Analysis: Nio's 21% Year-on-Year Revenue Growth In Q1 2024

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

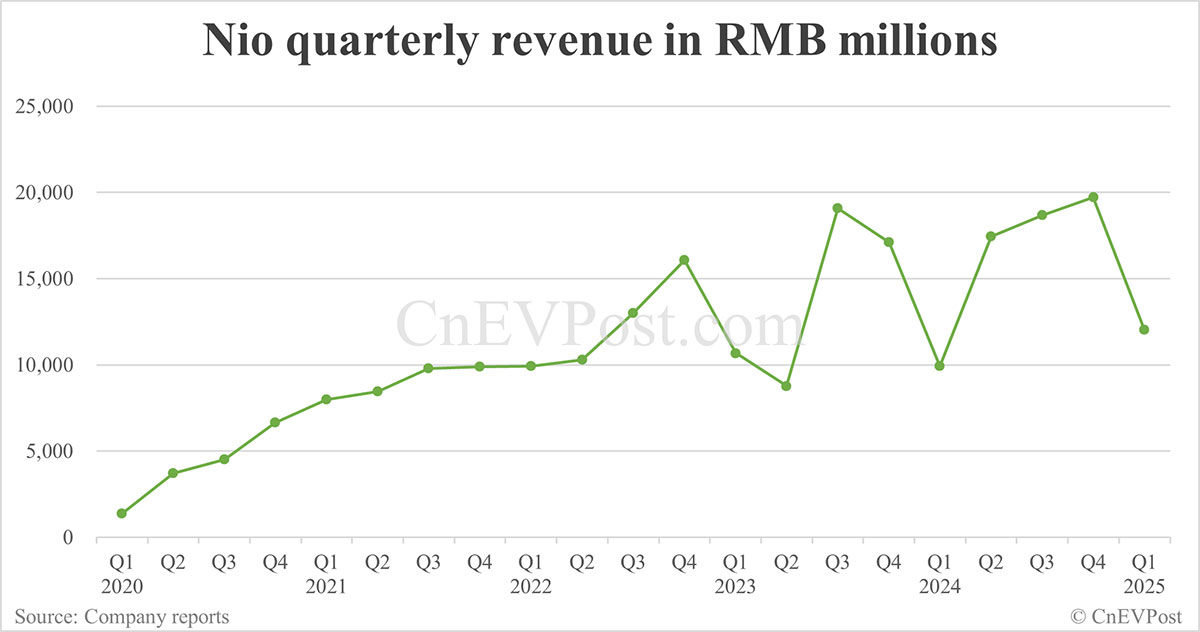

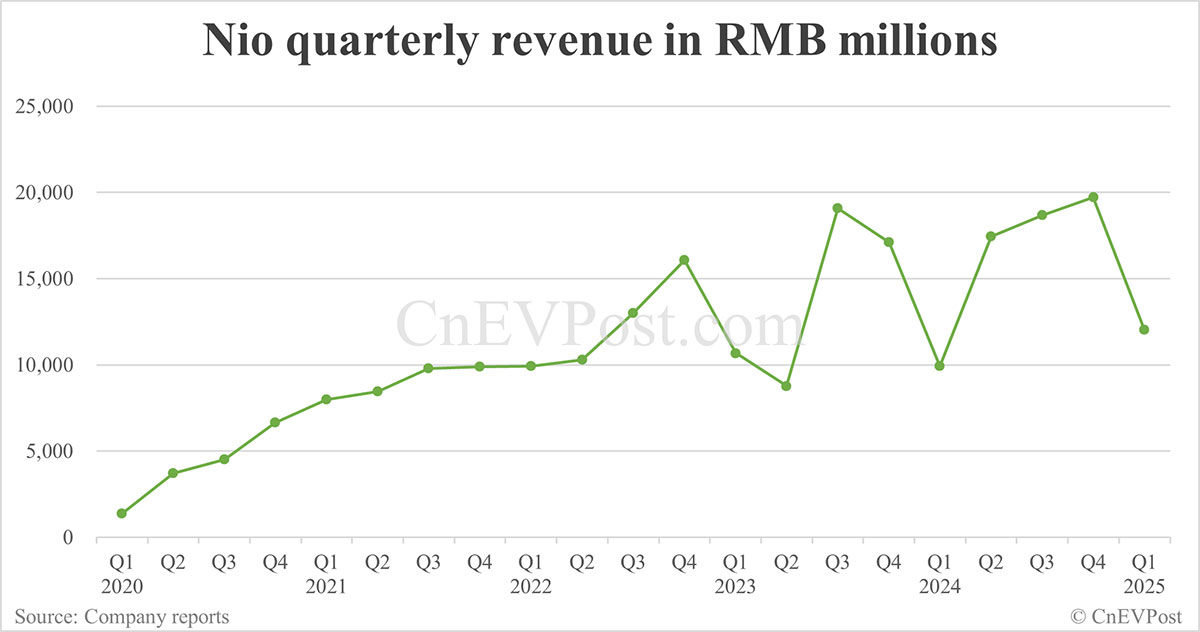

Analysis: Nio's 21% Year-on-Year Revenue Growth in Q1 2024 – A Sign of Strength or a Temporary Surge?

NIO, the Chinese electric vehicle (EV) maker, reported a solid 21% year-on-year revenue growth in Q1 2024, reaching [Insert actual revenue figure here]. While this figure signals continued growth in a challenging market, analysts are divided on whether this represents sustained momentum or a temporary blip. This article delves into the factors contributing to NIO's Q1 performance and explores the outlook for the company in the coming quarters.

Strong Vehicle Deliveries Fuel Revenue Growth:

NIO's Q1 2024 revenue surge can be largely attributed to a significant increase in vehicle deliveries. The company delivered [Insert actual delivery figures here] vehicles, a [Insert percentage change] increase compared to Q1 2023. This impressive growth stems from several factors, including:

- Successful New Model Launches: The introduction of new models like the [mention specific new models and their impact] has broadened NIO's appeal and attracted a wider range of customers. These new vehicles often come with enhanced features and technologies, justifying the higher price points.

- Expanding Charging Infrastructure: NIO's continued investment in its battery swapping network and charging infrastructure has played a crucial role in alleviating range anxiety, a major concern for potential EV buyers. A robust charging network is vital for market penetration, particularly in a country as vast as China.

- Government Incentives and Subsidies: While government support for the EV industry in China has fluctuated, existing policies likely played a role in boosting sales during Q1 2024. Further analysis is needed to quantify this impact precisely.

Challenges Remain for NIO:

Despite the positive Q1 results, NIO faces significant challenges:

- Intense Competition: The Chinese EV market is incredibly competitive, with established players like BYD and newer entrants vying for market share. This fierce competition puts pressure on pricing and profitability.

- Global Economic Uncertainty: Global economic headwinds, including inflation and potential recessionary pressures, could dampen consumer demand for luxury EVs like those offered by NIO.

- Supply Chain Disruptions: While supply chain issues have eased somewhat, potential future disruptions could impact production and delivery timelines, hindering growth.

Looking Ahead: Is This Sustainable Growth?

NIO's 21% year-on-year revenue growth in Q1 2024 is undoubtedly positive news. However, whether this represents sustainable long-term growth remains to be seen. The company's success will depend on its ability to navigate the intense competition, manage supply chain risks, and adapt to shifting market dynamics. Analysts will be closely monitoring NIO's performance in the coming quarters to assess the sustainability of this growth trajectory.

Key Takeaways:

- NIO achieved a 21% year-on-year revenue growth in Q1 2024, driven primarily by increased vehicle deliveries.

- New model launches, expanding charging infrastructure, and government support contributed to this success.

- However, intense competition, economic uncertainty, and potential supply chain disruptions remain significant challenges.

- The sustainability of NIO's growth remains a key question for investors and analysts.

Further Reading:

- [Link to NIO's official Q1 2024 earnings report]

- [Link to a reputable financial news source covering the EV market in China]

This analysis provides a comprehensive overview of NIO's Q1 2024 performance. Investors and EV enthusiasts should conduct their own thorough research before making any investment decisions. Stay tuned for further updates as the year progresses.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Analysis: Nio's 21% Year-on-Year Revenue Growth In Q1 2024. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Us Economy Faces Internal Threats Says Jp Morgan Ceo Jamie Dimon

Jun 03, 2025

Us Economy Faces Internal Threats Says Jp Morgan Ceo Jamie Dimon

Jun 03, 2025 -

Steel And Aluminum Tariffs Doubled Trumps Justification And The Potential Consequences

Jun 03, 2025

Steel And Aluminum Tariffs Doubled Trumps Justification And The Potential Consequences

Jun 03, 2025 -

Public Holiday China And New Zealand Stock Markets Closed Monday June 2nd 2025

Jun 03, 2025

Public Holiday China And New Zealand Stock Markets Closed Monday June 2nd 2025

Jun 03, 2025 -

Can Nio Overcome Tariff Challenges Q1 Earnings Preview

Jun 03, 2025

Can Nio Overcome Tariff Challenges Q1 Earnings Preview

Jun 03, 2025 -

3 02 Surge For Hims And Hers Hims Shares May 30th Update

Jun 03, 2025

3 02 Surge For Hims And Hers Hims Shares May 30th Update

Jun 03, 2025