Analysis: Nio's 21% Year-on-Year Revenue Growth In The First Quarter

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

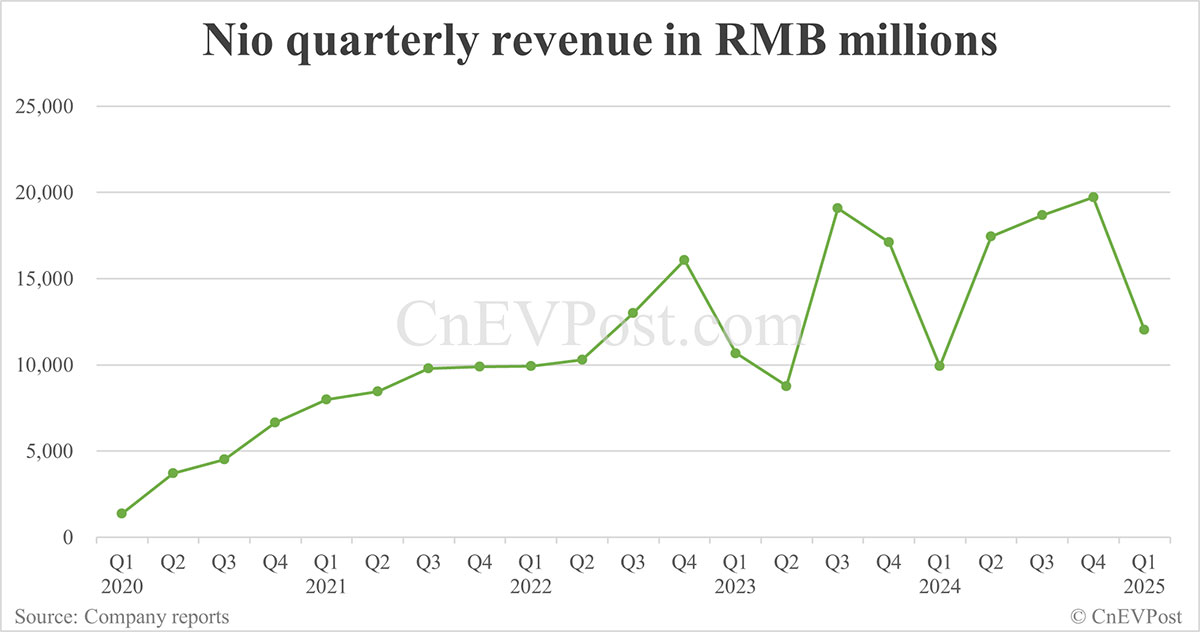

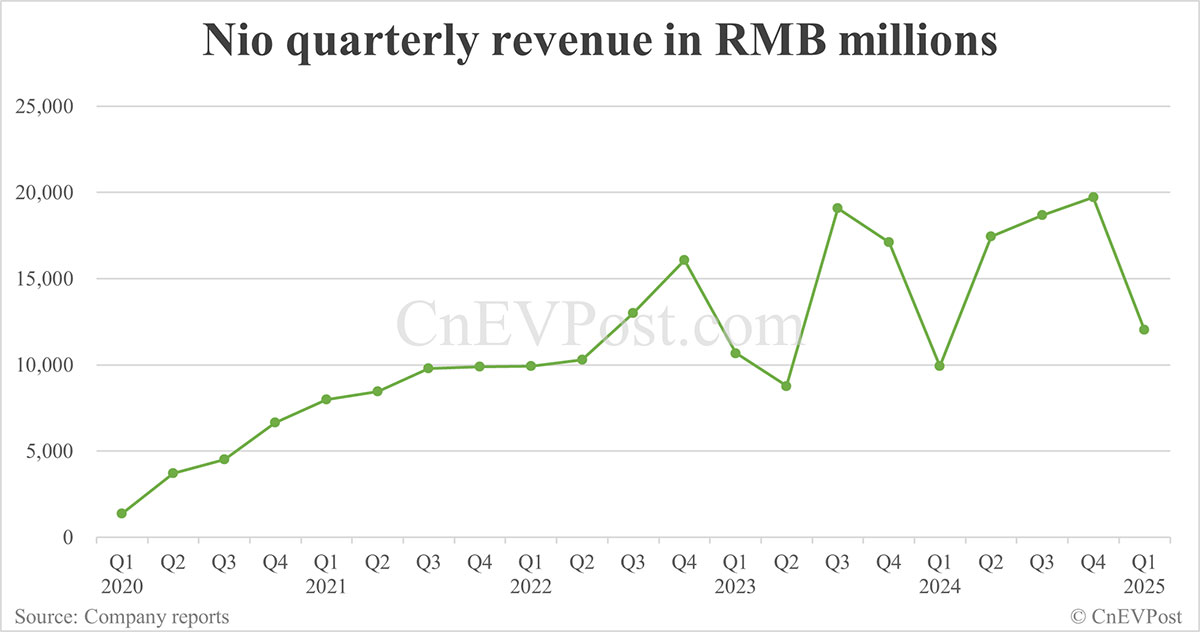

Analysis: Nio's 21% Year-on-Year Revenue Growth in the First Quarter – A Sign of Strength or a Temporary Surge?

NIO, the Chinese electric vehicle (EV) maker, reported a solid 21% year-on-year revenue growth in its first quarter of 2024, reaching [Insert Actual Revenue Figure Here]. While this figure paints a picture of continued growth, a closer analysis reveals a more nuanced story, prompting questions about the long-term sustainability of this upward trend. This article delves into the factors contributing to NIO's Q1 performance and examines potential challenges ahead.

NIO's Q1 2024 Revenue Growth: A Deeper Dive

The 21% year-on-year increase in revenue is undeniably positive news for NIO. However, it's crucial to understand the driving forces behind this growth. Several key factors played a significant role:

- Strong Sales of Existing Models: NIO's established models, like the ET7, ET5, and ES7, continued to see robust demand, contributing significantly to the overall revenue figures. This demonstrates the continued appeal of NIO's vehicles within the competitive Chinese EV market. [Link to NIO's official press release].

- Successful New Product Launches (If Applicable): If NIO launched any new models or significant upgrades during this period, their success would have undoubtedly boosted sales and revenue. Detailing the specific contribution of these launches is crucial for a complete analysis.

- Government Incentives and Subsidies: The Chinese government's continued support for the EV industry through various subsidies and incentives likely played a role in boosting consumer demand. Understanding the impact of these government policies is vital for evaluating the organic growth of NIO.

- Expanding Charging Infrastructure: NIO's commitment to building its battery swapping network and charging infrastructure has likely contributed to increased customer confidence and sales. A strong charging network is a key differentiator in the EV market. [Link to article about NIO's charging infrastructure].

Challenges and Uncertainties for NIO

Despite the positive Q1 results, several challenges remain for NIO:

- Intense Competition: The Chinese EV market is fiercely competitive, with established players like BYD and emerging startups constantly vying for market share. NIO needs to continue innovating and adapting to maintain its competitive edge.

- Supply Chain Disruptions: Global supply chain issues continue to pose a risk to automakers, potentially impacting production and delivery timelines. NIO's ability to manage these disruptions effectively is crucial for sustained growth.

- Economic Headwinds: The global economic slowdown could affect consumer spending on luxury goods, including high-end EVs. NIO's pricing strategy and ability to appeal to a broader range of consumers will be key in navigating economic uncertainty.

Looking Ahead: Long-Term Prospects for NIO

NIO's 21% year-on-year revenue growth in Q1 is a positive sign, but it's essential to maintain a balanced perspective. While the company demonstrated strength in several key areas, significant challenges remain. The long-term success of NIO will depend on its ability to navigate intense competition, mitigate supply chain risks, and adapt to evolving economic conditions. Investors and industry analysts will be keenly watching NIO's performance in the coming quarters for a clearer picture of its long-term growth trajectory.

Keywords: NIO, electric vehicle, EV, revenue growth, Q1 2024, Chinese EV market, competition, supply chain, economic outlook, stock market, investment, technology, innovation, battery swapping, charging infrastructure.

Call to Action (subtle): Stay tuned for our upcoming analysis of NIO's Q2 2024 results for further insights into the company's performance.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Analysis: Nio's 21% Year-on-Year Revenue Growth In The First Quarter. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Saharan Dust Cloud A Transatlantic Journey From Africa To The Americas

Jun 04, 2025

Saharan Dust Cloud A Transatlantic Journey From Africa To The Americas

Jun 04, 2025 -

Close Call In Cardiff England Beats West Indies In Tense Test Match Finish

Jun 04, 2025

Close Call In Cardiff England Beats West Indies In Tense Test Match Finish

Jun 04, 2025 -

Beanie Bishops Post Practice Actions Spark Outrage Steelers Respond

Jun 04, 2025

Beanie Bishops Post Practice Actions Spark Outrage Steelers Respond

Jun 04, 2025 -

Colleagues Friends Mourn Uche Ojeh Remembering Sheinelle Jones Husband

Jun 04, 2025

Colleagues Friends Mourn Uche Ojeh Remembering Sheinelle Jones Husband

Jun 04, 2025 -

Backlash On Twitter Ex West Virginia Players Pitt Logo Disrespect

Jun 04, 2025

Backlash On Twitter Ex West Virginia Players Pitt Logo Disrespect

Jun 04, 2025