Analysis: Nio's 21% Revenue Growth In Q1 2024

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Analysis: Nio's 21% Revenue Growth in Q1 2024 – A Sign of Resurgence or Temporary Boost?

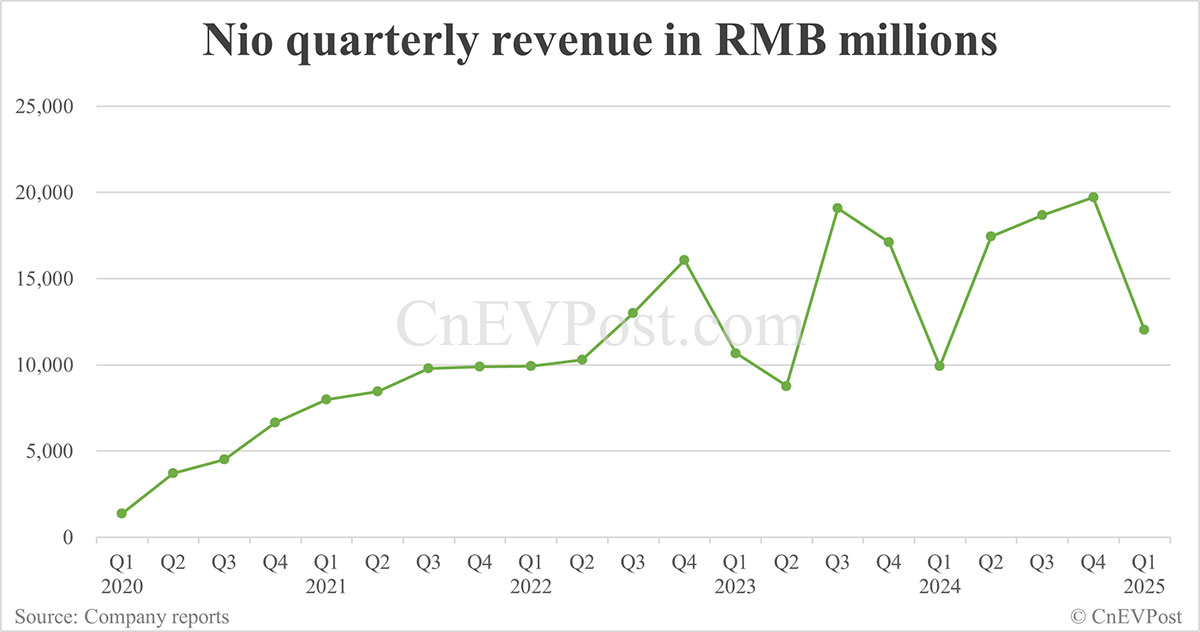

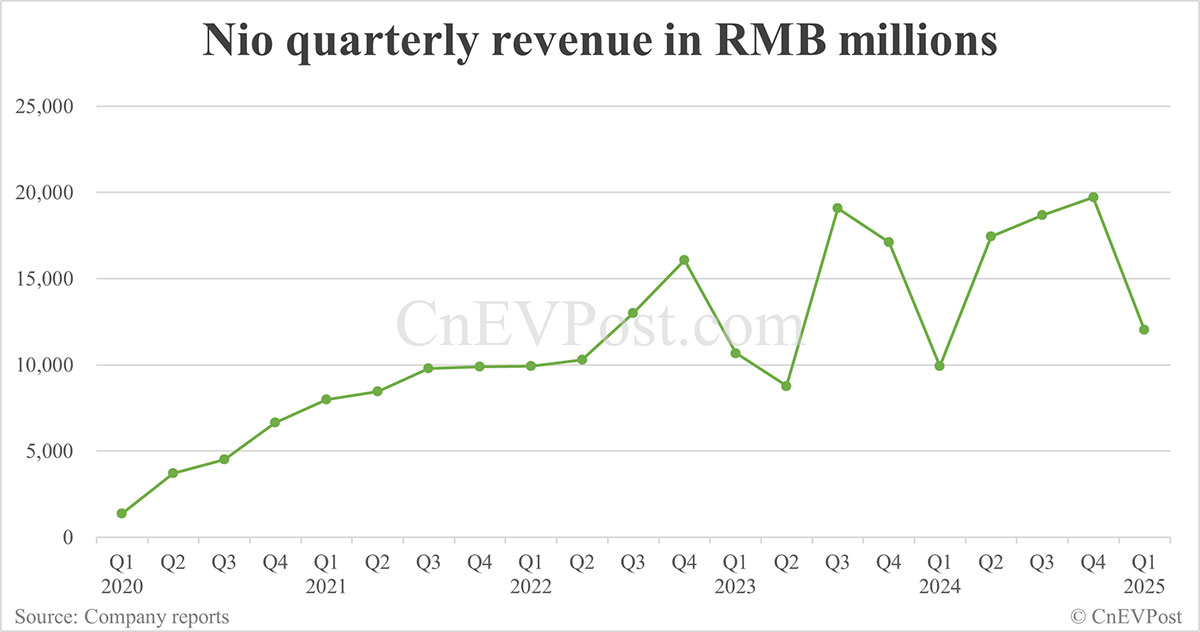

NIO, the Chinese electric vehicle (EV) maker, reported a robust 21% year-over-year revenue growth in Q1 2024, reaching [Insert Actual Revenue Figure Here]. While this surge offers a glimmer of hope after a period of market challenges, analysts remain divided on whether this represents a sustained recovery or a temporary upswing. This article delves into the key factors driving Nio's growth and examines the potential implications for the future.

Key Factors Contributing to Nio's Q1 2024 Revenue Growth:

Several factors contributed to Nio's impressive Q1 performance. These include:

-

Increased Vehicle Deliveries: A significant increase in vehicle deliveries compared to the same period last year played a crucial role. Nio delivered [Insert Actual Delivery Figures Here] vehicles, showcasing a growing demand for its EVs. This success can be partly attributed to the launch of new models and improved battery technology.

-

Stronger Pricing and Higher Average Selling Prices (ASPs): Nio’s strategic pricing adjustments and the introduction of premium features likely led to increased ASPs, boosting overall revenue. This reflects a growing willingness among consumers to invest in higher-end electric vehicles.

-

Expansion of Charging Infrastructure: Nio's continuous investment in its battery swap network and charging infrastructure has proven vital in alleviating range anxiety, a major concern for potential EV buyers. This improved infrastructure contributes to customer confidence and brand loyalty.

-

Government Incentives and Market Trends: Favorable government policies supporting the EV industry in China, coupled with a broader global shift towards electric mobility, have created a favorable environment for Nio's growth.

Challenges and Future Outlook:

Despite the positive Q1 results, Nio still faces significant challenges:

-

Intense Competition: The Chinese EV market is fiercely competitive, with established players like BYD and new entrants constantly vying for market share. Nio needs to maintain its innovative edge and brand recognition to stay ahead.

-

Global Economic Uncertainty: The ongoing global economic uncertainty presents a risk to consumer spending, potentially impacting demand for luxury EVs like those offered by Nio.

-

Supply Chain Issues: While improved, potential supply chain disruptions could still hamper production and negatively impact future growth.

Analyst Opinions and Predictions:

Analyst sentiment regarding Nio's long-term prospects is mixed. Some analysts believe this Q1 growth signifies a turning point, indicating a sustained recovery fueled by innovative products and effective strategies. Others remain cautious, highlighting the challenges mentioned above and predicting a more volatile future. [Link to a relevant analyst report or news article].

Conclusion:

Nio's 21% revenue growth in Q1 2024 is undoubtedly positive news. However, it's crucial to interpret this growth within the context of the larger market dynamics and ongoing challenges. Whether this signifies a lasting resurgence or a temporary boost remains to be seen. The coming quarters will be critical in determining Nio's trajectory and its ability to sustain this momentum in the face of fierce competition and economic uncertainty. Further monitoring of vehicle deliveries, ASPs, and market share will be crucial for assessing the long-term viability of Nio's growth strategy.

Keywords: NIO, Nio Q1 2024, Electric Vehicle, EV, Revenue Growth, Chinese EV Market, Battery Swap, Charging Infrastructure, EV Sales, Auto Industry, Stock Market, Investment.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Analysis: Nio's 21% Revenue Growth In Q1 2024. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Miley And Billy Cyrus Bond New Details Emerge From A Close Source

Jun 03, 2025

Miley And Billy Cyrus Bond New Details Emerge From A Close Source

Jun 03, 2025 -

From Hollywood To Heartland Roseanne Barrs Post Accident Life In Texas

Jun 03, 2025

From Hollywood To Heartland Roseanne Barrs Post Accident Life In Texas

Jun 03, 2025 -

How Al Roker Sustained His 100 Pound Weight Loss For 20 Years

Jun 03, 2025

How Al Roker Sustained His 100 Pound Weight Loss For 20 Years

Jun 03, 2025 -

Jamie Dimons Blunt Assessment The Us China And The Economic Realities Of Tariffs

Jun 03, 2025

Jamie Dimons Blunt Assessment The Us China And The Economic Realities Of Tariffs

Jun 03, 2025 -

Anger Mounts As Rep Khanna And Labor Unions Fight Federal Layoffs

Jun 03, 2025

Anger Mounts As Rep Khanna And Labor Unions Fight Federal Layoffs

Jun 03, 2025