Analysis: Why Rigetti Computing (RGTI) Stock Dropped After Q1 Results

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Analysis: Why Rigetti Computing (RGTI) Stock Dropped After Q1 Results

Rigetti Computing (RGTI), a leading player in the burgeoning quantum computing industry, saw its stock price take a significant hit following the release of its Q1 2024 earnings report. While the company showcased advancements in its technology, several factors contributed to investor disappointment and the subsequent stock drop. This analysis delves into the key reasons behind the negative market reaction.

Q1 Earnings Miss Expectations: The most immediate cause for the stock decline was Rigetti's failure to meet Wall Street's revenue expectations. While the company reported progress on its technological roadmap, the actual revenue figures fell short of analyst projections, leading to a sell-off by investors who were anticipating stronger financial performance. This highlights the crucial role of meeting market expectations, especially in a sector as volatile as quantum computing, where financial projections often involve high degrees of uncertainty.

Increased Operational Losses: Beyond revenue, Rigetti's Q1 earnings also revealed increased operational losses compared to the same period last year. These losses, while perhaps expected in the early stages of a high-growth technology company, further fueled investor concerns about the company's path to profitability. Investors are increasingly scrutinizing the burn rate of companies in loss-making sectors, pushing for clear timelines towards financial sustainability.

Competition in the Quantum Computing Space: The quantum computing sector is becoming increasingly competitive, with several major players vying for market share. Rigetti faces stiff competition from established tech giants like Google, IBM, and Microsoft, each investing heavily in their own quantum computing initiatives. This intensified competition, coupled with the challenges in translating technological breakthroughs into tangible revenue, adds pressure on Rigetti to demonstrate a clear competitive advantage and faster-than-expected market penetration.

Concerns about the Long-Term Vision: While Rigetti showcased technological progress, some investors expressed concerns about the company's long-term vision and its ability to translate its advanced technology into commercially viable products and services. The quantum computing market is still in its nascent stages, and investors are looking for companies with a well-defined roadmap toward market dominance and demonstrable potential for significant returns on investment. A lack of clarity in this area could contribute to investor uncertainty.

Future Outlook for RGTI Stock: The stock's drop after the Q1 report underscores the challenges facing Rigetti and the broader quantum computing industry. While the technology holds immense promise, translating that promise into financial success requires navigating complex technical, competitive, and market-related hurdles. The future performance of RGTI stock will likely hinge on the company's ability to:

- Meet or exceed revenue expectations in subsequent quarters. Consistent financial performance is crucial to regain investor confidence.

- Demonstrate a clear path to profitability. Reducing operational losses and showcasing a viable business model will be essential.

- Highlight its competitive advantages. Rigetti needs to showcase what sets it apart from other players in the increasingly crowded quantum computing landscape.

- Secure strategic partnerships and funding. Collaborations and additional investment can provide crucial resources and support.

The short-term outlook for Rigetti remains uncertain. However, the long-term prospects of quantum computing are undeniable. Whether Rigetti can successfully navigate the challenges and capitalize on the opportunities within this exciting field remains to be seen. Investors will be closely watching the company's progress in the coming quarters.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you should consult with a financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Analysis: Why Rigetti Computing (RGTI) Stock Dropped After Q1 Results. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

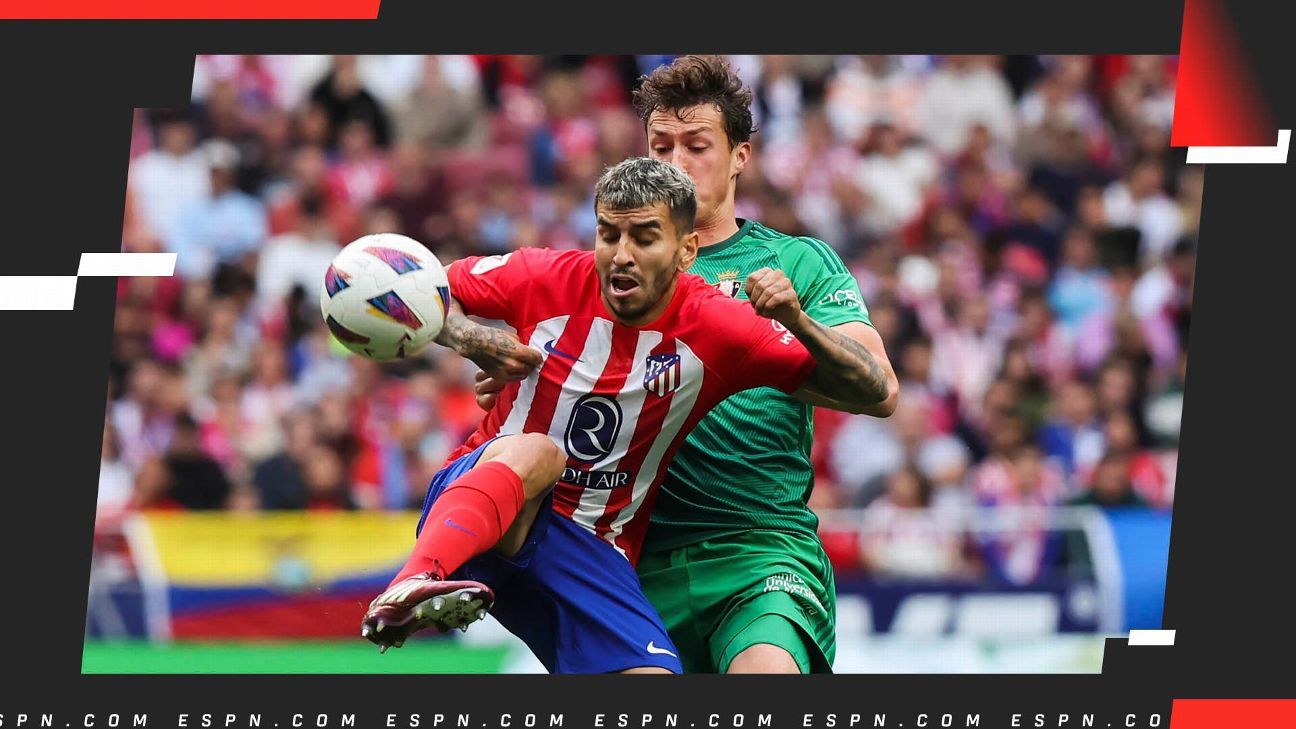

La Liga Atletico De Madrid Busca La Victoria Ante Osasuna

May 15, 2025

La Liga Atletico De Madrid Busca La Victoria Ante Osasuna

May 15, 2025 -

La Lucha Por Europa Inigo Y Sus Perspectivas

May 15, 2025

La Lucha Por Europa Inigo Y Sus Perspectivas

May 15, 2025 -

Beyond The Ballot Assessing The Duterte Dynastys Continued Power In The Philippines

May 15, 2025

Beyond The Ballot Assessing The Duterte Dynastys Continued Power In The Philippines

May 15, 2025 -

Cybersecurity Warning 89 Million Steam Accounts Exposed Take Action Now

May 15, 2025

Cybersecurity Warning 89 Million Steam Accounts Exposed Take Action Now

May 15, 2025 -

Alaves Vs Valencia La Liga Preview Predicted Xi And Key Battlegrounds

May 15, 2025

Alaves Vs Valencia La Liga Preview Predicted Xi And Key Battlegrounds

May 15, 2025