Analyzing NIO's Q1 2024 Financial Performance: Delivery Growth Vs. Tariff Headwinds

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Analyzing NIO's Q1 2024 Financial Performance: Delivery Growth vs. Tariff Headwinds

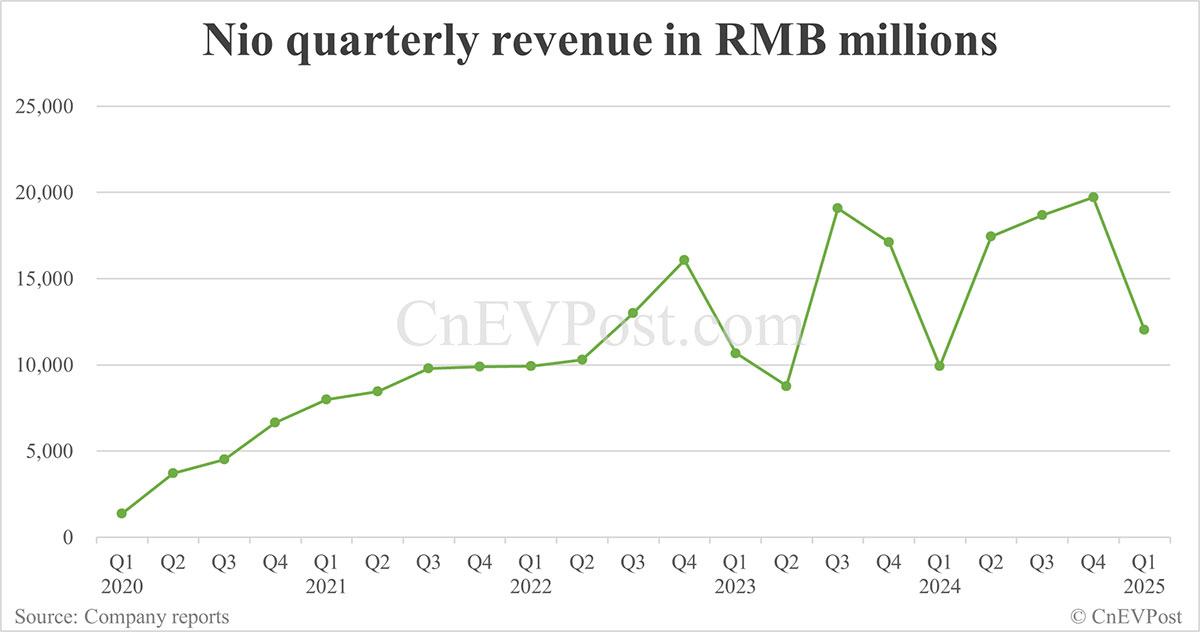

NIO, a leading Chinese electric vehicle (EV) manufacturer, recently released its Q1 2024 financial results, revealing a complex picture of strong delivery growth battling significant headwinds from increased tariffs. While the company showcased impressive vehicle deliveries, the impact of these tariffs on profitability casts a shadow over the overall success. This analysis delves into the key takeaways from NIO's Q1 2024 performance, examining the interplay between delivery growth and the challenges posed by escalating trade barriers.

Record Deliveries, but at What Cost?

NIO reported a substantial increase in vehicle deliveries for Q1 2024, exceeding market expectations. This surge in sales can be attributed to several factors, including the successful launch of new models, aggressive marketing campaigns, and a growing demand for EVs in China and internationally. The company's expanding charging infrastructure and battery swap technology also contribute to its competitive advantage. However, celebrating this success requires a nuanced approach.

- Impressive Delivery Numbers: [Insert specific delivery numbers here, citing the official NIO press release as a source]. This represents a [percentage]% increase compared to Q1 2023.

- New Model Success: Highlight the contribution of specific new models to the delivery surge, mentioning features that resonate with consumers. For example: "The ET7's innovative technology and sleek design played a significant role in driving sales."

- Expanding Market Reach: Briefly touch upon NIO's expansion into new international markets and their impact on overall deliveries.

Tariff Headwinds: A Major Obstacle

Despite the impressive delivery figures, the impact of increased tariffs on imported components significantly impacted NIO's profitability in Q1 2024. These tariffs, coupled with rising raw material costs, squeezed profit margins, leading to a less-than-stellar bottom line. This underscores the challenges faced by EV manufacturers operating in a globally interconnected market susceptible to geopolitical shifts.

- Impact on Profit Margins: Detail the specific impact of tariffs on NIO's profit margins, citing figures from the financial report. For example: "Tariffs contributed to a [percentage]% decrease in gross profit margin compared to the previous quarter."

- Raw Material Price Fluctuations: Discuss the effect of rising prices for essential raw materials, like lithium and cobalt, on NIO's operational costs.

- Supply Chain Disruptions: Mention any potential supply chain disruptions and their contribution to the cost increases.

Looking Ahead: Navigating the Challenges

NIO's Q1 2024 performance presents a mixed bag. While the significant delivery growth is undeniably positive, the negative impact of tariffs and rising costs cannot be ignored. The company will need to implement effective strategies to mitigate these headwinds in the coming quarters. This might involve:

- Supply Chain Diversification: Exploring alternative sourcing strategies to reduce reliance on tariff-affected components.

- Cost Optimization: Implementing measures to streamline production processes and reduce operational expenses.

- Strategic Pricing Adjustments: Carefully adjusting pricing strategies to maintain profitability while remaining competitive.

Conclusion:

NIO's Q1 2024 results highlight the complexities of operating in the dynamic EV market. The company’s ability to navigate the challenges posed by tariffs and maintain its impressive delivery growth will be crucial for its long-term success. Investors and industry analysts will be closely monitoring NIO's strategies to address these headwinds and maintain its competitive edge in the rapidly evolving landscape of the electric vehicle industry. Further analysis of subsequent financial reports will be necessary to fully assess the long-term impact of these factors.

Keywords: NIO, Q1 2024, financial performance, electric vehicle, EV, delivery growth, tariffs, headwinds, profitability, China, supply chain, raw materials, lithium, cobalt, stock market, investor, analysis, market share.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Analyzing NIO's Q1 2024 Financial Performance: Delivery Growth Vs. Tariff Headwinds. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Ballerina Film Len Wiseman Explains Why Its Not A John Wick Spin Off

Jun 04, 2025

Ballerina Film Len Wiseman Explains Why Its Not A John Wick Spin Off

Jun 04, 2025 -

Chinese Ev Maker Nios Q1 Earnings A Deep Dive Into Delivery Numbers And Tariff Effects

Jun 04, 2025

Chinese Ev Maker Nios Q1 Earnings A Deep Dive Into Delivery Numbers And Tariff Effects

Jun 04, 2025 -

Meet Lucy Guo How She Overtook Taylor Swifts Net Worth

Jun 04, 2025

Meet Lucy Guo How She Overtook Taylor Swifts Net Worth

Jun 04, 2025 -

Electric Vehicle Sales Surge Nios Q1 Revenue Jumps 21

Jun 04, 2025

Electric Vehicle Sales Surge Nios Q1 Revenue Jumps 21

Jun 04, 2025 -

Facing Backlash The Gops Defense Of Trumps Big Beautiful Bill Falters

Jun 04, 2025

Facing Backlash The Gops Defense Of Trumps Big Beautiful Bill Falters

Jun 04, 2025