Analyzing Sunnova's Bankruptcy: A Turning Point For Solar Energy?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Analyzing Sunnova's Bankruptcy: A Turning Point for Solar Energy?

Sunnova Energy International Inc.'s recent bankruptcy filing sent shockwaves through the solar energy industry. While the company itself is restructuring, not liquidating, the event raises crucial questions about the broader financial health of the solar sector and its future trajectory. Is this a mere hiccup, or a harbinger of larger challenges to come? Let's delve into the details.

Understanding Sunnova's Situation:

Sunnova, a prominent residential solar installer and energy storage provider, didn't declare bankruptcy due to a lack of demand. Instead, their struggles stem from a complex interplay of factors, including:

- High Debt Levels: Like many companies in the rapidly expanding renewable energy sector, Sunnova took on significant debt to fuel its growth. Rising interest rates made servicing this debt increasingly difficult.

- Supply Chain Disruptions: The global supply chain disruptions impacting various industries also affected Sunnova, leading to project delays and increased costs.

- Inflationary Pressures: The rising cost of materials and labor further squeezed profit margins and exacerbated financial difficulties.

- Interest Rate Hikes: The Federal Reserve's aggressive interest rate hikes significantly increased borrowing costs, making it harder for Sunnova to manage its existing debt.

These issues aren't unique to Sunnova. Many companies in the renewable energy sector face similar headwinds, making the situation a significant concern for industry analysts.

Is this a Systemic Issue or an Isolated Case?

While Sunnova's bankruptcy is a significant event, it's crucial to avoid overgeneralizing. The company's challenges are multifaceted and don't necessarily reflect the overall health of the solar energy market. However, it serves as a stark reminder of the financial risks associated with rapid expansion and reliance on debt financing.

Several other companies in the sector are navigating similar financial pressures. However, strong market demand for renewable energy and government incentives continue to support the overall growth of the industry. The long-term outlook for solar remains positive, despite the current headwinds.

The Future of Residential Solar:

The residential solar market continues to exhibit strong growth, driven by increasing energy prices, government incentives like the Inflation Reduction Act (IRA), and growing consumer awareness of climate change. Sunnova's restructuring, while disruptive, is not expected to significantly alter this trajectory.

What Sunnova's Bankruptcy Teaches Us:

Sunnova's experience underscores the importance of:

- Sustainable Financial Management: Companies need to carefully manage their debt levels and maintain sufficient liquidity to weather economic downturns.

- Resilient Supply Chains: Diversifying supply chains and mitigating risks associated with global disruptions is crucial for long-term success.

- Strategic Planning: A clear strategic plan that anticipates potential challenges and adapts to changing market conditions is essential.

Conclusion:

Sunnova's bankruptcy serves as a cautionary tale but doesn't signal the demise of the solar energy industry. The sector is still poised for substantial growth, driven by strong demand and policy support. However, this event highlights the need for financial prudence and robust risk management within the industry. The long-term outlook for solar remains positive, but the short-term landscape will undoubtedly see increased scrutiny of financial models and risk assessment across the sector. Only time will tell if this serves as a crucial turning point, forcing more sustainable practices across the board. For further insights into the intricacies of solar energy finance, consider exploring resources from reputable financial news outlets and industry publications.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Analyzing Sunnova's Bankruptcy: A Turning Point For Solar Energy?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Exploring The Career Of Michael C Hall Under The Cover

Jun 17, 2025

Exploring The Career Of Michael C Hall Under The Cover

Jun 17, 2025 -

Cancelled Comerica Park Gig Jonas Brothers Move Concert To Smaller Venue

Jun 17, 2025

Cancelled Comerica Park Gig Jonas Brothers Move Concert To Smaller Venue

Jun 17, 2025 -

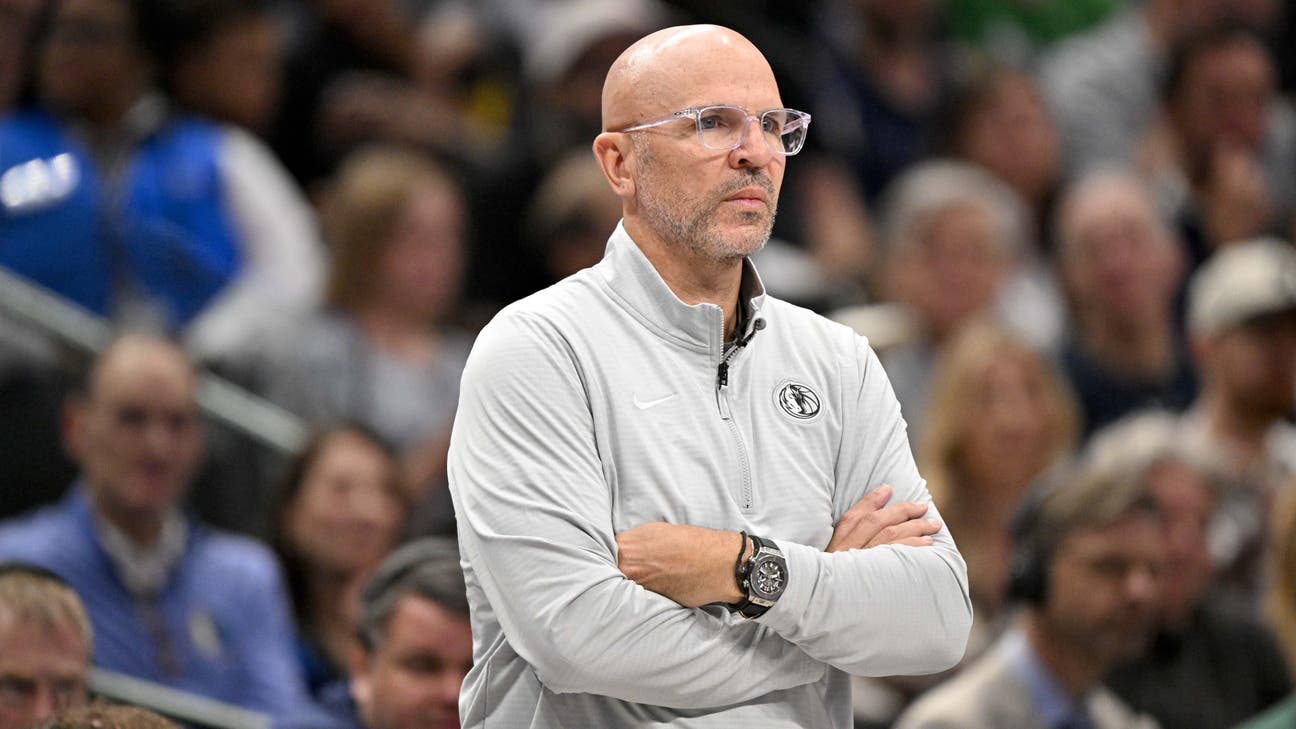

Knicks Coaching Search Notes Interview Process Begins With Taylor Jenkins Kidd In The Mix

Jun 17, 2025

Knicks Coaching Search Notes Interview Process Begins With Taylor Jenkins Kidd In The Mix

Jun 17, 2025 -

Ice Deportations Trumps New Directive Targets Democratic Cities

Jun 17, 2025

Ice Deportations Trumps New Directive Targets Democratic Cities

Jun 17, 2025 -

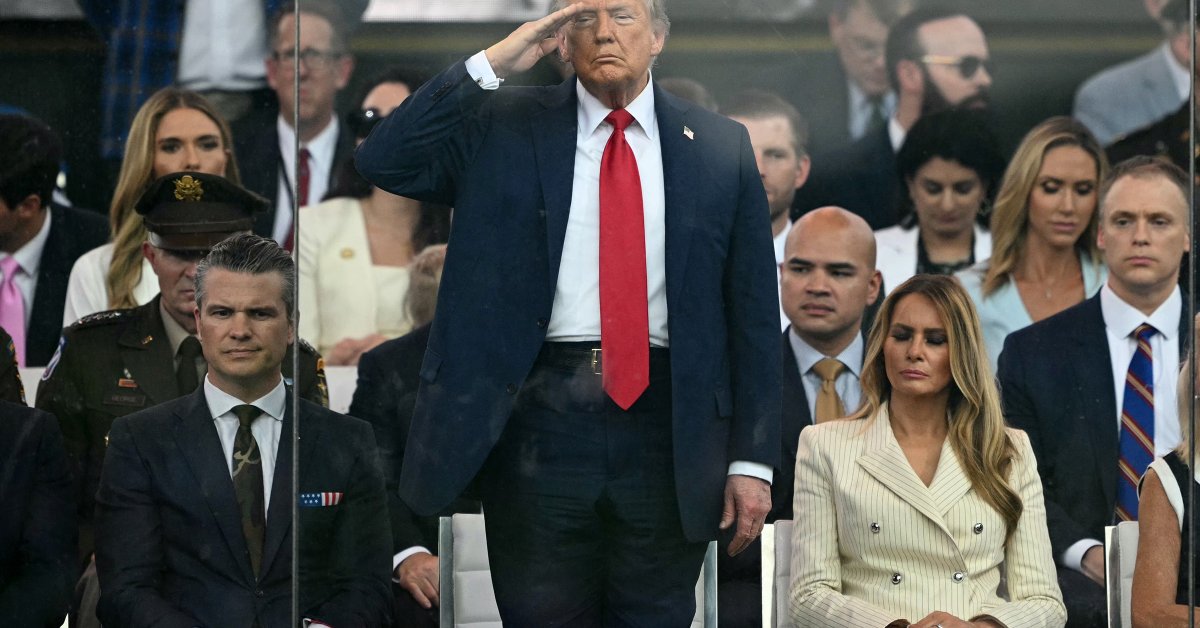

No Kings Uprising Nationwide Protest Erupts Following Trumps Military Parade

Jun 17, 2025

No Kings Uprising Nationwide Protest Erupts Following Trumps Military Parade

Jun 17, 2025