Analysis Of Nio's 21% Q1 2024 Revenue Growth

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Nio's Q1 2024 Revenue Surges 21%: A Deep Dive into the Chinese EV Giant's Performance

Nio, a leading player in the burgeoning Chinese electric vehicle (EV) market, announced a robust 21% year-over-year revenue growth for the first quarter of 2024. This impressive figure signals a continued upward trajectory for the company, defying some market predictions and solidifying its position in the increasingly competitive EV landscape. But what fueled this significant growth, and what does it mean for Nio's future? Let's delve into the details.

Key Factors Driving Nio's Q1 2024 Revenue Growth:

Several factors contributed to Nio's impressive Q1 performance. While the overall Chinese EV market experienced growth, Nio outpaced many competitors. Key drivers include:

-

Strong Vehicle Deliveries: Nio delivered a substantial number of vehicles in Q1 2024, exceeding expectations and demonstrating strong consumer demand for its range of EVs. This success is largely attributed to the company's innovative product lineup and its commitment to technological advancements. [Link to Nio's official Q1 2024 delivery announcement]

-

Expansion of Charging Infrastructure: Nio's strategic investment in its battery swap network and charging infrastructure played a vital role. The convenience and speed offered by this network continue to attract customers and differentiate Nio from competitors reliant solely on traditional charging methods. This commitment to infrastructure development is a significant competitive advantage.

-

Successful New Model Launches: The launch of new models and variants likely boosted sales. The introduction of upgraded features, improved battery technology, and appealing design elements contributed to increased consumer interest and market share. [Link to information about Nio's latest models]

-

Government Support and Subsidies: While not explicitly stated by Nio, the continued government support for the EV industry in China likely played a supporting role in the company's overall success. Favorable policies and incentives continue to stimulate growth within the sector.

Challenges and Future Outlook for Nio:

Despite the positive Q1 results, Nio faces ongoing challenges:

-

Intense Competition: The Chinese EV market is fiercely competitive, with established players and numerous startups vying for market share. Maintaining its growth trajectory will require continuous innovation and strategic decision-making.

-

Supply Chain Issues: Global supply chain disruptions can still impact production and delivery timelines. Nio's ability to manage these challenges effectively will be crucial for sustaining its momentum.

-

Global Expansion Strategies: While Nio has made strides in expanding internationally, penetrating new markets requires significant investment and adaptation to local market conditions.

Overall, the 21% revenue growth is a significant win for Nio. The company's focus on innovation, its robust charging infrastructure, and successful product launches have all contributed to this positive outcome. However, navigating the competitive landscape and managing potential challenges will be critical for sustaining this growth in the long term. Investors and industry analysts will be closely watching Nio's performance in the coming quarters to see if this strong start translates into sustained success.

What are your thoughts on Nio's Q1 2024 performance? Share your insights in the comments below!

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Analysis Of Nio's 21% Q1 2024 Revenue Growth. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

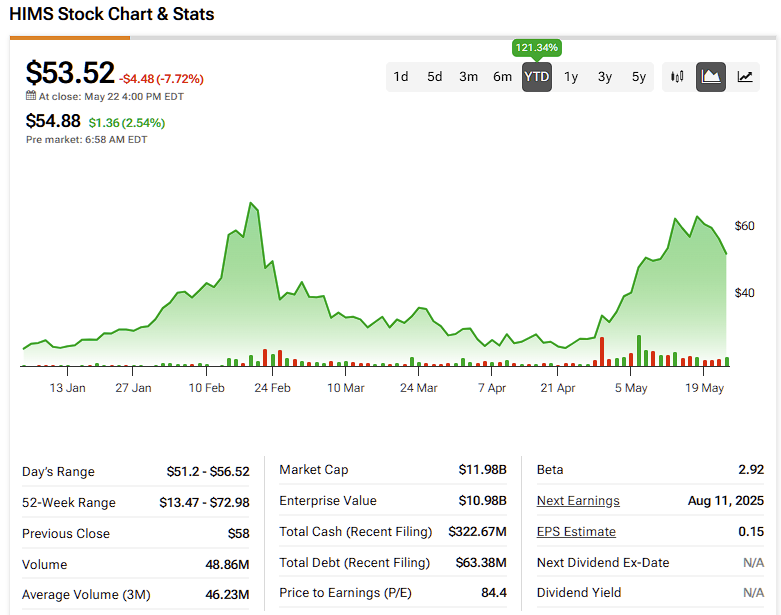

The Future Of Hims And Hers Hims A Stock Market Outlook

Jun 04, 2025

The Future Of Hims And Hers Hims A Stock Market Outlook

Jun 04, 2025 -

Steelers Practice Aftermath Beanie Bishop Defiles Pitt Logo

Jun 04, 2025

Steelers Practice Aftermath Beanie Bishop Defiles Pitt Logo

Jun 04, 2025 -

Ukraine Drone Strikes A New Global Warfare Standard

Jun 04, 2025

Ukraine Drone Strikes A New Global Warfare Standard

Jun 04, 2025 -

Crimean Bridge Hit Ukraine Claims Successful Strike With Underwater Explosives

Jun 04, 2025

Crimean Bridge Hit Ukraine Claims Successful Strike With Underwater Explosives

Jun 04, 2025 -

Veteran Joe Root Still A Key Player For England Says Brook

Jun 04, 2025

Veteran Joe Root Still A Key Player For England Says Brook

Jun 04, 2025