Analysis: Nio's 21% Q1 Revenue Growth – A Sign Of Market Strength?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Analysis: Nio's 21% Q1 Revenue Growth – A Sign of Market Strength or a Fleeting Uptick?

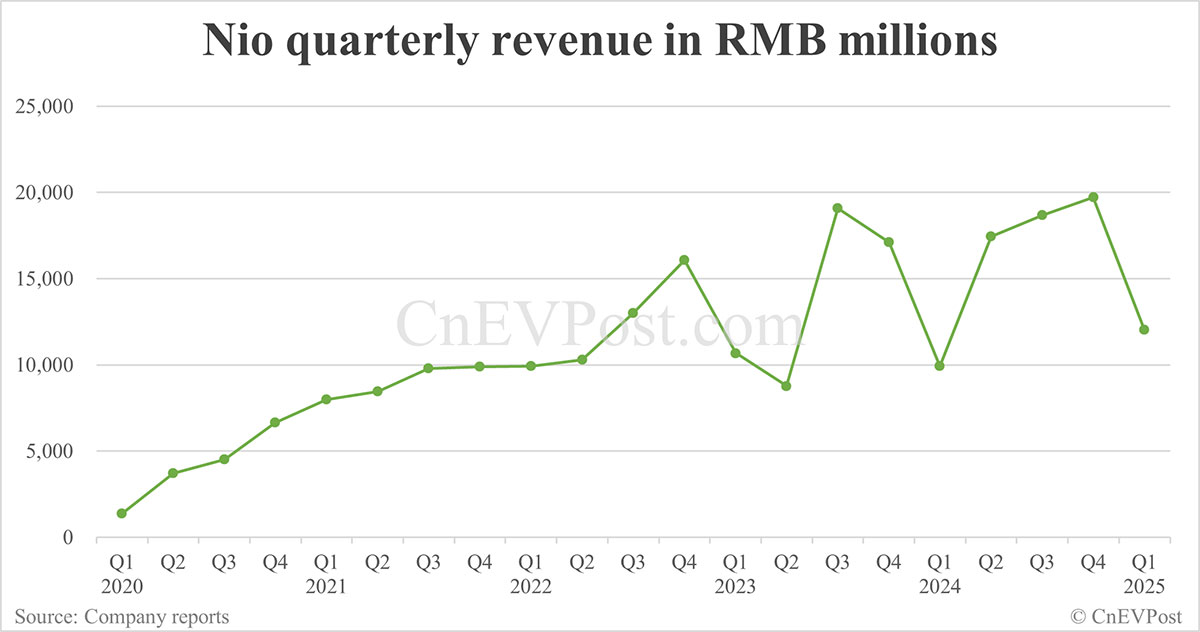

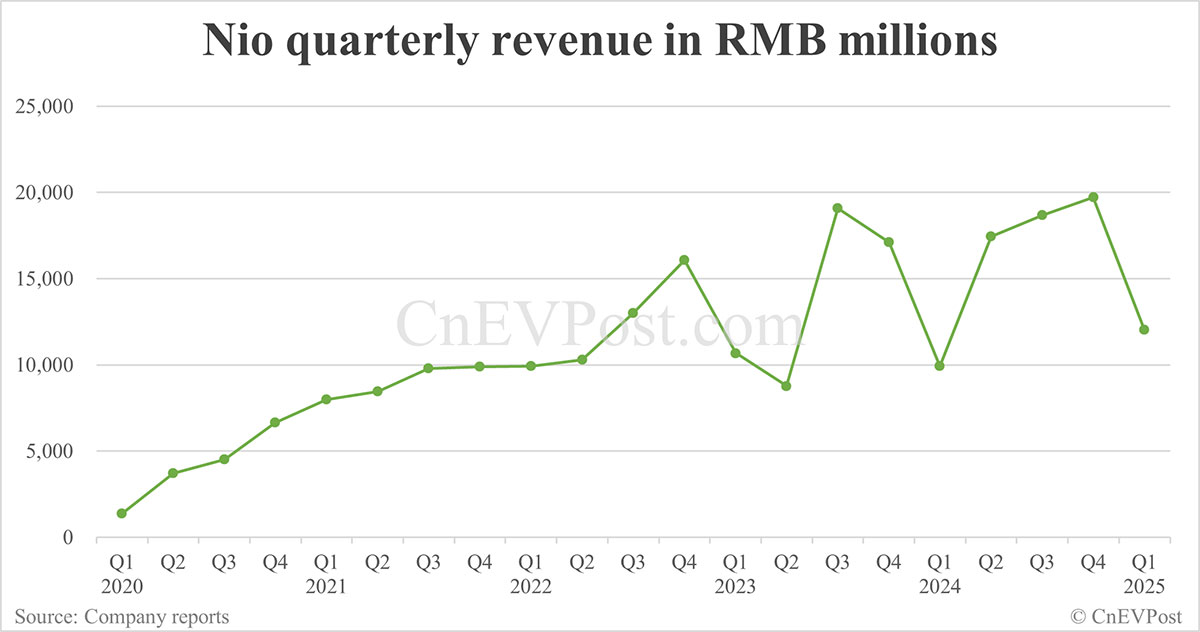

Nio, the Chinese electric vehicle (EV) maker, reported a robust 21% year-over-year revenue growth in its first quarter of 2024, reaching [Insert Actual Revenue Figure Here]. While this surge initially paints a picture of strength in the competitive EV market, a deeper dive reveals a more nuanced reality. Is this sustained growth, or a temporary blip in a challenging landscape? Let's analyze the factors contributing to Nio's performance and explore the implications for the future.

Nio's Q1 Success: A Closer Look

Several factors contributed to Nio's impressive Q1 revenue growth. Firstly, the company benefited from increased demand for its existing models, particularly the [Mention specific popular models]. This suggests a strong brand loyalty and a continuing appeal to consumers in the Chinese EV market. Secondly, [Mention specific strategic initiatives, e.g., new battery technology, expansion into new markets, successful marketing campaigns] played a significant role in boosting sales. These initiatives demonstrate Nio's proactive approach to navigating the challenges of a dynamic market.

- Increased Production Capacity: Nio's ability to ramp up production to meet the growing demand was crucial. This showcases improvements in their manufacturing efficiency and supply chain management.

- Government Incentives: While not explicitly stated, potential government subsidies or incentives aimed at boosting the domestic EV sector could have contributed to the sales figures. Further investigation into this aspect is warranted.

- Pricing Strategies: Nio's pricing strategies, including any potential discounts or promotions, would also need to be considered as a contributing factor.

Challenges Remain in the EV Landscape

Despite the positive Q1 results, several headwinds persist for Nio and the broader EV industry. Intense competition from established automakers and numerous emerging EV startups continues to pressure margins and market share. The global chip shortage, though easing, still presents a potential constraint on production. Furthermore, fluctuating raw material prices, particularly for battery components, impact profitability.

Is this Sustainable Growth?

The 21% revenue growth is certainly positive news for Nio, but it's crucial to consider the sustainability of this trend. While the Q1 results are encouraging, consistent performance over subsequent quarters is necessary to confirm a long-term upward trajectory. Investors should closely monitor factors like:

- Ongoing Consumer Demand: Sustained consumer interest in Nio's vehicles is vital for maintaining growth momentum.

- Competitive Pressure: Nio's ability to differentiate its offerings and withstand competitive pressures will determine its future success.

- Technological Advancements: Continuous innovation and investment in cutting-edge technology are crucial for staying ahead in the rapidly evolving EV sector.

Conclusion: Cautious Optimism

Nio's 21% Q1 revenue growth is a noteworthy achievement, demonstrating the company's resilience and ability to capitalize on market opportunities. However, it's premature to declare this a definitive sign of market strength. Sustained growth hinges on navigating ongoing challenges and executing its strategic plans effectively. Investors and industry analysts should maintain a cautiously optimistic outlook, closely monitoring Nio's performance in the coming quarters to ascertain the long-term implications of this recent surge.

Keywords: Nio, electric vehicle, EV, revenue growth, Q1 2024 earnings, Chinese EV market, market analysis, competition, sustainable growth, stock market, investment, technology, battery technology, supply chain, production capacity.

Related Articles: (This section would include links to relevant articles on your website or other reputable sources discussing the EV market, Nio's competitors, etc.)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Analysis: Nio's 21% Q1 Revenue Growth – A Sign Of Market Strength?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

From Ball Boy To National Team Suhail Ahmad Bhats Football Success Story

Jun 04, 2025

From Ball Boy To National Team Suhail Ahmad Bhats Football Success Story

Jun 04, 2025 -

England Edges West Indies In Cardiff Roots Unbeaten 166 Steals The Show

Jun 04, 2025

England Edges West Indies In Cardiff Roots Unbeaten 166 Steals The Show

Jun 04, 2025 -

Adp Report Weak Private Sector Job Growth Raises Recession Concerns

Jun 04, 2025

Adp Report Weak Private Sector Job Growth Raises Recession Concerns

Jun 04, 2025 -

The Blue Tigers Ascent Suhail Bhats Path To The Indian National Team

Jun 04, 2025

The Blue Tigers Ascent Suhail Bhats Path To The Indian National Team

Jun 04, 2025 -

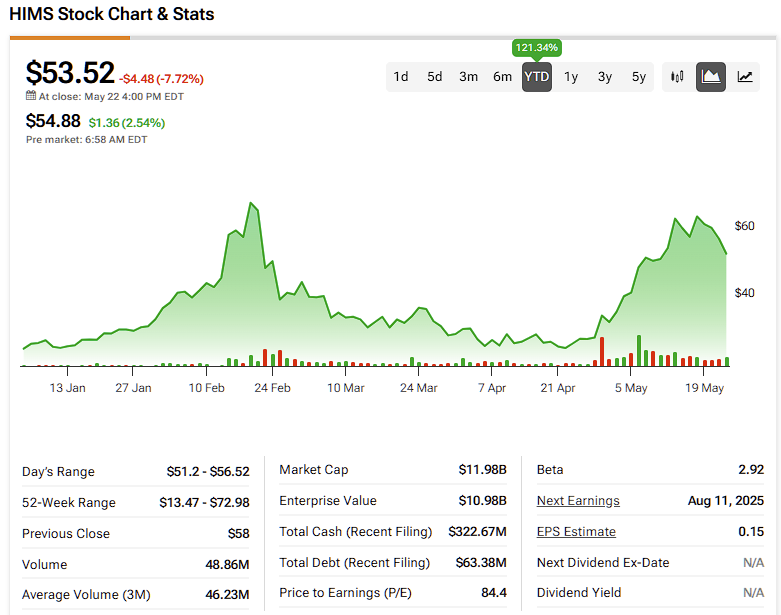

Investing In Hims And Hers Hims A Risky Bet Or Smart Investment

Jun 04, 2025

Investing In Hims And Hers Hims A Risky Bet Or Smart Investment

Jun 04, 2025