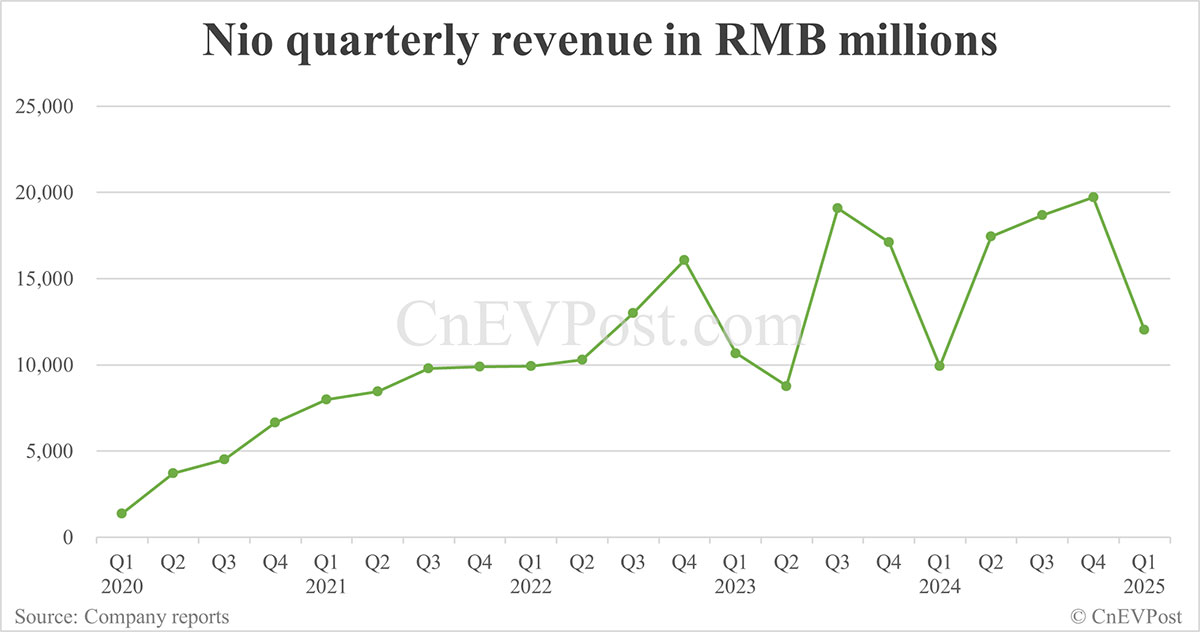

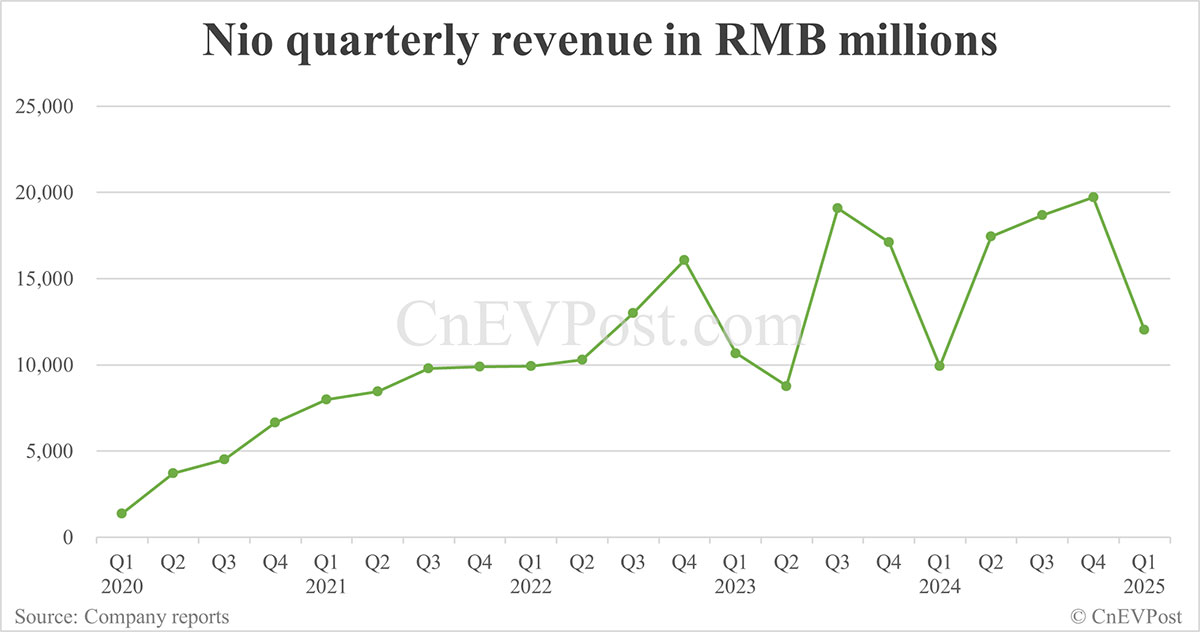

Analysis: Nio's 21% Year-on-Year Revenue Jump In Q1 2024

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Analysis: Nio's 21% Year-on-Year Revenue Jump in Q1 2024 – A Sign of Continued Growth?

NIO Inc. (NIO) reported a significant 21% year-on-year increase in revenue for the first quarter of 2024, exceeding analysts' expectations and sparking renewed optimism about the Chinese electric vehicle (EV) maker's future. This impressive jump, however, needs closer examination to understand the underlying factors and predict future performance. This analysis delves into the key drivers behind NIO's Q1 2024 success and explores potential challenges on the horizon.

Key Factors Driving NIO's Revenue Growth

NIO's Q1 2024 revenue surge wasn't a fluke; several key factors contributed to this positive outcome:

-

Strong Vehicle Deliveries: The most significant contributor was a substantial increase in vehicle deliveries. NIO successfully ramped up production and met increased demand, exceeding many analysts' predictions. This demonstrates improved supply chain management and a growing market share in the competitive Chinese EV market.

-

Higher Average Selling Prices (ASPs): NIO's focus on higher-end models and innovative features, such as its battery-as-a-service (BaaS) program, led to higher average selling prices. This strategy effectively mitigates the impact of potential price wars and allows for higher profit margins.

-

BaaS Program Success: The BaaS program continues to gain traction. By decoupling battery costs from vehicle purchase prices, NIO makes its EVs more affordable and attracts a wider customer base. This recurring revenue stream also provides long-term financial stability.

-

Expansion of Charging Infrastructure: NIO's continued investment in its charging network has improved customer convenience and reduced range anxiety, a critical factor in EV adoption. This infrastructure investment is paying dividends in attracting new customers and enhancing brand loyalty.

Challenges and Future Outlook

While Q1 2024 results are undoubtedly positive, NIO still faces significant challenges:

-

Intense Competition: The Chinese EV market is incredibly competitive, with established players and numerous startups vying for market share. Maintaining its growth trajectory will require continuous innovation and aggressive marketing strategies.

-

Supply Chain Disruptions: Global supply chain volatility remains a concern. Any future disruptions could impact production and negatively affect NIO's ability to meet demand.

-

Economic Uncertainty: The global economic climate presents uncertainty. A downturn could affect consumer spending and reduce demand for luxury EVs like those offered by NIO.

Conclusion: A Promising Quarter, But Continued Vigilance is Key

NIO's 21% year-on-year revenue jump in Q1 2024 is a strong indication of the company's resilience and growth potential. However, the success isn't guaranteed. Continued focus on innovation, supply chain management, and navigating the competitive landscape will be crucial for sustaining this momentum. Investors should monitor NIO's performance closely, particularly regarding vehicle deliveries, ASPs, and the long-term impact of the BaaS program. The future success of NIO will largely depend on its ability to address the challenges mentioned above while continuing to capitalize on the growing demand for electric vehicles in China and beyond.

Keywords: NIO, Nio Stock, Electric Vehicle, EV, China EV Market, Q1 2024 Earnings, Revenue Growth, Battery-as-a-Service, BaaS, NIO Stock Price, Chinese Electric Vehicles, EV Industry, Automotive Industry, Supply Chain

Related Articles: (Links to other relevant articles on your site – example only, replace with actual links)

- [Link to article about the Chinese EV market]

- [Link to article about the impact of BaaS on the EV industry]

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct thorough research and consult with a financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Analysis: Nio's 21% Year-on-Year Revenue Jump In Q1 2024. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Miley Cyrus Mature Response To Billy Ray Cyrus Dating Elizabeth Hurley

Jun 03, 2025

Miley Cyrus Mature Response To Billy Ray Cyrus Dating Elizabeth Hurley

Jun 03, 2025 -

Marc Maron Bids Farewell To Wtf Podcast After 16 Years On Air

Jun 03, 2025

Marc Maron Bids Farewell To Wtf Podcast After 16 Years On Air

Jun 03, 2025 -

Actor Tray Chaneys Son Hospitalized Georgia Tornado Aftermath

Jun 03, 2025

Actor Tray Chaneys Son Hospitalized Georgia Tornado Aftermath

Jun 03, 2025 -

Key Russia Crimea Link Severed Ukraines Underwater Bridge Strike

Jun 03, 2025

Key Russia Crimea Link Severed Ukraines Underwater Bridge Strike

Jun 03, 2025 -

The Ethics Of Sydney Sweeneys Bath Water Soap Consumer Reactions

Jun 03, 2025

The Ethics Of Sydney Sweeneys Bath Water Soap Consumer Reactions

Jun 03, 2025