Analyst Downgrade: Wall Street Zen Lowers Rating For CoreWeave (CRWV) Stock

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Analyst Downgrade: Wall Street Zen Lowers Rating for CoreWeave (CRWV) Stock

CoreWeave (CRWV), a leading player in the cloud computing space, experienced a setback today as Wall Street Zen, a prominent financial analysis firm, downgraded its rating for the company's stock. This move sent ripples through the market, prompting investors to reassess their positions in the rapidly growing, but volatile, cloud infrastructure sector. The downgrade highlights growing concerns about CoreWeave's future performance and profitability, offering a cautionary tale for those considering investment in high-growth tech stocks.

The downgrade from Wall Street Zen isn't the first negative assessment CoreWeave has faced recently. While the company boasts impressive technology and a strong client base, including major players in the artificial intelligence (AI) sector, concerns remain about its financial sustainability and its ability to navigate the increasingly competitive landscape.

Wall Street Zen's Rationale: Concerns Over Valuation and Competition

Wall Street Zen cited several key factors in its decision to lower its rating for CRWV stock. These include:

-

High Valuation: The firm believes CoreWeave's current market capitalization is significantly inflated, given its relatively short operating history and ongoing financial losses. This reflects a common concern among analysts regarding the valuation of many high-growth tech companies. Many investors are questioning whether current valuations justify the potential for future growth.

-

Intense Competition: The cloud computing market is incredibly competitive, with established giants like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP) dominating the space. CoreWeave faces an uphill battle to carve out a significant market share against these well-funded behemoths. New entrants also continue to emerge, further intensifying competition.

-

Profitability Concerns: While CoreWeave is experiencing rapid revenue growth, it remains unprofitable. The firm questions whether the company can achieve profitability in the foreseeable future, given its significant operating expenses and the need for continued investment in infrastructure and technology. This is a key factor influencing investor sentiment.

-

Economic Uncertainty: The current macroeconomic environment, characterized by rising interest rates and potential recessionary pressures, adds another layer of complexity to the outlook for CoreWeave and other high-growth tech companies. Investors are becoming increasingly risk-averse in this climate, favoring more established and profitable businesses.

Impact on CRWV Stock Price

Following the Wall Street Zen downgrade, CoreWeave's stock price experienced a noticeable dip. The extent of the decline will depend on several factors, including the overall market sentiment and the reaction of other analysts and investors. This highlights the significant impact analyst ratings can have on stock prices, particularly for companies operating in volatile sectors like cloud computing.

What Does This Mean for Investors?

This downgrade serves as a stark reminder of the risks involved in investing in high-growth tech stocks. While CoreWeave's technology is undeniably innovative and its potential significant, investors should carefully weigh the risks alongside the potential rewards before making any investment decisions. Thorough due diligence, including a review of the company's financials and an assessment of the competitive landscape, is crucial. Consider consulting with a qualified financial advisor before making any investment choices.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Investing in the stock market involves significant risk, and you could lose money. Always conduct your own research and consult with a financial professional before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Analyst Downgrade: Wall Street Zen Lowers Rating For CoreWeave (CRWV) Stock. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Taylor Fritzs Roland Garros Campaign Ends Early Altmaiers Upset Win

May 28, 2025

Taylor Fritzs Roland Garros Campaign Ends Early Altmaiers Upset Win

May 28, 2025 -

Nfl 2025 Bengals Schedule Sets Stage For Deep Playoff Run Cincy Has Been Right There

May 28, 2025

Nfl 2025 Bengals Schedule Sets Stage For Deep Playoff Run Cincy Has Been Right There

May 28, 2025 -

Expect Heat Humidity And Potential Storms In Orlando This Week

May 28, 2025

Expect Heat Humidity And Potential Storms In Orlando This Week

May 28, 2025 -

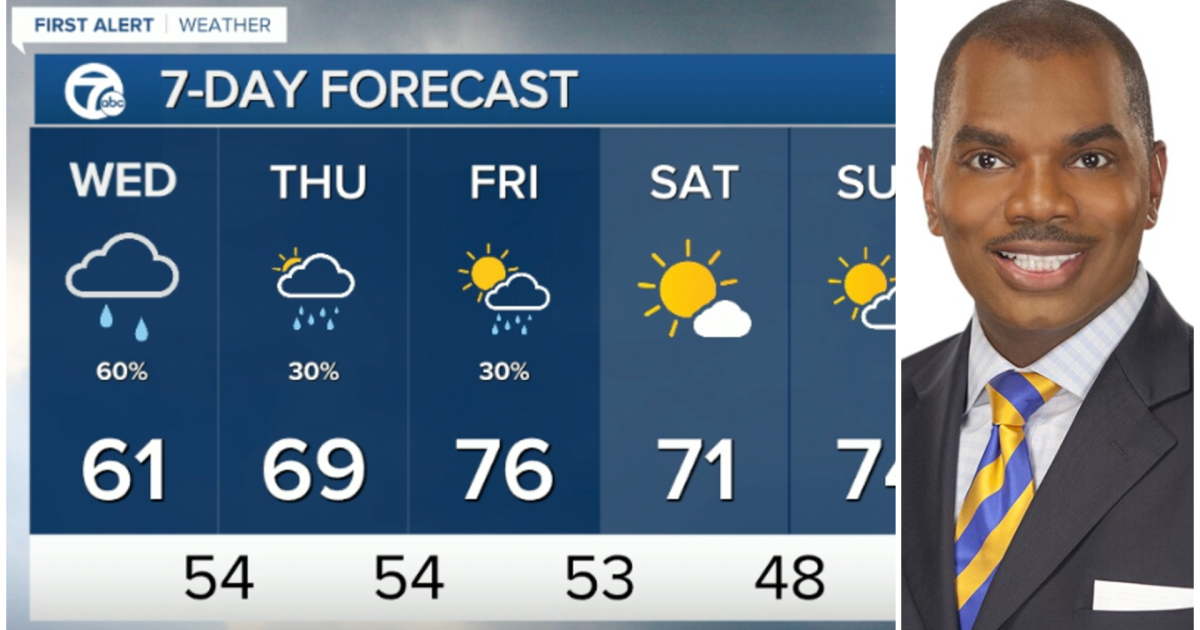

Rain Chances Rise For Metro Detroit On Wednesday

May 28, 2025

Rain Chances Rise For Metro Detroit On Wednesday

May 28, 2025 -

Major Power Outage 165 000 Affected By Overnight Storm

May 28, 2025

Major Power Outage 165 000 Affected By Overnight Storm

May 28, 2025