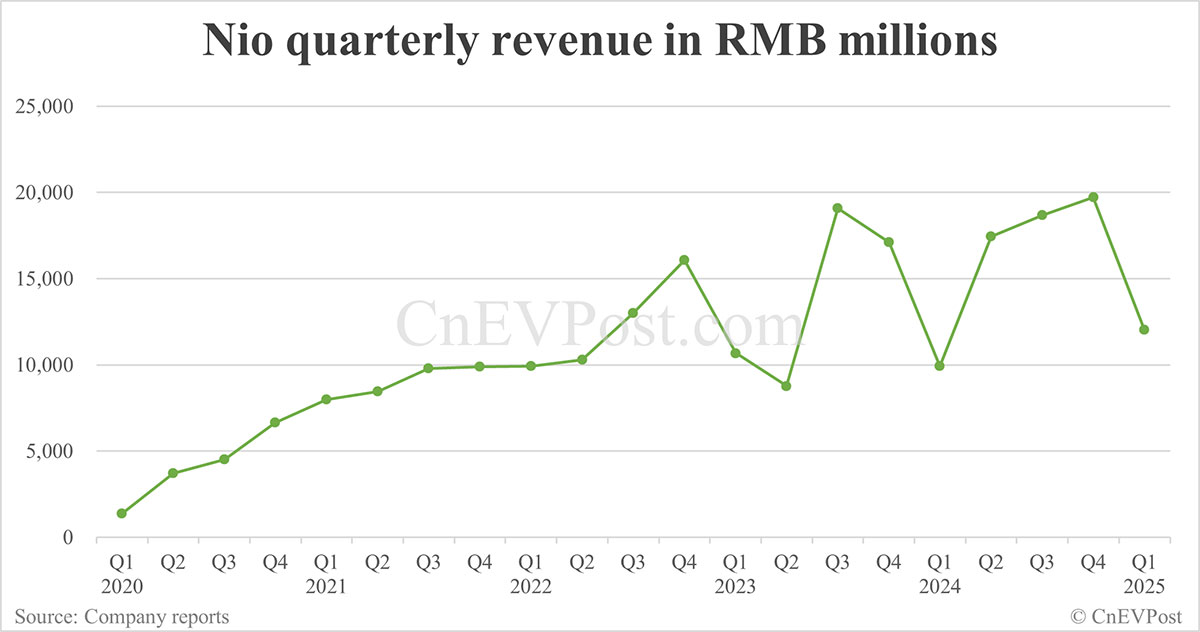

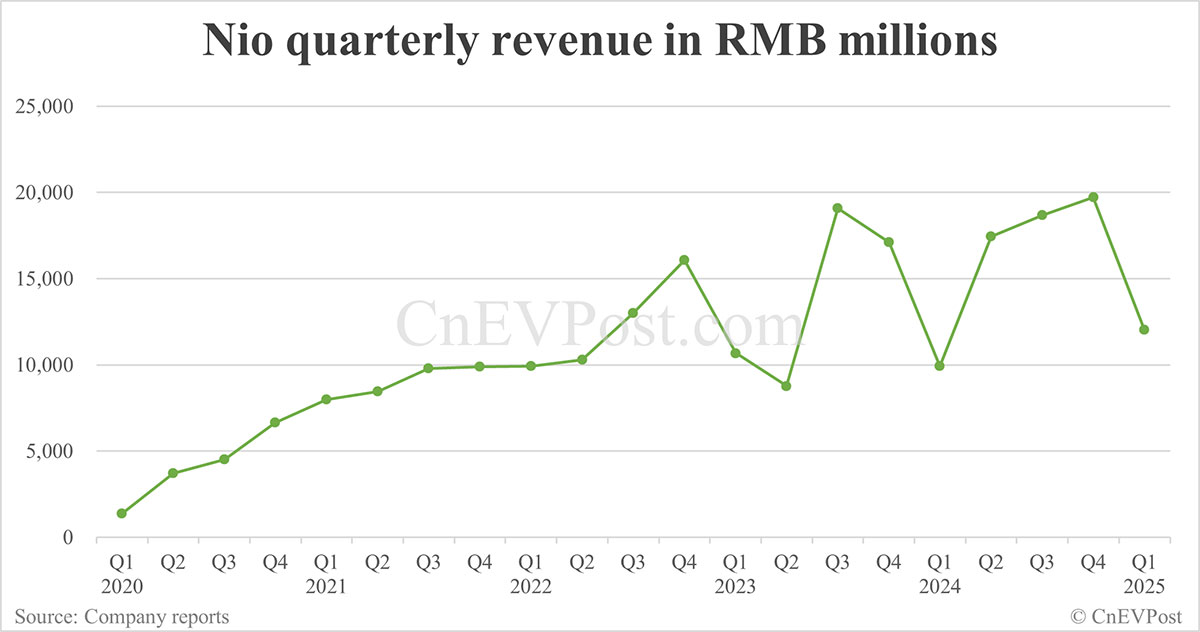

Analysis Of Nio's 21% Year-on-Year Revenue Growth In Q1 2024

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Nio's Electrifying Q1 2024: 21% Revenue Growth Analyzed

Nio, a leading Chinese electric vehicle (EV) manufacturer, reported a robust 21% year-on-year revenue growth in Q1 2024, defying some market predictions and cementing its position in the competitive EV landscape. This impressive performance, however, presents a complex picture requiring deeper analysis beyond the headline figures. Let's delve into the key factors driving this growth and the potential challenges ahead.

Key Drivers of Nio's Q1 2024 Revenue Surge:

-

Increased Vehicle Deliveries: Nio's Q1 2024 saw a significant increase in vehicle deliveries compared to the same period in 2023. This surge is largely attributed to the successful launch of new models and improved production efficiency. The company's focus on expanding its charging infrastructure and battery swap technology also played a crucial role in attracting new customers.

-

Strong Demand for New Models: The introduction of new models, particularly the ET7 and ET5, significantly boosted sales. These vehicles, praised for their advanced technology and stylish design, have resonated well with consumers seeking premium EVs. This demonstrates Nio's success in adapting to evolving consumer preferences within the luxury EV market segment.

-

Expanding Market Reach: Nio's continued expansion into new markets both within China and internationally contributed to the overall revenue increase. This strategic move has diversified its customer base and reduced reliance on a single geographic market. Their commitment to global expansion is a key factor in their long-term growth strategy.

-

Battery as a Service (BaaS) Model Success: Nio's innovative BaaS model, which allows customers to lease batteries separately from the vehicle, has proven increasingly popular. This flexible approach reduces the upfront cost of ownership, making EVs more accessible to a broader range of consumers. This strategy also provides a recurring revenue stream for the company.

Challenges and Future Outlook:

While the 21% year-on-year growth is commendable, Nio still faces considerable challenges. The intense competition within the Chinese EV market, dominated by players like BYD and Tesla, remains a significant hurdle. Furthermore, global economic uncertainty and potential supply chain disruptions could impact future performance.

Maintaining Momentum: Key Strategies for Nio:

To sustain its growth trajectory, Nio needs to:

-

Continue Innovation: Staying ahead of the curve in terms of technology and design is crucial. Investing in research and development to bring innovative features and improved battery technology to the market will be vital.

-

Strengthen its Charging Network: Expanding its charging infrastructure, particularly in less-developed regions, is essential to alleviate range anxiety among consumers and maintain a competitive advantage.

-

Enhance Brand Awareness Internationally: Further penetration into international markets requires a concerted effort to enhance brand recognition and build trust with consumers outside of China.

Conclusion:

Nio's 21% year-on-year revenue growth in Q1 2024 is a significant achievement, showcasing the company's resilience and strategic adaptability. However, maintaining this momentum in the face of fierce competition and global economic uncertainties will require continued innovation, strategic expansion, and a keen focus on customer experience. The coming quarters will be crucial in determining whether Nio can consolidate its position as a leading player in the rapidly evolving EV market. Investors and industry analysts will be closely watching Nio's performance to assess its long-term potential. For more insights into the EV market, check out [link to a relevant industry analysis report].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Analysis Of Nio's 21% Year-on-Year Revenue Growth In Q1 2024. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Public Reaction To Sydney Sweeneys Bathwater Infused Soap Hype Or Horror

Jun 03, 2025

Public Reaction To Sydney Sweeneys Bathwater Infused Soap Hype Or Horror

Jun 03, 2025 -

Is Sydney Sweeney Actually Selling Her Used Bathwater

Jun 03, 2025

Is Sydney Sweeney Actually Selling Her Used Bathwater

Jun 03, 2025 -

Steel And Aluminum Tariffs Doubled Analyzing Trumps Decision And Its Impact

Jun 03, 2025

Steel And Aluminum Tariffs Doubled Analyzing Trumps Decision And Its Impact

Jun 03, 2025 -

No Trading Today China And New Zealand Market Closures June 2 2025

Jun 03, 2025

No Trading Today China And New Zealand Market Closures June 2 2025

Jun 03, 2025 -

Successions Mountainhead Unmasking The Real Life Tech Executives That Shaped The Character

Jun 03, 2025

Successions Mountainhead Unmasking The Real Life Tech Executives That Shaped The Character

Jun 03, 2025