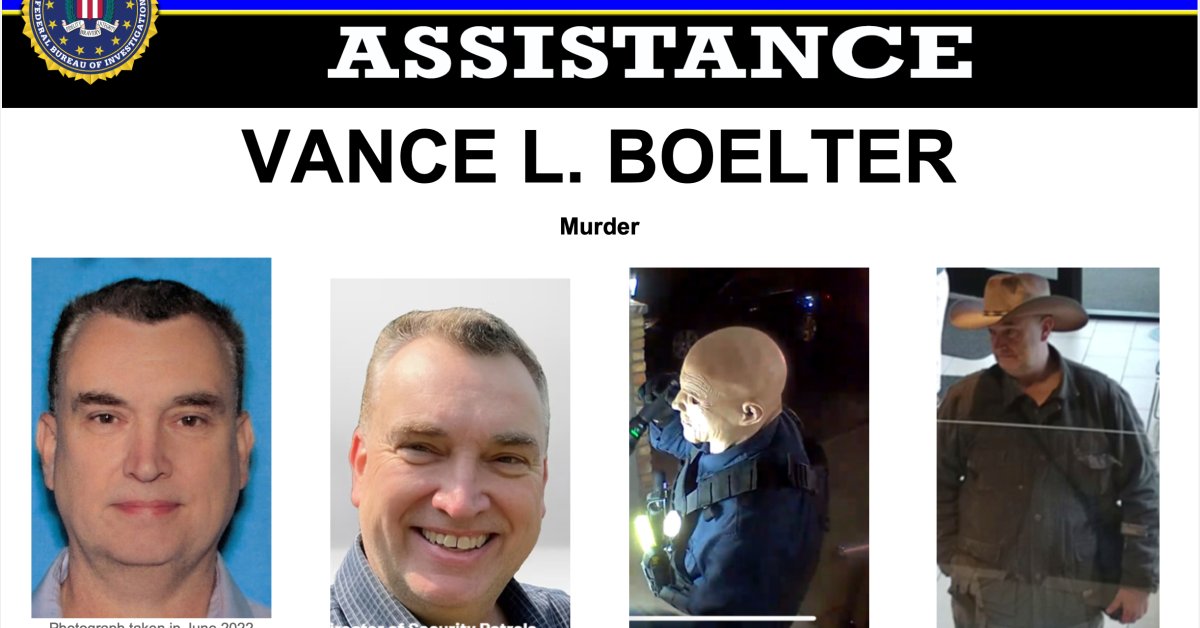

Vance L Boelter And The Minnesota Lawmaker Attack A Comprehensive Overview

Jun 17, 2025

Vance L Boelter And The Minnesota Lawmaker Attack A Comprehensive Overview

Jun 17, 2025