Analyst Upgrade: Wedbush Raises Oklo (OKLO) Price Target To $55, Reiterates Positive Outlook

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Analyst Upgrade Sends Oklo (OKLO) Stock Soaring: Wedbush Predicts $55 Price Target

Oklo, Inc. (OKLO) saw its stock price jump following a significant analyst upgrade from Wedbush Securities. The investment firm raised its price target for the advanced nuclear technology company to $55, reiterating its positive outlook on the company's future prospects. This bullish prediction has ignited investor interest and sent ripples through the renewable energy sector.

The move by Wedbush represents a substantial vote of confidence in Oklo's innovative approach to nuclear energy. The company is pioneering the development of small modular reactors (SMRs), a technology touted for its potential to provide clean, safe, and reliable energy while minimizing waste. This upgrade underscores the growing recognition of Oklo's potential to disrupt the energy market and contribute significantly to a cleaner energy future.

Why the Upgrade? Wedbush Highlights Key Factors

Wedbush's decision to raise its price target wasn't arbitrary. The firm cited several key factors driving its positive assessment of Oklo:

-

Technological Advancement: Wedbush highlighted Oklo's progress in developing its advanced SMR technology. The firm emphasized the company's successful testing and the potential for rapid deployment once regulatory approvals are secured. This technological leadership is a major driver of the increased price target.

-

Strong Regulatory Momentum: The analyst report also noted the increasing regulatory support for advanced nuclear technologies in the United States. A more favorable regulatory environment significantly reduces the hurdles Oklo faces in bringing its SMRs to market, boosting investor confidence.

-

Growing Market Demand: The global demand for clean energy solutions continues to surge. Wedbush believes Oklo is well-positioned to capitalize on this burgeoning market, particularly given the limitations of intermittent renewable sources like solar and wind power. Oklo's SMRs offer a consistent and reliable baseload power option.

-

Potential for Long-Term Growth: The long-term growth potential of the advanced nuclear energy sector is another key factor contributing to Wedbush's bullish outlook. The firm predicts significant market expansion in the coming years, placing Oklo at the forefront of this promising industry.

Oklo's Response and Future Outlook

While Oklo hasn't issued a direct statement responding to the Wedbush upgrade, the stock's positive reaction speaks volumes. The company continues its focus on securing regulatory approvals and moving toward commercial deployment of its SMR technology. This strategic focus, combined with the positive analyst sentiment, paints a picture of significant potential for future growth.

Investing in the Future of Energy: Considerations for Investors

The renewable energy sector, and particularly the advanced nuclear energy segment, remains relatively volatile. While the Wedbush upgrade is undeniably positive, investors should conduct thorough due diligence before making any investment decisions. Understanding the risks associated with investing in a relatively young company in a rapidly evolving sector is crucial.

Further Research: For more in-depth analysis on Oklo and the advanced nuclear energy market, consider exploring resources like the [link to relevant industry publication] and the [link to SEC filings for OKLO].

Disclaimer: This article is for informational purposes only and should not be considered investment advice. Always consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Analyst Upgrade: Wedbush Raises Oklo (OKLO) Price Target To $55, Reiterates Positive Outlook. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Geopolitical Fallout China North Korea And Russias Assessment Of Trumps Golden Dome

May 28, 2025

Geopolitical Fallout China North Korea And Russias Assessment Of Trumps Golden Dome

May 28, 2025 -

Analyst Outlook 24 Predictions On Uber Technologies Growth Trajectory

May 28, 2025

Analyst Outlook 24 Predictions On Uber Technologies Growth Trajectory

May 28, 2025 -

Nathan Fielders Rehearsal Season 2 Finale A Deep Dive Into The Production

May 28, 2025

Nathan Fielders Rehearsal Season 2 Finale A Deep Dive Into The Production

May 28, 2025 -

Unexpected Roland Garros Result Altmaier Stuns Fritz In Round One

May 28, 2025

Unexpected Roland Garros Result Altmaier Stuns Fritz In Round One

May 28, 2025 -

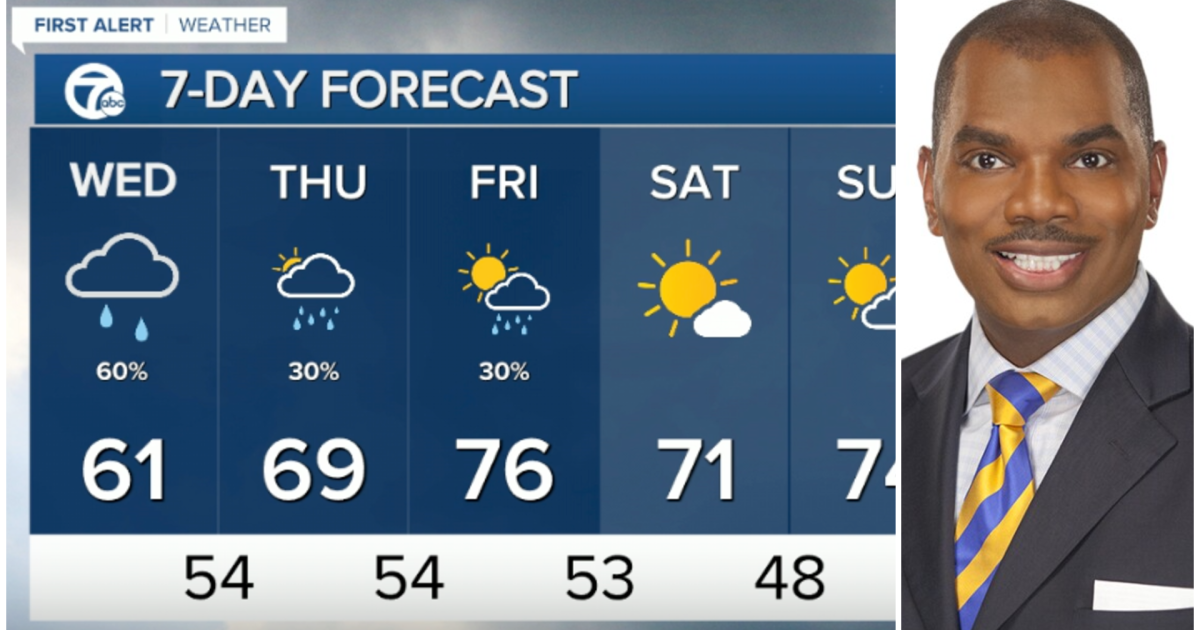

Metro Detroit To See Increased Rain Chances On Wednesday

May 28, 2025

Metro Detroit To See Increased Rain Chances On Wednesday

May 28, 2025