Analysis: Wellington Management's Investment In Robinhood (HOOD) - 15,775 Shares

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Wellington Management Takes a Stake in Robinhood: A Deep Dive into the 15,775 Share Investment

Headline: Wellington Management's Robinhood Investment: What Does it Mean for HOOD Stock?

Introduction: The financial world took notice recently when Wellington Management, a prominent global investment firm, revealed a new position in Robinhood Markets, Inc. (HOOD). This investment, totaling 15,775 shares, sparks questions about the future trajectory of the popular trading app and its stock price. This analysis delves into the implications of Wellington's move, exploring the potential reasons behind the investment and what it might signify for HOOD investors.

Wellington Management: A Heavyweight Enters the Arena

Wellington Management is not your average investor. Known for its long-term, value-oriented investment strategy and managing billions of dollars in assets, their interest in Robinhood carries significant weight. Their decision to acquire even a relatively small number of shares (compared to their overall portfolio) suggests a level of confidence in Robinhood's future prospects, despite the stock's volatility. [Link to Wellington Management's website]

Why the Interest in Robinhood? Potential Factors:

Several factors could explain Wellington Management's decision to invest in HOOD. These include:

- Long-Term Growth Potential: Robinhood, despite recent challenges, remains a dominant player in the retail brokerage space. Its massive user base and potential for expansion into new financial services could appeal to a long-term investor like Wellington.

- Valuation Opportunity: Some analysts believe HOOD's current stock price might undervalue its long-term potential. Wellington may see this as a compelling entry point, anticipating future growth and a subsequent increase in share value.

- Diversification Strategy: The investment could simply be part of Wellington's broader diversification strategy, adding exposure to the fintech sector to its portfolio.

Challenges Facing Robinhood and Potential Risks:

It's crucial to acknowledge the challenges Robinhood faces. These include:

- Increased Competition: The retail brokerage market is fiercely competitive, with established players and new entrants constantly vying for market share.

- Regulatory Scrutiny: The financial industry is subject to significant regulatory oversight, and Robinhood has faced its share of regulatory scrutiny in the past. [Link to a relevant news article about Robinhood's regulatory challenges]

- Market Volatility: The overall market environment can significantly impact Robinhood's performance, especially given its dependence on trading activity.

The Implications for HOOD Investors:

Wellington Management's investment, while not a massive stake, provides a degree of validation for Robinhood. It could potentially boost investor confidence and contribute to a more positive market sentiment surrounding HOOD. However, investors should remain cautious and conduct their own thorough due diligence before making any investment decisions.

Conclusion: A Cautiously Optimistic Outlook

Wellington Management's investment in Robinhood is a noteworthy development. While it doesn't guarantee future success, it suggests a degree of confidence in the company's long-term prospects. The investment highlights the ongoing debate surrounding Robinhood’s future valuation and its ability to navigate the challenges within the competitive fintech landscape. Further analysis and observation of market reactions will be crucial in understanding the long-term implications of this move.

Keywords: Robinhood, HOOD, Wellington Management, investment, stock, shares, fintech, retail brokerage, trading app, market analysis, stock market, financial news, investment strategy, valuation, regulatory scrutiny, competition.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Analysis: Wellington Management's Investment In Robinhood (HOOD) - 15,775 Shares. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

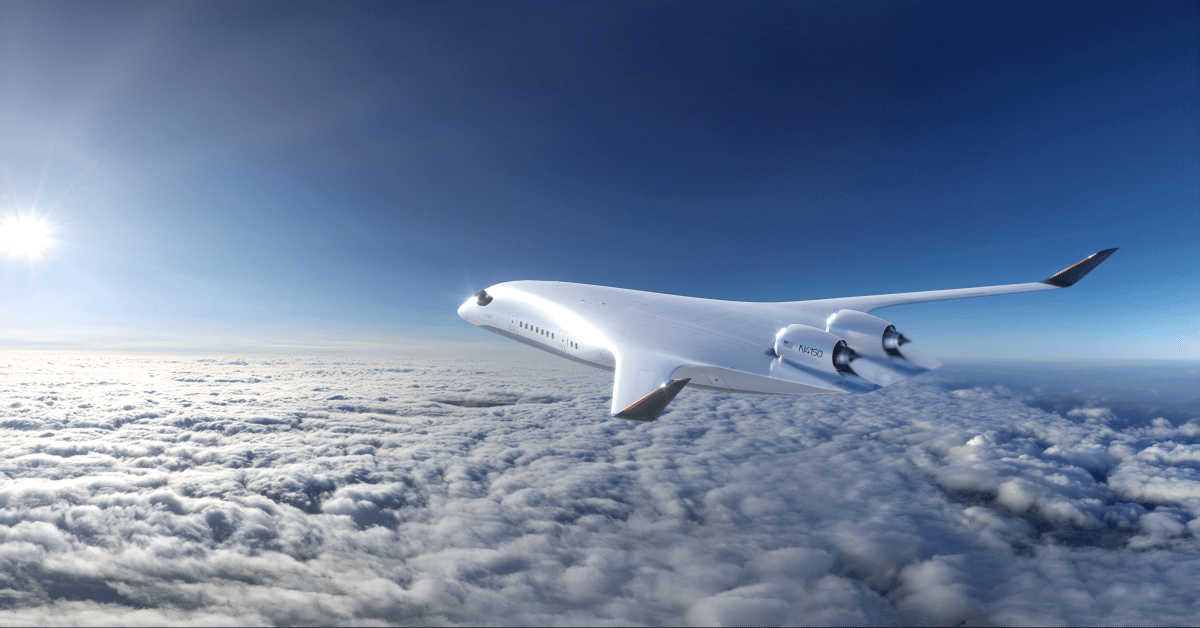

This Companys Game Changing Technology For Low Carbon Air Travel

Jun 14, 2025

This Companys Game Changing Technology For Low Carbon Air Travel

Jun 14, 2025 -

Positive Update Amber Alert Cancelled 4 Year Old And Mother Located

Jun 14, 2025

Positive Update Amber Alert Cancelled 4 Year Old And Mother Located

Jun 14, 2025 -

Robert Mac Intyres Us Open Strategy Harnessing Momentum For A Major Win

Jun 14, 2025

Robert Mac Intyres Us Open Strategy Harnessing Momentum For A Major Win

Jun 14, 2025 -

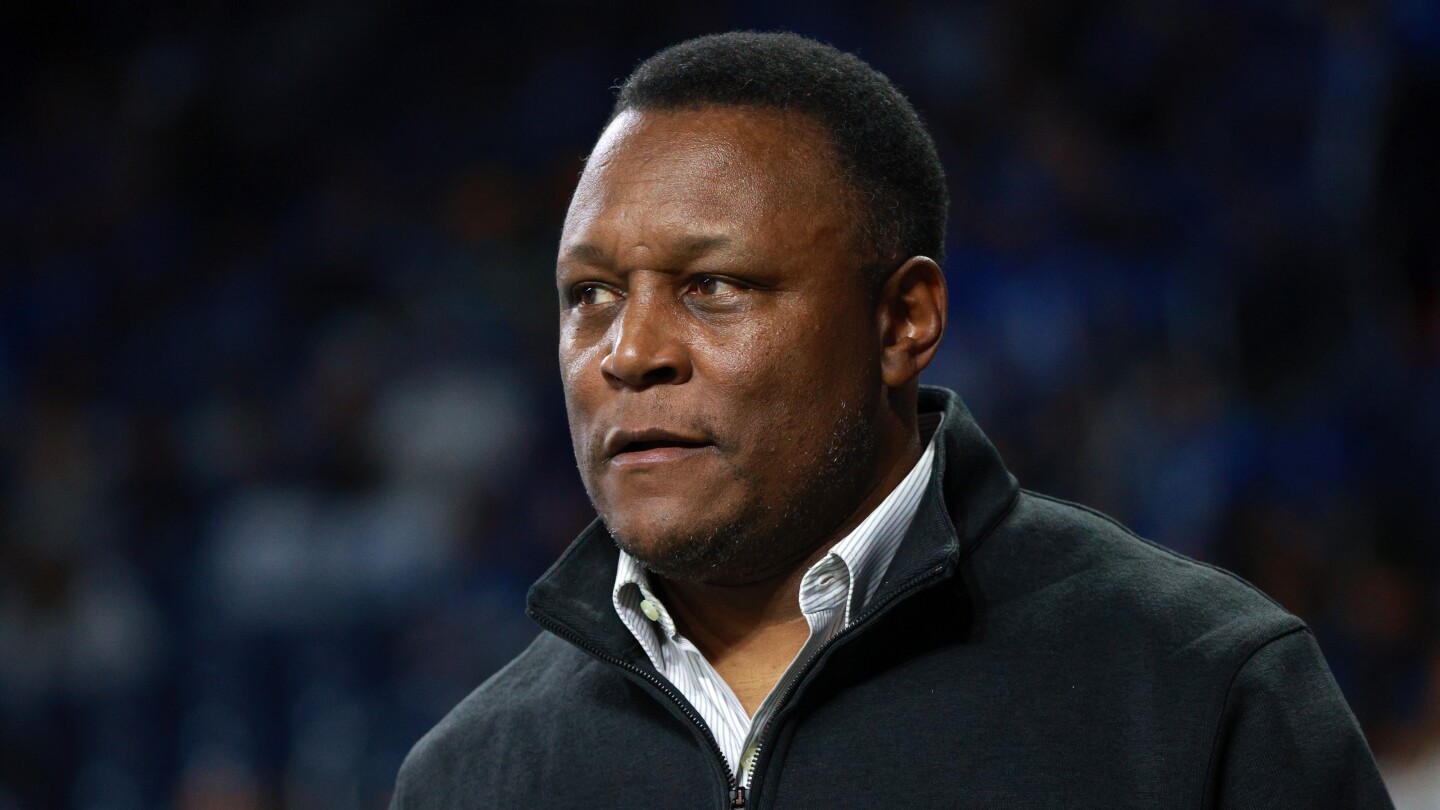

Barry Sanders Shares His Story Overcoming A Heart Attack

Jun 14, 2025

Barry Sanders Shares His Story Overcoming A Heart Attack

Jun 14, 2025 -

65 At The U S Open Sam Burns Masterful Final Putt

Jun 14, 2025

65 At The U S Open Sam Burns Masterful Final Putt

Jun 14, 2025