Analysis: Wall Street Zen's Lowered Rating Impacts CoreWeave (CRWV) Stock

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Analysis: Wall Street Zen's Downgrade Shakes CoreWeave (CRWV) Stock

CoreWeave (CRWV), a prominent player in the rapidly expanding cloud computing market specializing in AI infrastructure, experienced a significant stock price dip following a lowered rating from Wall Street Zen. This unexpected downgrade sent ripples through the investment community, prompting analysts and investors alike to re-evaluate their positions on the company. Understanding the implications of this rating change is crucial for anyone invested in or considering investing in CRWV.

Wall Street Zen's Rationale: A Deeper Dive

Wall Street Zen, a reputable investment research platform known for its in-depth analysis, recently downgraded CoreWeave's stock, citing concerns about several key factors. While the specific details of their analysis remain behind a paywall for subscribers, preliminary reports suggest that their concerns center around:

-

Increased Competition: The cloud computing sector is fiercely competitive, with established giants like AWS, Google Cloud, and Azure constantly innovating. Wall Street Zen's downgrade likely reflects concerns about CoreWeave's ability to maintain its market share in the face of this intense pressure. This increased competition is a significant factor affecting not just CRWV, but the entire cloud computing industry.

-

Valuation Concerns: The initial public offering (IPO) of CRWV resulted in a high valuation, and Wall Street Zen's analysis may suggest that this valuation is currently inflated relative to the company's current performance and future growth projections. This is a common concern following successful IPOs, as investor expectations are often high.

-

Profitability: Achieving profitability in the cloud computing sector requires significant scale and efficient operations. Wall Street Zen's downgrade may indicate concerns about CoreWeave's path to profitability, particularly given the intense competition and high capital expenditures needed to maintain infrastructure. Investors are keenly focused on a company's ability to demonstrate sustainable profits.

Market Reaction and Investor Sentiment

The market reacted swiftly to Wall Street Zen's downgrade, with CRWV stock experiencing a noticeable decline. Investor sentiment has shifted, with some expressing concerns about the company's long-term prospects. However, it's important to note that not all analysts share the same pessimistic outlook. Several other firms maintain a positive outlook on CoreWeave, highlighting its strong technological foundation and potential for future growth in the burgeoning AI market.

What This Means for Investors

The lowered rating from Wall Street Zen serves as a stark reminder of the inherent risks involved in investing in the technology sector. While CoreWeave operates in a high-growth market, navigating intense competition and achieving sustainable profitability remains a significant challenge.

Investors should carefully consider the following:

- Diversification: A well-diversified portfolio can help mitigate the impact of individual stock performance fluctuations.

- Due Diligence: Thoroughly research any investment before committing your capital. Read analyst reports from multiple sources to gain a balanced perspective.

- Long-Term Perspective: Investing in the technology sector often requires a long-term perspective, as companies can experience periods of volatility before achieving sustainable growth.

The Future of CRWV: A Cautious Outlook?

While Wall Street Zen's downgrade raises valid concerns, it doesn't necessarily signal the end for CoreWeave. The company's innovative technology and position in the rapidly growing AI infrastructure market still hold significant potential. However, investors should approach CRWV with a degree of caution, closely monitoring the company's performance and paying attention to future analyst reports and market developments. The coming months will be crucial in determining whether CoreWeave can address the concerns raised by Wall Street Zen and regain investor confidence. Further analysis and updates are needed to fully assess the long-term impact of this downgrade.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Analysis: Wall Street Zen's Lowered Rating Impacts CoreWeave (CRWV) Stock. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

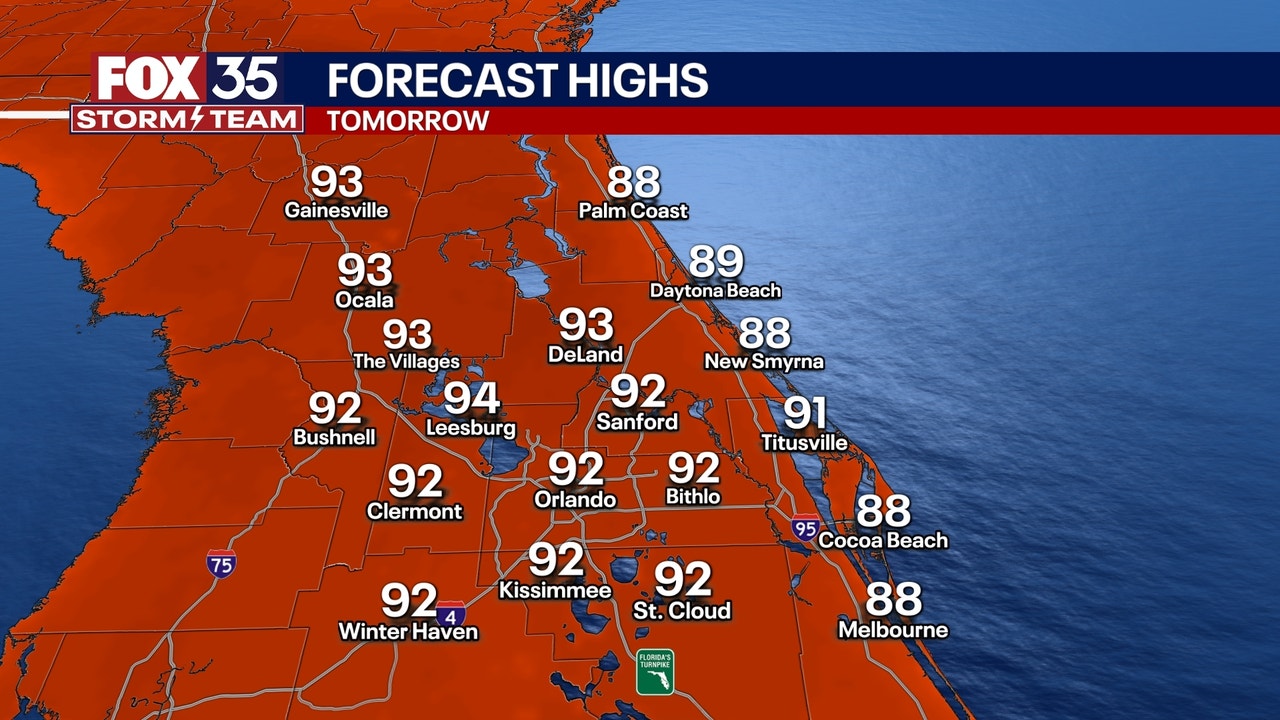

Orlando Facing Increased Heat And Humidity Storms Possible Midweek

May 28, 2025

Orlando Facing Increased Heat And Humidity Storms Possible Midweek

May 28, 2025 -

Investors Respond To Lincoln Financials Tender Offer With 812 Million In Securities

May 28, 2025

Investors Respond To Lincoln Financials Tender Offer With 812 Million In Securities

May 28, 2025 -

Orlando Weather Sizzling Heat And Humidity Storms Possible Midweek

May 28, 2025

Orlando Weather Sizzling Heat And Humidity Storms Possible Midweek

May 28, 2025 -

Investing In Ai 3 Stocks To Watch For Palantir Level Growth

May 28, 2025

Investing In Ai 3 Stocks To Watch For Palantir Level Growth

May 28, 2025 -

Taylor Fritz Falls In Roland Garros First Round Altmaier Secures Upset Win

May 28, 2025

Taylor Fritz Falls In Roland Garros First Round Altmaier Secures Upset Win

May 28, 2025