Analyzing NIO's Q1 2024 Financial Results: Delivery Performance And Tariff Effects

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Analyzing NIO's Q1 2024 Financial Results: Delivery Performance and Tariff Effects

NIO, a leading Chinese electric vehicle (EV) manufacturer, recently released its Q1 2024 financial results, revealing a mixed bag of performance indicators. While delivery numbers showed encouraging growth, the impact of tariffs and ongoing market competition presented significant challenges. This analysis delves into the key takeaways from NIO's report, focusing on delivery performance and the effects of tariffs on the company's financial health.

NIO Q1 2024: A Snapshot of Key Performance Indicators

NIO reported a significant increase in vehicle deliveries compared to the same period last year. However, this growth needs to be viewed within the context of a highly competitive EV market in China and globally. The company's financial statements showed [Insert specific numbers from the Q1 2024 report: e.g., a total of X,XXX vehicles delivered, representing a Y% increase year-over-year]. This growth, while positive, fell slightly short of analysts' expectations, sparking discussions about the company's future trajectory.

Delivery Performance: A Closer Look

Several factors contributed to NIO's Q1 2024 delivery performance. These include:

- Increased Production Capacity: NIO's investment in expanding its manufacturing facilities likely played a crucial role in boosting production and, consequently, deliveries.

- New Model Introductions: The launch of new EV models or significant upgrades to existing ones could have attracted new customers and boosted sales. [Mention specific models and their impact if available from the report].

- Supply Chain Improvements: Addressing previous supply chain bottlenecks would have enabled NIO to meet the increased demand.

- Market Competition: The intense competition in the Chinese EV market, with players like BYD, XPeng, and Li Auto, continues to exert pressure on NIO's market share.

The Impact of Tariffs:

The impact of tariffs, particularly those related to imported components or raw materials, significantly affected NIO's profitability in Q1 2024. [Insert specific details from the report about the impact of tariffs on profit margins or operational costs]. The company's management likely discussed strategies to mitigate these tariff effects, possibly through localization of production or sourcing materials domestically.

NIO's Outlook and Future Strategies:

NIO's management commentary on the Q1 2024 results likely offered insights into the company's strategic direction for the remainder of 2024 and beyond. This might include:

- Expansion Plans: Further expansion into international markets or new regions within China.

- Technological Advancements: Investments in research and development for advanced battery technologies, autonomous driving capabilities, and other innovative features.

- Cost-Cutting Measures: Strategies to enhance efficiency and reduce costs in response to the competitive landscape and tariff pressures.

Conclusion: Navigating a Challenging Market

NIO's Q1 2024 results present a complex picture. While increased deliveries demonstrate growth, the impact of tariffs and ongoing market competition pose significant challenges. The company's success in navigating these challenges will depend heavily on its ability to execute its strategic plans effectively, adapt to evolving market dynamics, and maintain its competitive edge in the ever-expanding EV landscape. Investors and industry analysts will be closely watching NIO's performance in the coming quarters to gauge its long-term prospects.

Keywords: NIO, Q1 2024, financial results, electric vehicle, EV, China, delivery performance, tariffs, market competition, supply chain, profitability, stock market, investment, technology, autonomous driving, battery technology.

(Note: This article is a template. You need to replace the bracketed information with the actual data from NIO's Q1 2024 financial report.)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Analyzing NIO's Q1 2024 Financial Results: Delivery Performance And Tariff Effects. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

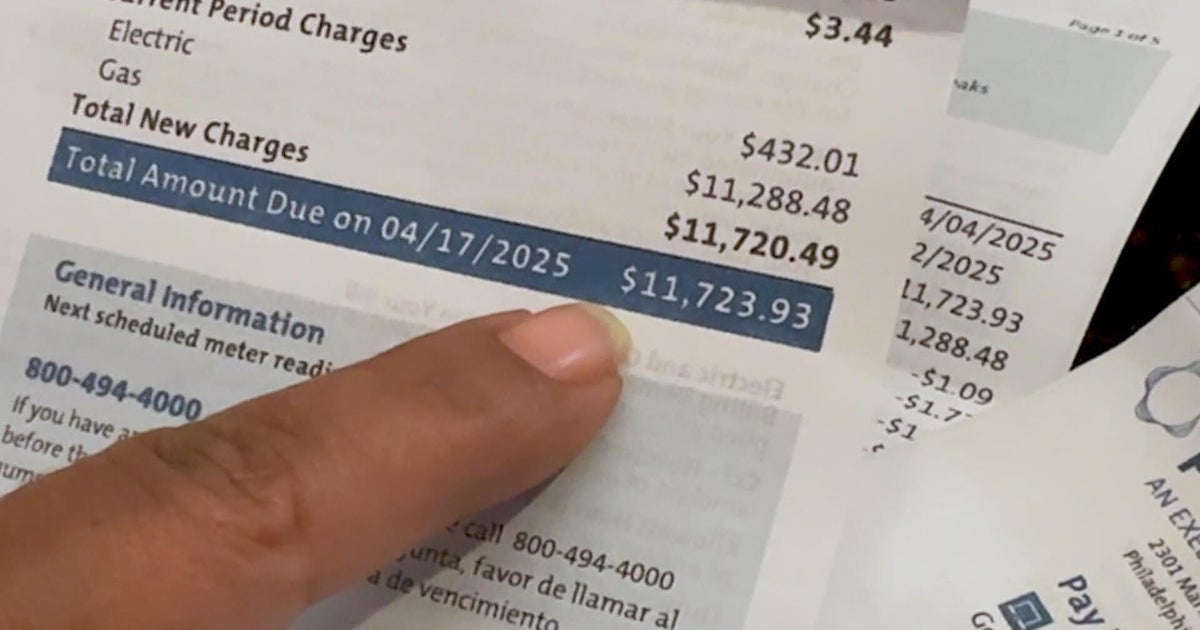

Pecos Billing System Under Fire After Customer Hit With 12 000 Bill

Jun 03, 2025

Pecos Billing System Under Fire After Customer Hit With 12 000 Bill

Jun 03, 2025 -

Pam Bondis Actions Reduce Abas Vetting Power For Trumps Judges

Jun 03, 2025

Pam Bondis Actions Reduce Abas Vetting Power For Trumps Judges

Jun 03, 2025 -

Patti Lu Pone Faces Backlash From 500 Broadway Artists Over Allegations Of Racism

Jun 03, 2025

Patti Lu Pone Faces Backlash From 500 Broadway Artists Over Allegations Of Racism

Jun 03, 2025 -

Analysis Trumps Rationale For Doubling Steel And Aluminum Tariffs Sparks Controversy

Jun 03, 2025

Analysis Trumps Rationale For Doubling Steel And Aluminum Tariffs Sparks Controversy

Jun 03, 2025 -

Donald Trump Publicly Criticizes Scott Walker What Happened

Jun 03, 2025

Donald Trump Publicly Criticizes Scott Walker What Happened

Jun 03, 2025