Analysis: Nio's 21% YoY Revenue Growth In Q1 2024

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Analysis: Nio's 21% YoY Revenue Growth in Q1 2024 – A Sign of Continued EV Market Strength?

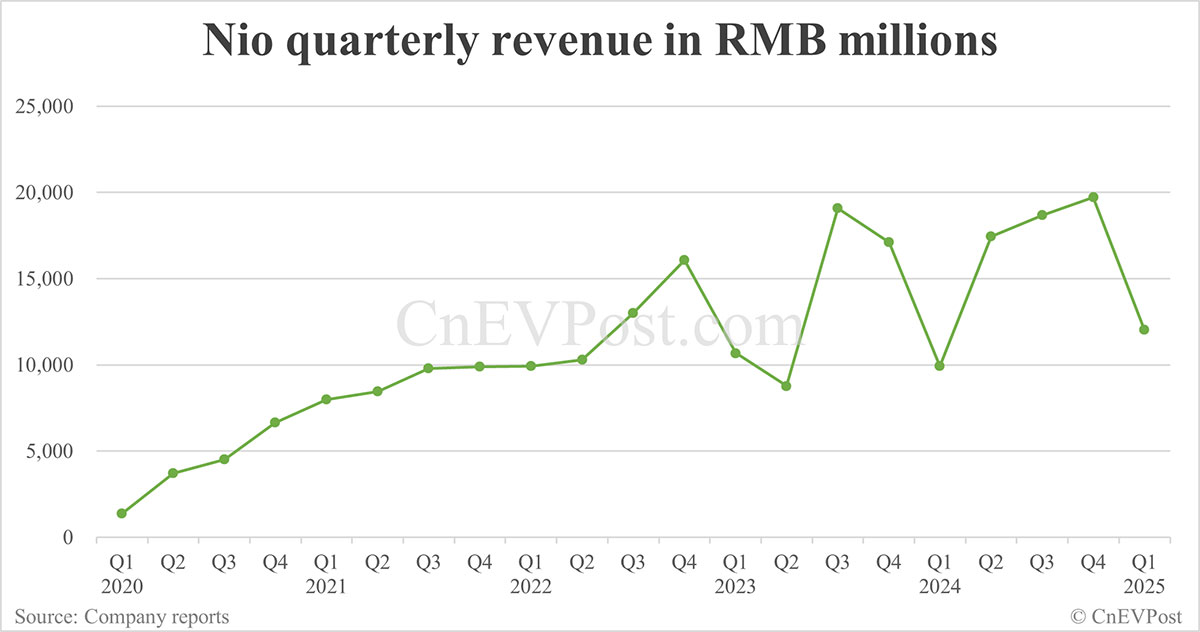

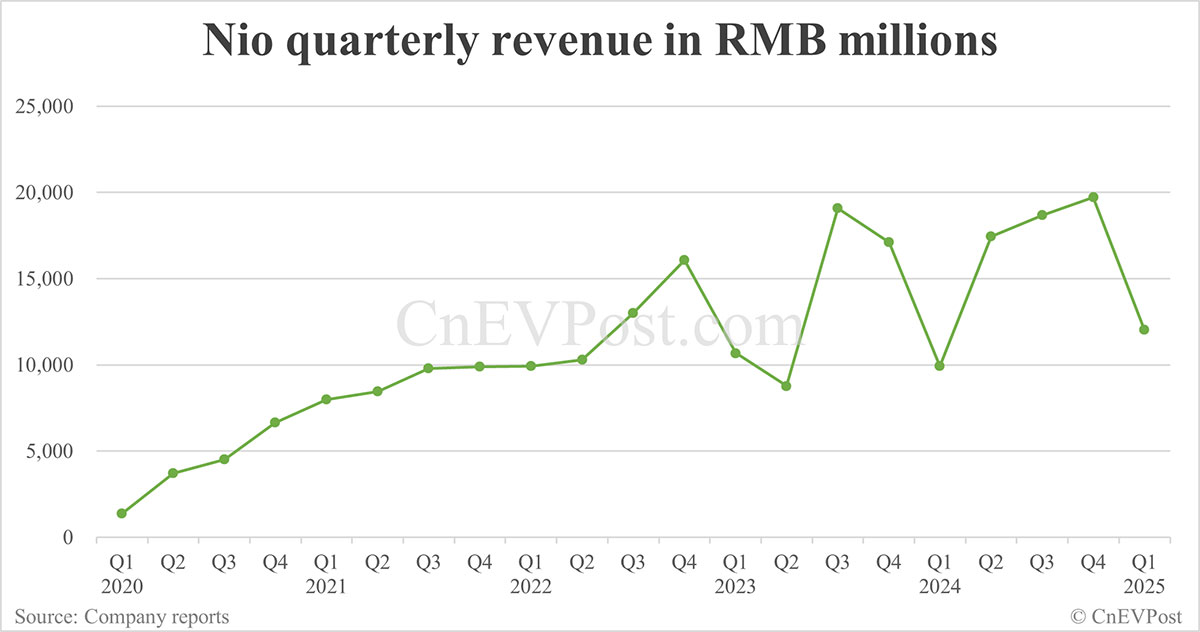

NIO, a leading Chinese electric vehicle (EV) manufacturer, announced a robust 21% year-over-year (YoY) revenue growth in Q1 2024, defying some analysts' predictions of a slowdown in the EV market. This impressive performance raises questions about the company's future trajectory and the overall health of the Chinese EV sector. Did NIO's strategic moves pay off, and what does this mean for investors and the broader EV landscape? Let's delve into the details.

NIO's Q1 2024 Performance: Key Highlights

NIO's Q1 2024 earnings report revealed more than just a simple revenue increase. The 21% YoY growth, reaching [Insert Actual Revenue Figure Here], showcased significant progress across several key areas:

- Strong Vehicle Deliveries: Increased vehicle deliveries were a major driver of the revenue surge. [Insert Specific Delivery Numbers and Percentage Change Here]. This indicates strong consumer demand for NIO's vehicles, particularly its newer models.

- Expansion of Services: NIO's battery-as-a-service (BaaS) subscription model continued to gain traction, contributing to recurring revenue streams and strengthening its overall business model. [Insert Data on BaaS Growth Here, if available].

- Price Adjustments and Market Positioning: While the EV market remains competitive, NIO's strategic price adjustments and focus on premium features seem to have resonated with consumers. This suggests a successful balancing act between affordability and market positioning.

- Technological Advancements: Continued investment in research and development (R&D) is paying dividends. Improvements in battery technology, autonomous driving capabilities, and overall vehicle performance are likely contributing factors to the strong sales figures.

Factors Contributing to NIO's Success

Several factors likely contributed to NIO's impressive Q1 performance:

- Government Support for the EV Industry: Continued government incentives and support for the EV sector in China have undoubtedly played a significant role in boosting overall market demand.

- Growing Consumer Awareness: Increased consumer awareness of environmental concerns and the benefits of electric vehicles is fueling higher adoption rates.

- Improved Charging Infrastructure: The expansion of charging infrastructure across China makes owning an EV more convenient, reducing range anxiety among potential buyers.

- Effective Marketing and Brand Building: NIO's strong brand image and effective marketing campaigns have successfully positioned the company as a premium EV brand.

Challenges and Future Outlook

Despite the positive Q1 results, NIO faces ongoing challenges:

- Intense Competition: The Chinese EV market is highly competitive, with established players and new entrants vying for market share. Maintaining its competitive edge requires continuous innovation and strategic adaptations.

- Global Economic Uncertainty: Global economic uncertainties could impact consumer spending and affect demand for luxury EVs.

- Supply Chain Disruptions: Potential supply chain disruptions could hinder production and negatively affect future performance.

Conclusion: A Positive Sign, But Caution Remains

NIO's 21% YoY revenue growth in Q1 2024 is a significant achievement and suggests a strong position within the competitive Chinese EV market. However, investors should remain cautious, considering the ongoing challenges and uncertainties in the global economy. The company's long-term success will depend on its ability to maintain its innovative edge, adapt to market dynamics, and navigate potential challenges effectively. Further analysis of future quarters will be crucial to assess the sustainability of this growth trajectory. Keep an eye on NIO's upcoming announcements and industry trends to stay informed about this dynamic sector.

Keywords: NIO, electric vehicles, EV, revenue growth, Q1 2024 earnings, Chinese EV market, battery-as-a-service, BaaS, vehicle deliveries, competition, EV industry, investment, stock market, technology, autonomous driving.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Analysis: Nio's 21% YoY Revenue Growth In Q1 2024. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Global Tectonic Shifts Jamie Dimons Crucial Guidance For Trump

Jun 03, 2025

Global Tectonic Shifts Jamie Dimons Crucial Guidance For Trump

Jun 03, 2025 -

Michigan Families Face Potential Bankruptcy From Dte Rate Hikes

Jun 03, 2025

Michigan Families Face Potential Bankruptcy From Dte Rate Hikes

Jun 03, 2025 -

Us Economic Outlook Imperiled Jp Morgan Ceo Highlights Internal Threats

Jun 03, 2025

Us Economic Outlook Imperiled Jp Morgan Ceo Highlights Internal Threats

Jun 03, 2025 -

Uche Ojeh Funeral Sheinelle Jones Finds Comfort In Today Show Colleagues

Jun 03, 2025

Uche Ojeh Funeral Sheinelle Jones Finds Comfort In Today Show Colleagues

Jun 03, 2025 -

Hims And Hers Health Inc Hims Stock Up 3 02 May 30

Jun 03, 2025

Hims And Hers Health Inc Hims Stock Up 3 02 May 30

Jun 03, 2025