Analyzing NIO's Q1 2024 Performance: Balancing Delivery Success With Tariff Headwinds

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Analyzing NIO's Q1 2024 Performance: Balancing Delivery Success with Tariff Headwinds

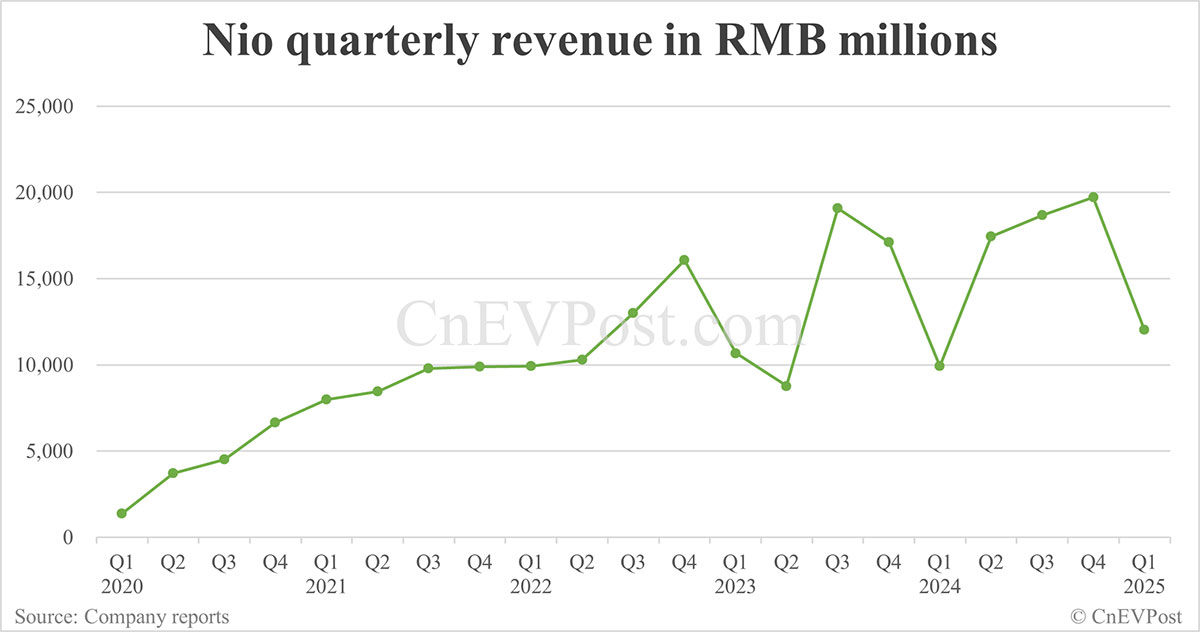

NIO, a leading electric vehicle (EV) manufacturer in China, recently released its Q1 2024 financial results, revealing a complex picture of growth and challenges. While the company celebrated strong vehicle deliveries, headwinds from import tariffs and increased competition cast a shadow on the overall performance. This analysis delves into the key takeaways, examining both the successes and setbacks that shaped NIO's first quarter of the year.

Record Deliveries, Yet Profitability Remains Elusive:

NIO announced record vehicle deliveries for Q1 2024, exceeding market expectations. This surge in sales, driven by the popularity of models like the ET7 and ES7, demonstrates strong consumer demand and the effectiveness of NIO's marketing and sales strategies. However, despite the impressive delivery figures, profitability continues to be a hurdle. The company reported a net loss, highlighting the ongoing pressure to balance growth with cost management. This is a common challenge faced by many EV startups striving for market dominance.

The Impact of Import Tariffs: A Significant Headwind:

One significant factor affecting NIO's profitability is the impact of import tariffs. The company relies on importing certain components and materials, making it vulnerable to fluctuating global trade policies. These tariffs directly increase production costs, squeezing profit margins and impacting the overall financial performance. NIO's management acknowledged this challenge in their earnings call, emphasizing the need for diversification of supply chains and exploration of cost-reduction strategies to mitigate the impact of future tariff increases.

Intense Competition in the EV Market:

The Chinese EV market is increasingly competitive, with both established domestic players and international brands vying for market share. This intense competition puts pressure on pricing and necessitates continuous innovation to maintain a competitive edge. NIO is investing heavily in research and development (R&D) to develop cutting-edge technologies and new models, hoping to stay ahead of the curve and appeal to discerning consumers. However, this significant investment in R&D also contributes to the company's ongoing losses.

Looking Ahead: NIO's Strategy for Future Growth:

NIO’s future success hinges on several key factors. These include:

- Further Expansion of its Charging Network: A robust and reliable charging infrastructure is crucial for EV adoption. NIO’s battery swap technology is a key differentiator, but expanding its network remains a critical element of its growth strategy.

- Continued Innovation in Battery Technology: Improvements in battery technology are essential for enhancing vehicle range and reducing charging times. NIO's commitment to battery innovation is vital to its long-term competitiveness.

- Strategic Partnerships and Supply Chain Diversification: Mitigating the impact of import tariffs requires securing alternative supply sources and forging strategic partnerships to reduce reliance on single suppliers.

- Aggressive Marketing and Brand Building: Maintaining brand awareness and appealing to a wider consumer base is critical in the crowded EV market. Targeted marketing campaigns and effective brand building remain essential.

Conclusion:

NIO's Q1 2024 results present a mixed bag. While record deliveries signify a strong market position and consumer confidence, the challenges of import tariffs and intense competition highlight the complexities of navigating the EV landscape. The company's future performance will depend on its ability to successfully execute its strategic initiatives and navigate the ever-evolving dynamics of the global EV market. Investors will be closely monitoring NIO’s progress in addressing these challenges in the coming quarters. For further information on NIO's financial performance, you can visit their official investor relations website. [Link to NIO Investor Relations]. Stay tuned for further analysis and updates on the EV market.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Analyzing NIO's Q1 2024 Performance: Balancing Delivery Success With Tariff Headwinds. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Caribbean Suffocated By Giant Sahara Dust Cloud Us Next

Jun 03, 2025

Caribbean Suffocated By Giant Sahara Dust Cloud Us Next

Jun 03, 2025 -

Mpsc Town Hall Looms Detroit Lawmaker Calls For Dte Energy Accountability

Jun 03, 2025

Mpsc Town Hall Looms Detroit Lawmaker Calls For Dte Energy Accountability

Jun 03, 2025 -

The Ethics Of Sydney Sweeneys Bath Water Soap Consumer Reactions

Jun 03, 2025

The Ethics Of Sydney Sweeneys Bath Water Soap Consumer Reactions

Jun 03, 2025 -

Detroit Representative To Question Dte Energys Practices At Public Forum

Jun 03, 2025

Detroit Representative To Question Dte Energys Practices At Public Forum

Jun 03, 2025 -

Strong Q1 For Nio Revenue Up 21 Year On Year

Jun 03, 2025

Strong Q1 For Nio Revenue Up 21 Year On Year

Jun 03, 2025