Analysis Of Wellington Management's Investment In Robinhood (NASDAQ:HOOD)

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Wellington Management Doubles Down on Robinhood: A Deep Dive into the Investment

Wellington Management, a prominent global investment firm, recently increased its stake in Robinhood Markets, Inc. (NASDAQ:HOOD), sparking renewed interest in the volatile yet potentially lucrative fintech company. This move signifies a vote of confidence in Robinhood's long-term prospects, despite ongoing challenges and market uncertainty. But what does this investment truly mean for Robinhood and its investors? Let's delve into the details.

Wellington's Growing Confidence in Robinhood's Future

Wellington Management's increased investment in Robinhood isn't a fleeting decision. It represents a calculated strategy based on a likely positive outlook for the company's future performance. The firm, known for its long-term investment approach and rigorous due diligence, clearly sees potential for significant growth within Robinhood's business model. This strategic move follows a period of market volatility for HOOD, suggesting Wellington believes the current market price undervalues the company's intrinsic worth.

Analyzing the Investment: Key Factors to Consider

Several factors likely contributed to Wellington's decision:

-

Robinhood's Expanding Services: Beyond its initial commission-free trading platform, Robinhood has aggressively expanded its offerings. This includes options trading, cryptocurrency trading, and more recently, a push into wealth management services. This diversification strategy aims to attract a wider customer base and generate more revenue streams, mitigating reliance on single-product performance.

-

Growth Potential in the Fintech Sector: The fintech sector remains a rapidly evolving and highly competitive landscape. However, Robinhood's early-mover advantage and established brand recognition provide a strong foundation for continued growth, particularly as younger generations increasingly adopt digital financial tools. This burgeoning sector presents significant opportunities for long-term investment growth.

-

Strategic Management Changes: Robinhood has undertaken significant management and operational changes in recent times, aiming to improve efficiency and profitability. These changes might have played a role in reassuring Wellington Management about the company's long-term viability and management competency.

-

Market Sentiment and Valuation: While Robinhood's stock price has fluctuated considerably, Wellington's investment suggests a belief that the current market sentiment underestimates the company's long-term value. This implies a potential for significant upside as the market re-evaluates Robinhood's prospects.

Challenges Remain for Robinhood

Despite the positive outlook, Robinhood faces considerable challenges:

-

Increased Competition: The brokerage industry is increasingly competitive, with established players and new entrants constantly vying for market share. Maintaining a competitive edge requires continuous innovation and adaptation.

-

Regulatory Scrutiny: Fintech companies are subject to significant regulatory scrutiny. Navigating this complex regulatory landscape effectively is crucial for long-term success.

-

Profitability Concerns: Robinhood has yet to consistently achieve profitability. Demonstrating sustainable profitability is vital to build investor confidence and drive long-term growth.

Conclusion: A Cautiously Optimistic Outlook

Wellington Management's increased stake in Robinhood signals a degree of confidence in the company's long-term potential. While significant challenges remain, Robinhood's expansion into new services, strategic management changes, and the overall growth potential of the fintech sector create a cautiously optimistic outlook for investors. However, potential investors should conduct thorough due diligence and consider the inherent risks associated with investing in a volatile growth stock before making any investment decisions. This analysis is for informational purposes only and does not constitute financial advice. Always consult with a qualified financial advisor before making any investment choices.

Keywords: Robinhood, HOOD, NASDAQ:HOOD, Wellington Management, Fintech, Investment, Stock Market, Brokerage, Cryptocurrency, Options Trading, Wealth Management, Stock Analysis, Market Volatility, Regulatory Scrutiny, Investment Strategy, Long-Term Investment.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Analysis Of Wellington Management's Investment In Robinhood (NASDAQ:HOOD). We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Ex 49er Deebo Samuels Viral Video George Kittles Strong Defense

Jun 14, 2025

Ex 49er Deebo Samuels Viral Video George Kittles Strong Defense

Jun 14, 2025 -

La Protests And Curfew Night Two Brings More Confrontations

Jun 14, 2025

La Protests And Curfew Night Two Brings More Confrontations

Jun 14, 2025 -

Viral Video Sparks Debate Kittles Defense Of Deebo Samuel

Jun 14, 2025

Viral Video Sparks Debate Kittles Defense Of Deebo Samuel

Jun 14, 2025 -

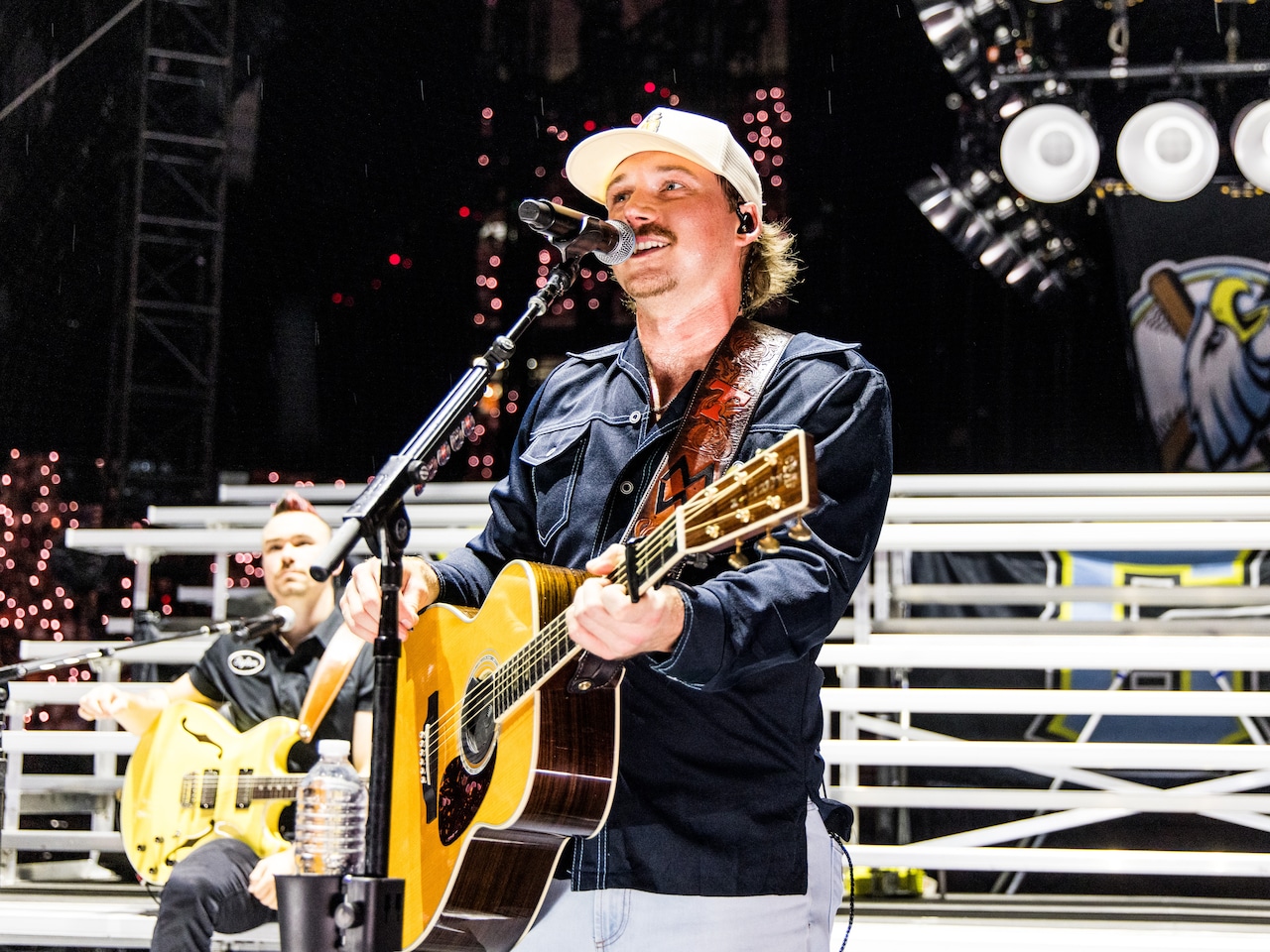

I M The Problem Tour Cheap Morgan Wallen Tickets In Houston June 20 And 21

Jun 14, 2025

I M The Problem Tour Cheap Morgan Wallen Tickets In Houston June 20 And 21

Jun 14, 2025 -

Nfl Legend Barry Sanders Opens Up About His Heart Attack In New Documentary

Jun 14, 2025

Nfl Legend Barry Sanders Opens Up About His Heart Attack In New Documentary

Jun 14, 2025