Analysis: Wellington Management's 15,775 Share Purchase Of Robinhood (NASDAQ:HOOD)

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Wellington Management Bets Big on Robinhood: A Deep Dive into their 15,775 Share Purchase

Headline: Wellington Management's Significant Robinhood Investment: What Does it Mean for HOOD Stock?

Introduction: The investment world took notice when Wellington Management, a behemoth in the asset management industry, revealed a significant purchase of 15,775 shares of Robinhood (NASDAQ:HOOD) stock. This strategic move has sparked considerable speculation about the future trajectory of the popular trading platform. This analysis delves into the implications of Wellington's investment, examining the potential catalysts driving this decision and what it could mean for both Robinhood and its investors.

Why Wellington Management's Investment Matters:

Wellington Management isn't just any investor; it's a renowned firm known for its meticulous research and long-term investment strategy. Their decision to acquire a stake in Robinhood carries significant weight, suggesting a degree of confidence in the company's future prospects. This move could influence other investors, potentially boosting HOOD's stock price and attracting further institutional interest.

Analyzing the Potential Catalysts:

Several factors could have contributed to Wellington Management's decision. These include:

-

Robinhood's Expanding Services: Robinhood has been aggressively expanding its product offerings beyond its initial brokerage services. The introduction of new features like crypto trading, options trading, and wealth management tools positions the company for growth in a competitive market. Wellington might see this diversification as a key driver of future profitability.

-

Growth in the Retail Investing Market: The retail investing boom, fueled in part by Robinhood's user-friendly platform, shows no signs of slowing down. This presents a significant market opportunity for Robinhood, a factor likely considered by Wellington's analysts.

-

Strategic Partnerships and Acquisitions: Robinhood's potential for strategic partnerships and acquisitions could also play a role. By expanding its ecosystem and acquiring complementary businesses, Robinhood can further strengthen its position within the financial technology landscape.

-

Improving Financials: While Robinhood has faced challenges, recent financial reports may have indicated improved performance and a path to profitability. Wellington's investment could reflect confidence in the company's ability to overcome its previous hurdles.

Potential Risks and Challenges:

Despite the positive indicators, several challenges remain for Robinhood. These include:

-

Increased Competition: The brokerage and financial technology sector is fiercely competitive. Robinhood faces competition from established players and emerging fintech startups.

-

Regulatory Scrutiny: The regulatory environment for financial technology companies is constantly evolving, presenting potential challenges and uncertainties for Robinhood.

-

Market Volatility: The broader macroeconomic environment and market volatility can significantly impact Robinhood's performance.

What's Next for Robinhood?

Wellington Management's investment adds another layer of intrigue to Robinhood's ongoing narrative. While the future remains uncertain, the firm's confidence in Robinhood suggests a potentially positive outlook. Continued innovation, strategic partnerships, and a focus on profitability will be crucial for the company's sustained growth. Investors will be closely watching Robinhood's upcoming financial reports and strategic announcements for further insights.

Conclusion:

Wellington Management's 15,775 share purchase of Robinhood signifies a vote of confidence in the company's potential. While challenges remain, the combination of strategic diversification, growth in the retail investing market, and potential improvements in financial performance positions Robinhood for future growth. However, investors should remain aware of the inherent risks associated with investing in the volatile financial technology sector. Further analysis and monitoring of Robinhood's progress will be crucial in determining the long-term impact of this significant investment.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money. Always conduct thorough research and consult with a financial advisor before making investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Analysis: Wellington Management's 15,775 Share Purchase Of Robinhood (NASDAQ:HOOD). We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Scottish Golf Course Tests Robert Mac Intyres Iron Game

Jun 14, 2025

Scottish Golf Course Tests Robert Mac Intyres Iron Game

Jun 14, 2025 -

Sam Burns Climbs U S Open Leaderboard With Record Breaking Round At Oakmont 2025

Jun 14, 2025

Sam Burns Climbs U S Open Leaderboard With Record Breaking Round At Oakmont 2025

Jun 14, 2025 -

Nfl Great Barry Sanders Opens Up About Near Fatal Heart Attack

Jun 14, 2025

Nfl Great Barry Sanders Opens Up About Near Fatal Heart Attack

Jun 14, 2025 -

Historic Night Mc Cutchen Climbs Past Clemente In Pirates Hr Rankings

Jun 14, 2025

Historic Night Mc Cutchen Climbs Past Clemente In Pirates Hr Rankings

Jun 14, 2025 -

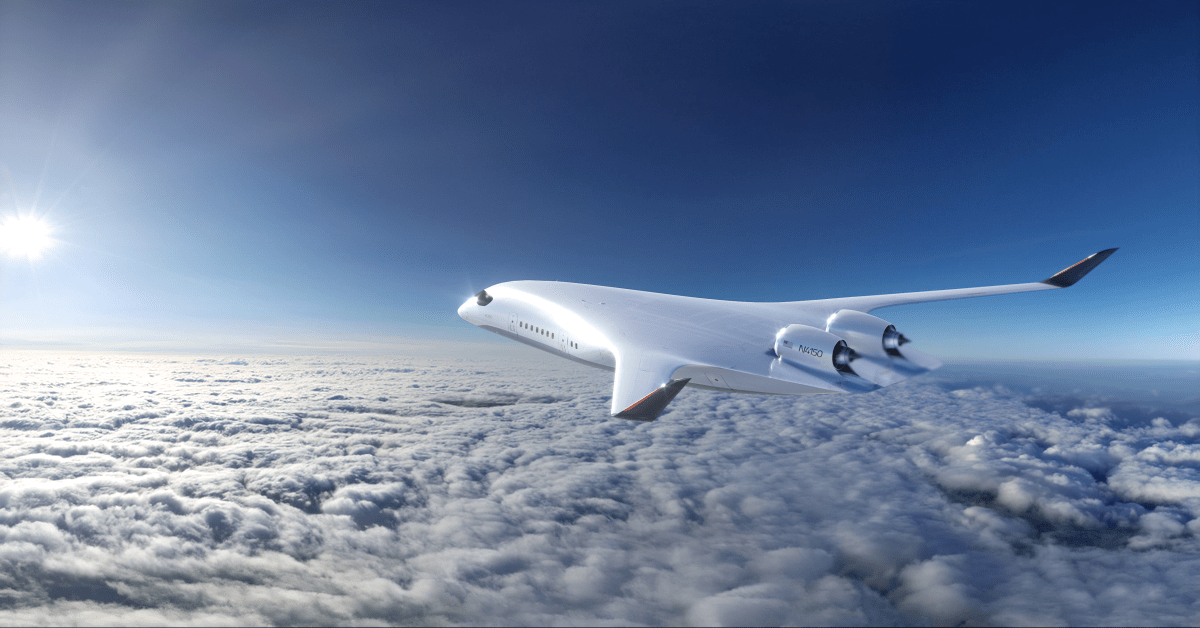

Sustainable Skies A Look At This Companys Impact On Low Carbon Air Travel

Jun 14, 2025

Sustainable Skies A Look At This Companys Impact On Low Carbon Air Travel

Jun 14, 2025